Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Patricia wanted to start her own company instead of working for someone else. She had been thinking about different low-risk ventures she can start

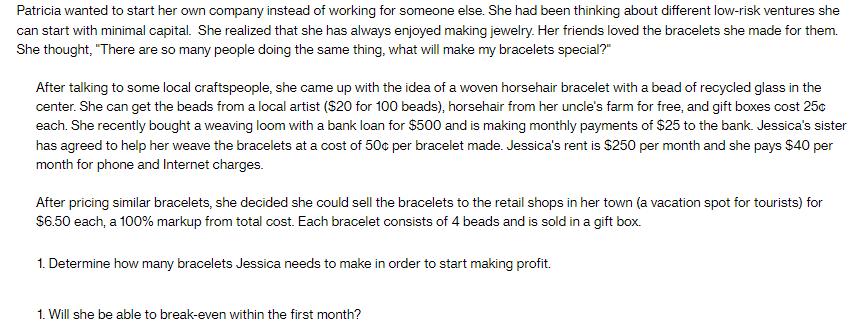

Patricia wanted to start her own company instead of working for someone else. She had been thinking about different low-risk ventures she can start with minimal capital. She realized that she has always enjoyed making jewelry. Her friends loved the bracelets she made for them. She thought, "There are so many people doing the same thing, what will make my bracelets special?" After talking to some local craftspeople, she came up with the idea of a woven horsehair bracelet with a bead of recycled glass in the center. She can get the beads from a local artist ($20 for 100 beads), horsehair from her uncle's farm for free, and gift boxes cost 25c each. She recently bought a weaving loom with a bank loan for $500 and is making monthly payments of $25 to the bank. Jessica's sister has agreed to help her weave the bracelets at a cost of 50 per bracelet made. Jessica's rent is $250 per month and she pays $40 per month for phone and Internet charges. After pricing similar bracelets, she decided she could sell the bracelets to the retail shops in her town (a vacation spot for tourists) for $6.50 each, a 100% markup from total cost. Each bracelet consists of 4 beads and is sold in a gift box. 1. Determine how many bracelets Jessica needs to make in order to start making profit. 1. Will she be able to break-even within the first month?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the number of bracelets Patricia needs to make in order to start making a profit we need to calculate her total costs and then divide it ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started