Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pat Mendi owns Mobi Electronics which carry's out repairs to all types of electronic devices and equipment. Pat provided the following list of selected

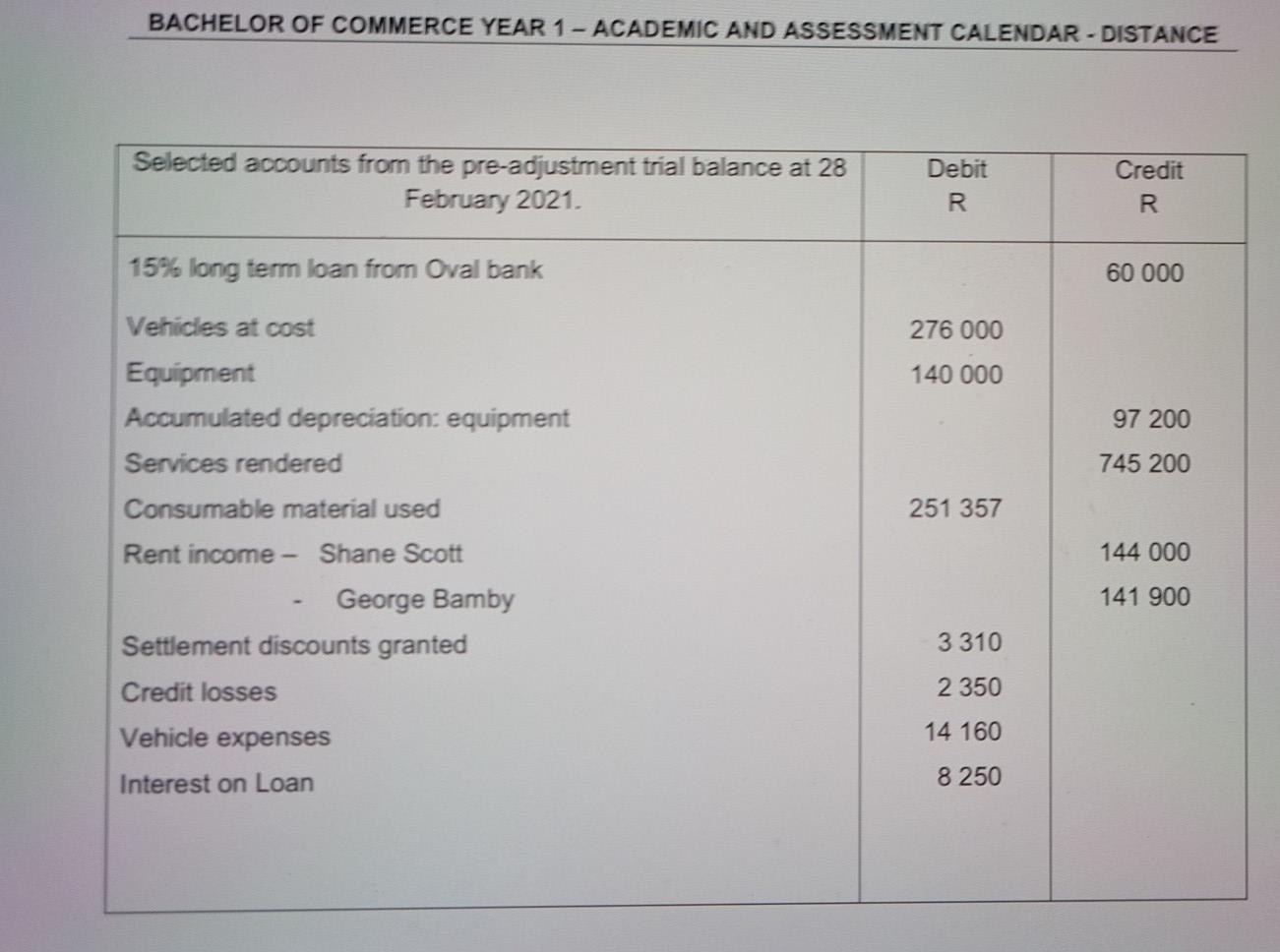

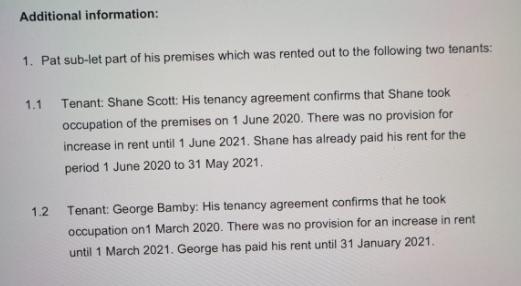

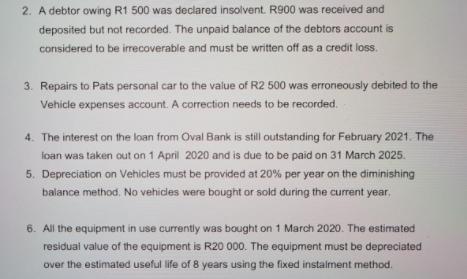

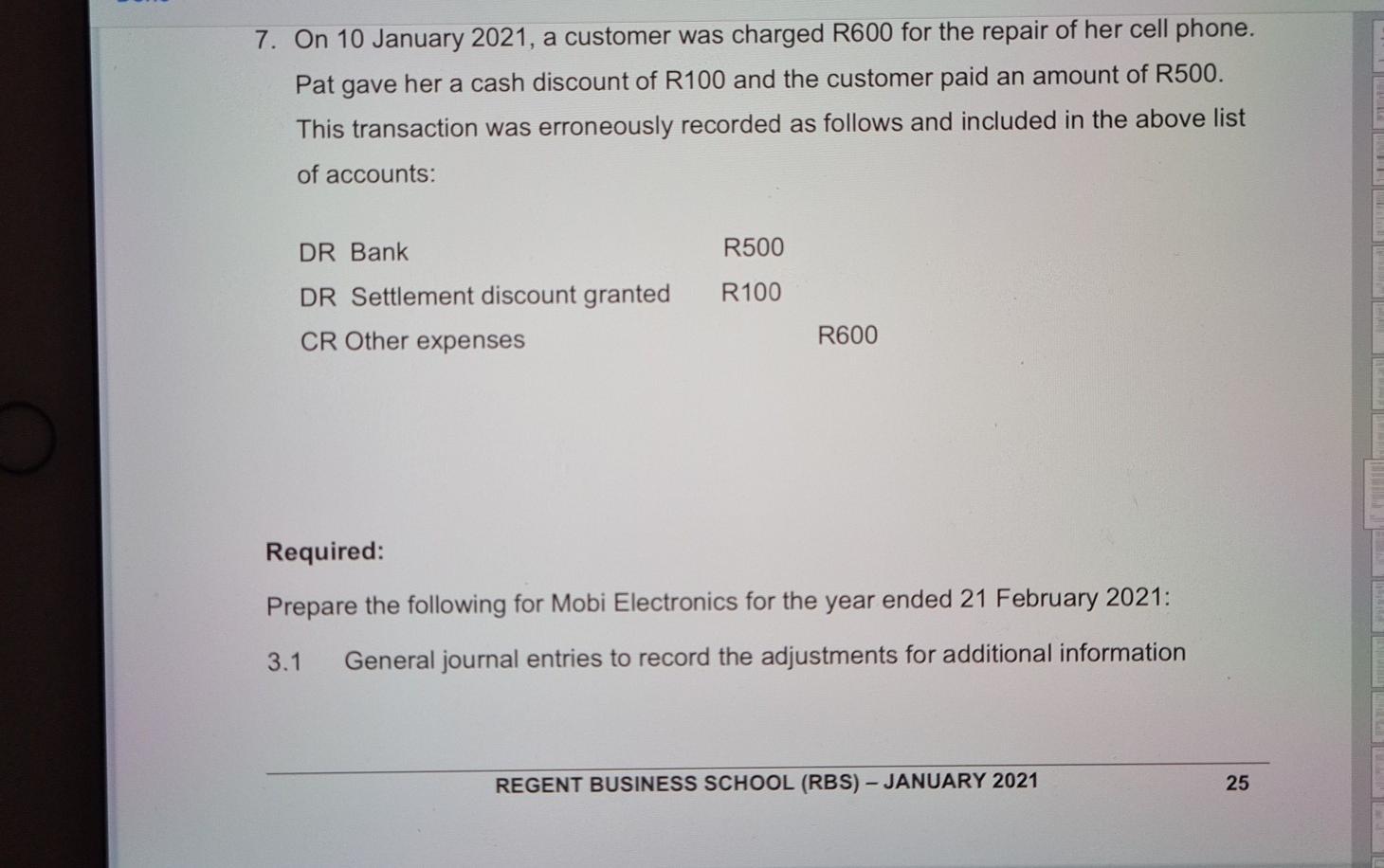

Pat Mendi owns Mobi Electronics which carry's out repairs to all types of electronic devices and equipment. Pat provided the following list of selected account balances extracted from the pre-adjustment trial balance at 28 February 2021, the end of the current financial year: BACHELOR OF COMMERCE YEAR 1- ACADEMIC AND ASSESSMENT CALENDAR -DISTANCE Selected accounts from the pre-adjustment trial balance at 28 February 2021. Debit Credit R. R. 15% long term loan from Oval bank 60 000 Vehicles at cost 276 000 Equipment 140 000 Accumulated depreciation: equipment 97 200 Services rendered 745 200 Consumable material used 251 357 Rent income - Shane Scott 144 000 George Bamby 141 900 Settlement discounts granted 3310 Credit losses 2 350 Vehicle expenses 14 160 Interest on Loan 8 250 Additional information: 1. Pat sub-let part of his premises which was rented out to the