Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Patricia Johnson is the new owner of Patricia's Computer Services. At the end of July 2022, her first month of ownership, Patricia is trying to

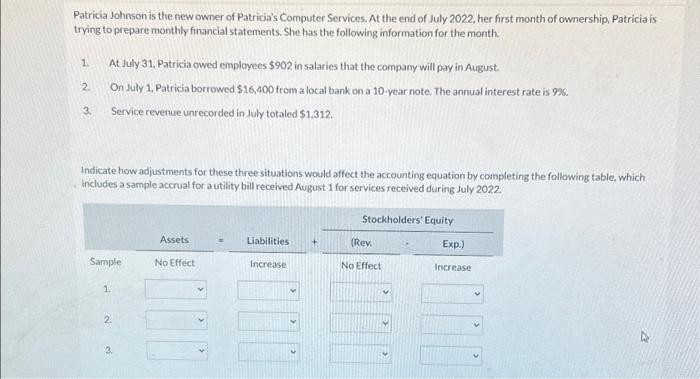

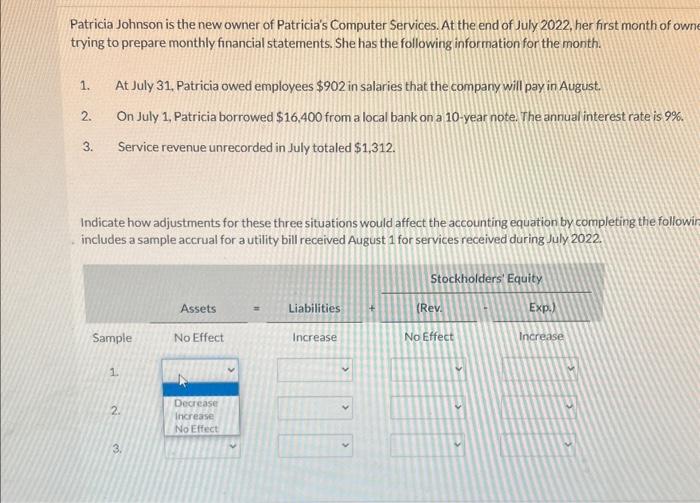

Patricia Johnson is the new owner of Patricia's Computer Services. At the end of July 2022, her first month of ownership, Patricia is trying to prepare monthly financial statements. She has the following information for the month. 2. 3. At July 31, Patricia owed employees $902 in salaries that the company will pay in August. On July 1, Patricia borrowed $16,400 from a local bank on a 10-year note. The annual interest rate is 9%. Service revenue unrecorded in July totaled $1,312. Indicate how adjustments for these three situations would affect the accounting equation by completing the following table, which includes a sample accrual for a utility bill received August 1 for services received during July 2022. Sample 1. P 2. 3. Assets No Effect = Liabilities Increase + Stockholders' Equity (Rev. No Effect t Exp.) Increase

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started