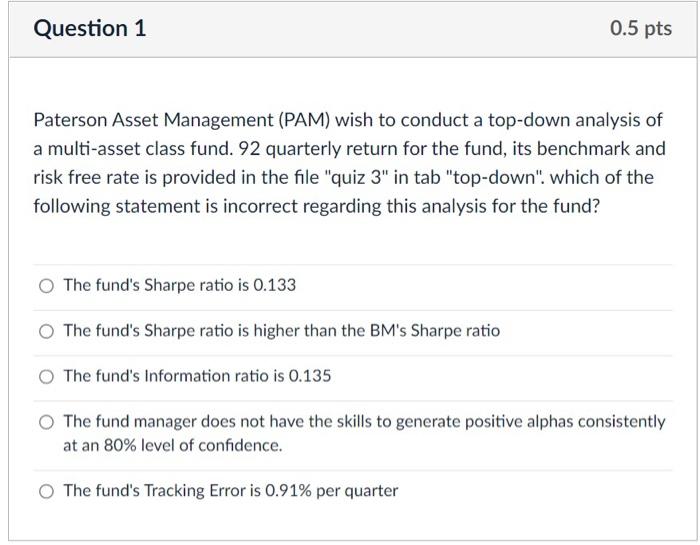

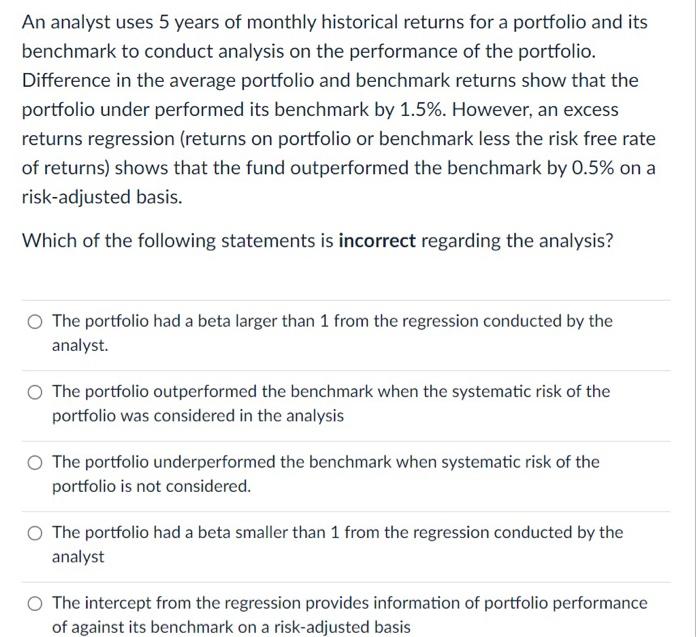

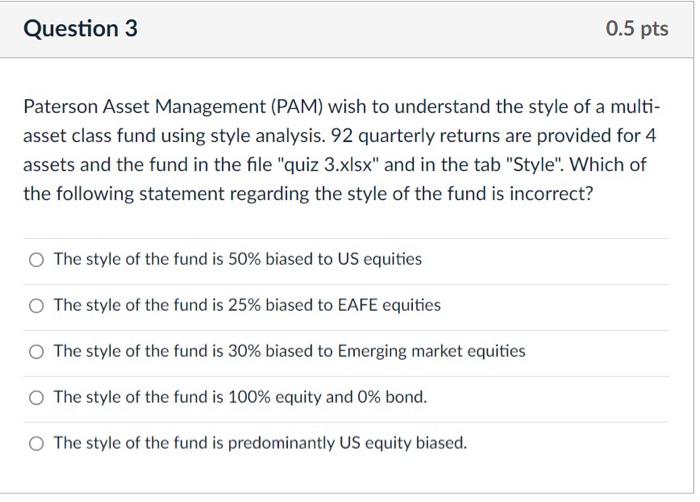

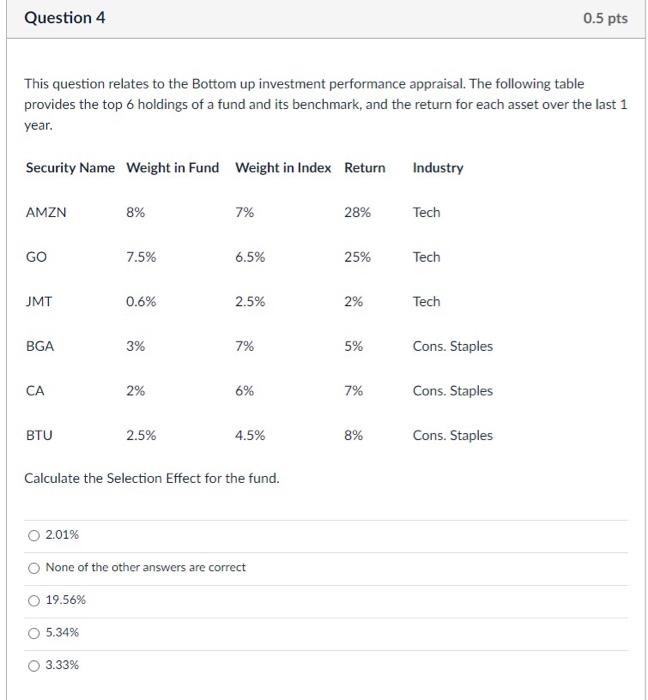

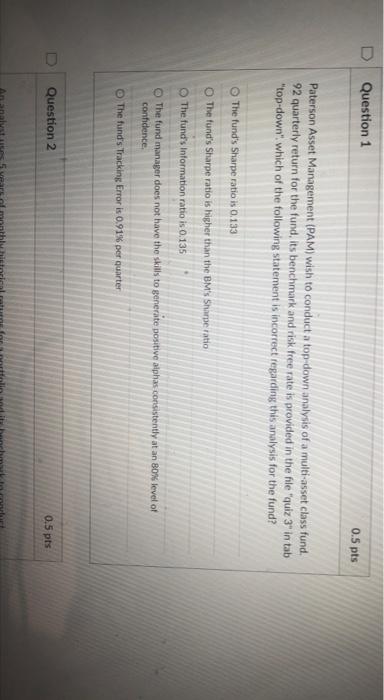

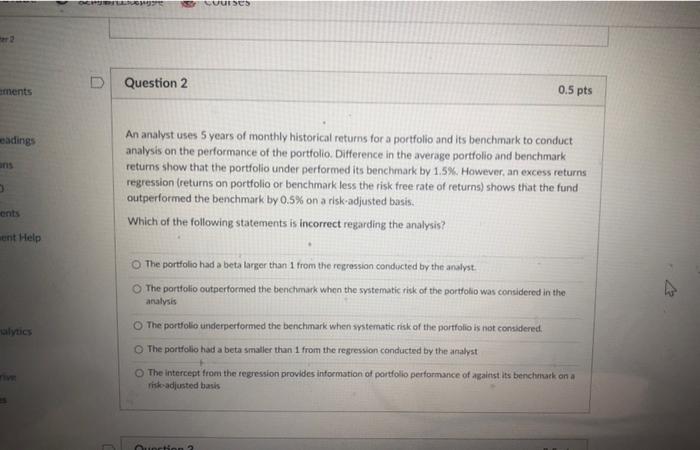

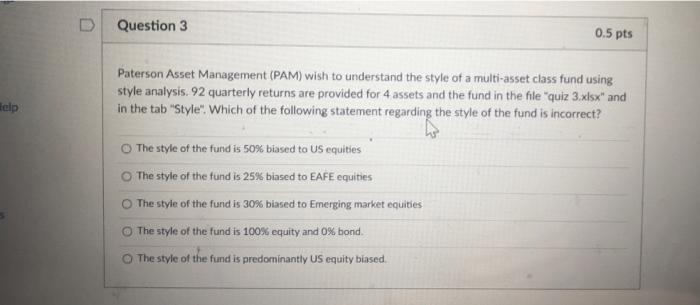

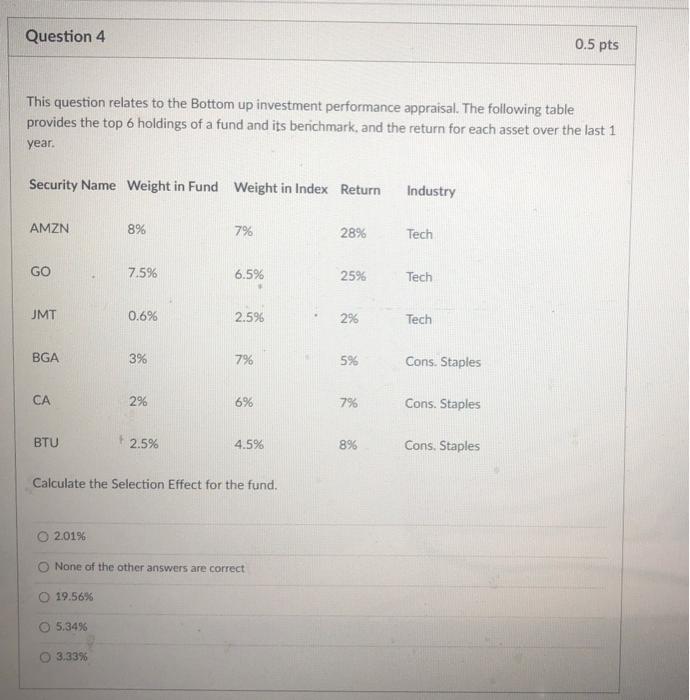

Paterson Asset Management (PAM) wish to conduct a top-down analysis of a multi-asset class fund. 92 quarterly return for the fund, its benchmark and risk free rate is provided in the file "quiz 3 " in tab "top-down". which of the following statement is incorrect regarding this analysis for the fund? The fund's Sharpe ratio is 0.133 The fund's Sharpe ratio is higher than the BM's Sharpe ratio The fund's Information ratio is 0.135 The fund manager does not have the skills to generate positive alphas consistently at an 80% level of confidence. The fund's Tracking Error is 0.91% per quarter An analyst uses 5 years of monthly historical returns for a portfolio and its benchmark to conduct analysis on the performance of the portfolio. Difference in the average portfolio and benchmark returns show that the portfolio under performed its benchmark by 1.5%. However, an excess returns regression (returns on portfolio or benchmark less the risk free rate of returns) shows that the fund outperformed the benchmark by 0.5% on a risk-adjusted basis. Which of the following statements is incorrect regarding the analysis? The portfolio had a beta larger than 1 from the regression conducted by the analyst. The portfolio outperformed the benchmark when the systematic risk of the portfolio was considered in the analysis The portfolio underperformed the benchmark when systematic risk of the portfolio is not considered. The portfolio had a beta smaller than 1 from the regression conducted by the analyst The intercept from the regression provides information of portfolio performance of against its benchmark on a risk-adjusted basis Paterson Asset Management (PAM) wish to understand the style of a multiasset class fund using style analysis. 92 quarterly returns are provided for 4 assets and the fund in the file "quiz 3.xlsx" and in the tab "Style". Which of the following statement regarding the style of the fund is incorrect? The style of the fund is 50% biased to US equities The style of the fund is 25% biased to EAFE equities The style of the fund is 30% biased to Emerging market equities The style of the fund is 100% equity and 0% bond. The style of the fund is predominantly US equity biased. This question relates to the Bottom up investment