following two tenants: 1.1 Tenant: Shane Scott: His tenancy agreement confirms that Shane took occupation of the premises on 1 June 2020. There was no provision for increase in rent until 1 June 2021. Shane has already paid his rent for the period 1 June 2020 to 31 May 2021. 1.2 Tenant: George Bamby: His tenancy agreement confirms that he took occupation on 1 March 2020. There was no provision for an increase in rent until 1 March 2021. George has paid his rent until 31 January 2021. 2. A debtor owing R1 500 was declared insolvent. R900 was received and deposited but not recorded. The unpaid balance of the debtors account is considered to be irrecoverable and must be written off as a credit loss. 3. Repairs to Pats personal car to the value of R2 500 was erroneously debited to the Vehicle expenses account. A correction needs to be recorded. 4. The interest on the loan from Oval Bank is still outstanding for February 2021. The ioan was taken out on 1 April 2020 and is due to be paid on 31 March 2025. 5. Depreciation on Vehicles must be provided at 20% per year on the diminishing balance method. No vehicles were bought or sold during the current year, 6. All the equipment in use currently was bought on 1 March 2020. The estimated residual value of the equipment is R20 000. The equipment must be depreciated over the estimated useful life of 8 years using the fixed instalment method. 7. On 10 January 2021, a customer was charged R600 for the repair of her cell phone. Pat her a cash discount of R100 and the customer paid an amount of R500. gave This transaction was erroneously recorded as follows and included in the above list of accounts: DR Bank R500 DR Settlement discount granted R100 CR Other expenses R600 Required: Prepare the following for Mobi Electronics for the year ended 21 February 2021: 3.1 General journal entries to record the adjustments for additional information REGENT BUSINESS SCHOOL (RBS)- JANUARY 2021 25 BACHELOR OF COMMERCE YEAR 1- ACADEMIC AND ASSESSMENT CALENDAR - DISTANCE Number 1 to 7. Include a brief narration. (15) 3.2 The statement of profit or loss and other comprehensive income for the year (10) ended 28 February 2021.

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries to record Adjustmrnt entries as follows IN THE BOOKS OF MOBI ELETRONICS JOURNAL ENTR...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

60915c5da1350_208666.pdf

180 KBs PDF File

60915c5da1350_208666.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started