Answered step by step

Verified Expert Solution

Question

1 Approved Answer

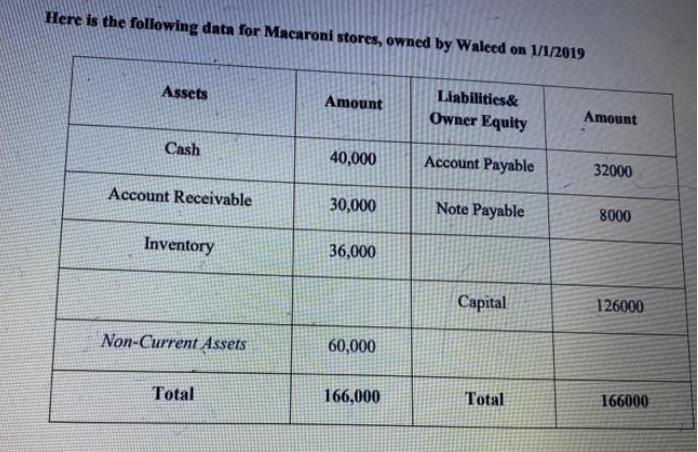

Here is the following data for Macaroni stores, owned by Waleed on 1/1/2019 Assets Liabilities& Amount Amount Owner Equity Cash 40,000 Account Payable 32000

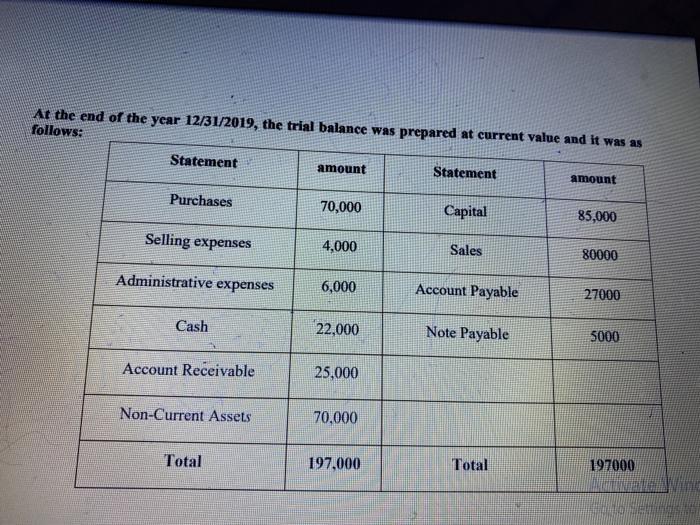

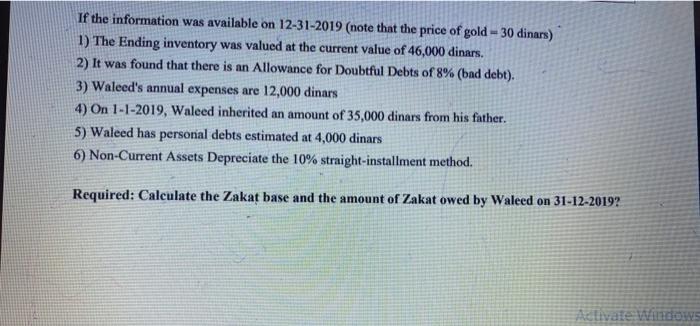

Here is the following data for Macaroni stores, owned by Waleed on 1/1/2019 Assets Liabilities& Amount Amount Owner Equity Cash 40,000 Account Payable 32000 Account Receivable 30,000 Note Payable 8000 Inventory 36,000 Capital 126000 Non-Current Assets 60,000 Total 166,000 Total 166000 At the end of the year 12/31/2019, the trial balance was prepared at current value and it was as follows: Statement amount Statement amount Purchases 70,000 Capital 85,000 Selling expenses 4,000 Sales 80000 Administrative expenses 6,000 Account Payable 27000 Cash 22,000 Note Payable 5000 Account Receivable 25,000 Non-Current Assets 70,000 197000 N Wind Total 197.000 Total If the information was available on 12-31-2019 (note that the price of gold - 30 dinars) %3D 1) The Ending inventory was valued at the current value of 46,000 dinars. 2) It was found that there is an Allowance for Doubtful Debts of 8% (bad debt). 3) Waleed's annual expenses are 12,000 dinars 4) On 1-1-2019, Waleed inherited an amount of 35,000 dinars from his father. 5) Waleed has personal debts estimated at 4,000 dinars 6) Non-Current Assets Depreciate the 10% straight-installment method. Required: Calculate the Zakat base and the amount of Zakat owed by Waleed on 31-12-2019? Activate Windows

Step by Step Solution

★★★★★

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of Zakat base Dinars Dinars Pure Gold an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started