performance appraisal. The following table provides the top 6 holdings of a fund and its benchmark, and the return for each asset over the last 1 year. Calculate the Selection Effect for the fund. 2.01% None of the other answers are correct 19.56% 5.34% 3.33% Paterson Asset Management (PAM) wish to conduct a top-down analysis of a multi-asset class fund. 92 quarterly return for the fund, its benchmark and risk free rate is provided in the file "quiz 3"in in "top-down". which of the following statement is incorrect regarding this analysis for the fund? The fund's Sharpe ratio is 0.133 The fund's Sharpe ratio is higher than the BM's Sharpe ratio The funds information ratio is 0.135 The fund manager does not have the skills to generate positive aiphas consistently at an 80 level of confidence. The fund s Tracking Error is 0.91% per quarter An analyst uses 5 years of monthly historical returns for a portfolio and its benchmark to conduct analysis on the performance of the portfolio. Difference in the average portfolio and benchmark returns show that the portfolio under performed its benchmark by 1.5%. However, an excess returns regression (returns on portfolio or benchmark less the risk free rate of returns) shows that the fund outperformed the benchmark by 0.5% on a risk-adjusted basis. Which of the following statements is incorrect regarding the analysis? The portfolio had a beta larger than 1 from the regression condicted by the analyst. The portolio outperformed the benchmark when the systematic risk of the portfolio was considered in the analysis The portfolio underperformed the benchmark when spitematic risk of the portfolio is not considered. The portfolio had a beta smaller than 1 from the regressian conducted by the analyst The intercept from the regession provides information of portfolio performance of agaitst its benchumark on a Thiskadjusted basis Paterson Asset Management (PAM) wish to understand the style of a multi-asset class fund using style analysis. 92 quarterly returns are provided for 4 assets and the fund in the file "quiz 3.xsx " and in the tab "Style". Which of the following statement regarding the style of the fund is incorrect? The style of the fund is 50% biased to US equities The style of the fund is 25% biased to EAFE equities The style of the fund is 30% biased to Emerging market equities The style of the fund is 100% equity and 0% bond. The style of the fund is predominantly US equity biased. This question relates to the Bottom up investment performance appraisal. The following table provides the top 6 holdings of a fund and its