Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pat Koontz makes necklaces from glass beads, metal beads, and natural beads. After reading about hybrid costing, she realized that the different types of necklaces

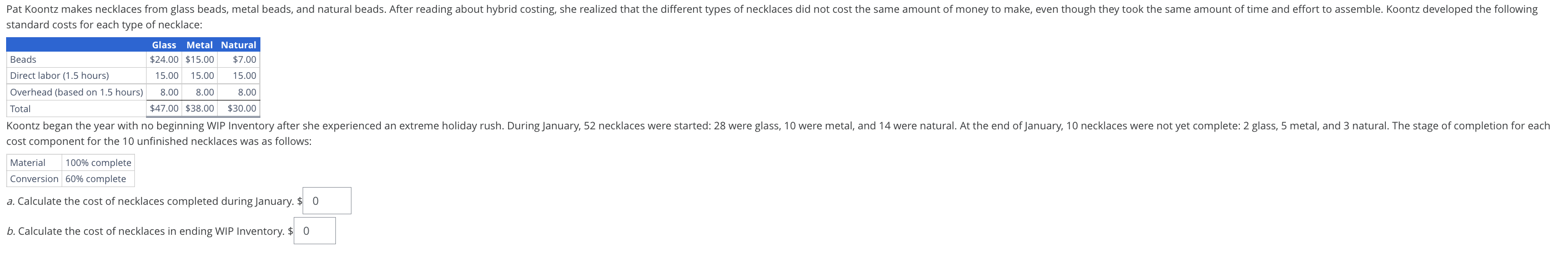

Pat Koontz makes necklaces from glass beads, metal beads, and natural beads. After reading about hybrid costing, she realized that the different types of necklaces did not cost the same amount of money to make, even though they took the same amount of time and effort to assemble. Koontz developed the following standard costs for each type of necklace: standard costs for each type of necklace:

tableGlass,Metal,NaturalBeads$$$Direct labor hoursOverhead based on hoursTotal$$$

cost component for the unfinished necklaces was as follows:

a Calculate the cost of necklaces completed during January. $

b Calculate the cost of necklaces in ending WIP Inventory. $

Glass Metal Natural

Beads $ $ $

Direct labor hours

Overhead based on hours

Total $ $ $

Koontz began the year with no beginning WIP Inventory after she experienced an extreme holiday rush. During January, necklaces were started: were glass, were metal, and were natural. At the end of January, necklaces were not yet complete: glass, metal, and natural. The stage of completion for each cost component for the unfinished necklaces was as follows:

Material complete

Conversion complete

a Calculate the cost of necklaces completed during January. $Answer

b Calculate the cost of necklaces in ending WIP Inventory. $Answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started