Answered step by step

Verified Expert Solution

Question

1 Approved Answer

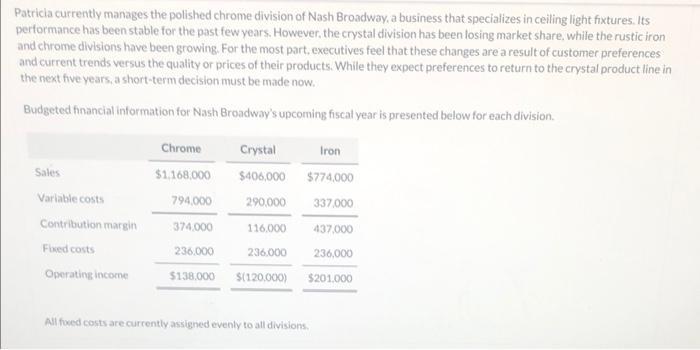

Patricia currently manages the polished chrome division of Nash Broadway, a business that specializes in ceiling light fixtures. Its performance has been stable for

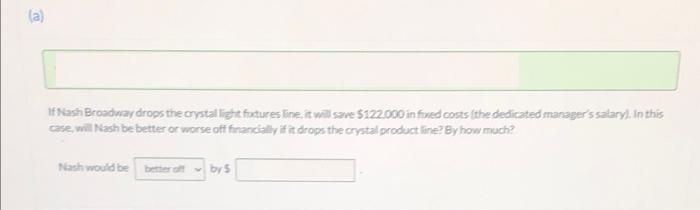

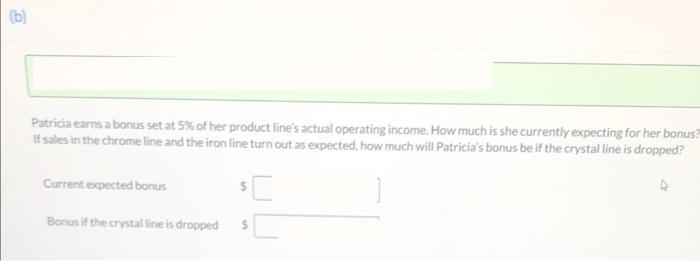

Patricia currently manages the polished chrome division of Nash Broadway, a business that specializes in ceiling light fixtures. Its performance has been stable for the past few years. However, the crystal division has been losing market share, while the rustic iron and chrome divisions have been growing. For the most part, executives feel that these changes are a result of customer preferences and current trends versus the quality or prices of their products. While they expect preferences to return to the crystal product line in the next five years, a short-term decision must be made now. Budgeted financial information for Nash Broadway's upcoming fiscal year is presented below for each division. Sales Variable costs Contribution margin Fixed costs Operating income Chrome $1,168,000 794,000 374,000 236.000 Crystal $406,000 290,000 236.000 Iron $774,000 116.000 437,000 236,000 $201.000 $138.000 $(120,000) 337,000 All foxed costs are currently assigned evenly to all divisions. TO If Nash Broadway drops the crystal light fixtures line, it will save $122.000 in fixed costs (the dedicated manager's salary). In this case, will Nash be better or worse off financially if it drops the crystal product line? By how much? Nash would be better off by S (b) Patricia earns a bonus set at 5% of her product line's actual operating income. How much is she currently expecting for her bonus? If sales in the chrome line and the iron line turn out as expected, how much will Patricia's bonus be if the crystal line is dropped? Current expected bonus Bonus if the crystal line is dropped (c) If you were Patricia, would you try to sway the executives one way or the other in their decision to keep or drop the crystal product line? Would Patricia be better/worse off if they drop the Crystal product line and by how much. Patricia would be Textbook and Media by $

Step by Step Solution

★★★★★

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Nash Broadways financial performance if the crystal product line is dropped If Nash Broadway drops t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started