berichmark, and the return for each asset over the last 1 year. Calculate the Selection Effect for the fund. 2.01% None of the other answers are correct 19.56% 5.34% 3.33% Paterson Asset Management (PAM) wish to conduct a top-down analysis of a multi-asset class fund. 92 quarterly return for the fund, its benchmark and risk free rate is provided in the file "quiz 3 " in tab "top-down". which of the following statement is incorrect regarding this analysis for the fund? The fund's Sharpe ratio is 0.133 The fund's Sharpe ratio is higher than the BM's Sharpe ratio The fund's Information ratio is 0.135 The fund manager does not have the skills to generate positive alphas consistently at an 80% level of confidence. The fund's Tracking Error is 0.91% per quarter An analyst uses 5 years of monthly historical returns for a portfolio and its benchmark to conduct analysis on the performance of the portfolio. Difference in the average portfolio and benchmark returns show that the portfolio under performed its benchmark by 1.5%. However, an excess returns regression (returns on portfolio or benchmark less the risk free rate of returns) shows that the fund outperformed the benchmark by 0.5% on a risk-adjusted basis. Which of the following statements is incorrect regarding the analysis? The portfolio had a beta larger than 1 from the regression conducted by the analyst. The portfolio outperformed the benchmark when the systematic risk of the portfolio was considered in the analysis The portfolio underperformed the benchmark when systematic risk of the portfolio is not considered. The portfolio had a beta smaller than 1 from the regression conducted by the analyst The intercept from the regression provides information of portfolio performance of against its benchmark on a risk-adjusted basis Paterson Asset Management (PAM) wish to understand the style of a multiasset class fund using style analysis. 92 quarterly returns are provided for 4 assets and the fund in the file "quiz 3.xlsx" and in the tab "Style". Which of the following statement regarding the style of the fund is incorrect? The style of the fund is 50% biased to US equities The style of the fund is 25% biased to EAFE equities The style of the fund is 30% biased to Emerging market equities The style of the fund is 100% equity and 0% bond. The style of the fund is predominantly US equity biased. This question relates to the Bottom up investment performance appraisal. The following table provides the top 6 holdings of a fund and its benchmark, and the return for each asset over the last 1 year. Calculate the Selection Effect for the fund. 2.01% None of the other answers are correct 19.56% 5.34% 3.33% Paterson Asset Management (PAM) wish to conduct a top-down analysis of a multi-asset class fund. 92 quarterly return for the fund, its benchmark and risk free rate is provided in the file "quiz 3"in in "top-down". which of the following statement is incorrect regarding this analysis for the fund? The fund's Sharpe ratio is 0.133 The fund's Sharpe ratio is higher than the BM's Sharpe ratio The funds information ratio is 0.135 The fund manager does not have the skills to generate positive aiphas consistently at an 80 level of confidence. The fund s Tracking Error is 0.91% per quarter An analyst uses 5 years of monthly historical returns for a portfolio and its benchmark to conduct analysis on the performance of the portfolio. Difference in the average portfolio and benchmark returns show that the portfolio under performed its benchmark by 1.5%. However, an excess returns regression (returns on portfolio or benchmark less the risk free rate of returns) shows that the fund outperformed the benchmark by 0.5% on a risk-adjusted basis. Which of the following statements is incorrect regarding the analysis? The portfolio had a beta larger than 1 from the regression condicted by the analyst. The portolio outperformed the benchmark when the systematic risk of the portfolio was considered in the analysis The portfolio underperformed the benchmark when spitematic risk of the portfolio is not considered. The portfolio had a beta smaller than 1 from the regressian conducted by the analyst The intercept from the regession provides information of portfolio performance of agaitst its benchumark on a Thiskadjusted basis Paterson Asset Management (PAM) wish to understand the style of a multi-asset class fund using style analysis. 92 quarterly returns are provided for 4 assets and the fund in the file "quiz 3.xsx " and in the tab "Style". Which of the following statement regarding the style of the fund is incorrect? The style of the fund is 50% biased to US equities The style of the fund is 25% biased to EAFE equities The style of the fund is 30% biased to Emerging market equities The style of the fund is 100% equity and 0% bond. The style of the fund is predominantly US equity biased. This question relates to the Bottom up investment performance appraisal. The following table provides the top 6 holdings of a fund and its berichmark, and the return for each asset over the last 1 year. Calculate the Selection Effect for the fund. 2.01% None of the other answers are correct 19.56% 5.34% 3.33%