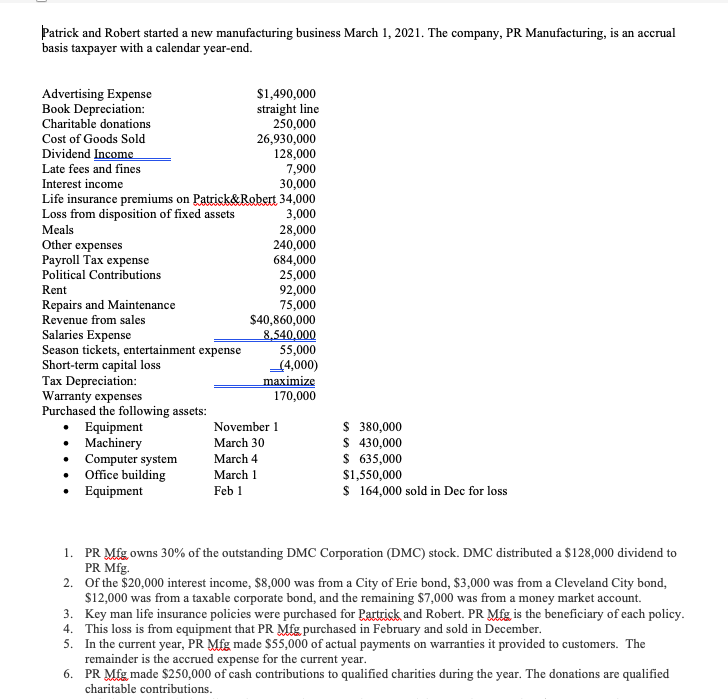

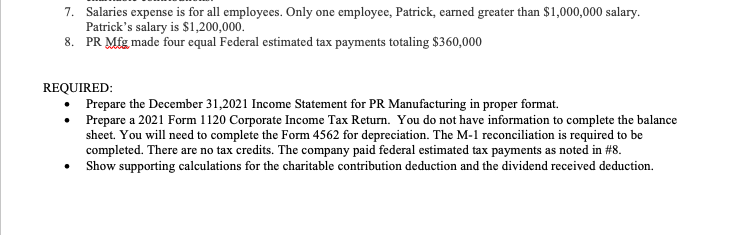

Patrick and Robert started a new manufacturing business March 1, 2021. The company, PR Manufacturing, is an accrual basis taxpayer with a calendar year-end. Advertising Expense Book Depreciation: Charitable donations $1,490,000 straight line 250,000 Cost of Goods Sold 26,930,000 Dividend Income 128,000 Late fees and fines 7,900 Interest income 30,000 34,000 Life insurance premiums on Patrick&Robert Loss from disposition of fixed assets 3,000 Meals 28,000 Other expenses 240,000 Payroll Tax expense 684,000 Political Contributions 25,000 Rent 92,000 Repairs and Maintenance 75,000 Revenue from sales $40,860,000 Salaries Expense 8,540,000 Season tickets, entertainment expense 55,000 Short-term capital loss (4,000) Tax Depreciation: maximize Warranty expenses 170,000 Purchased the following assets: Equipment November 1 $ 380,000 Machinery March 30 $ 430,000 Computer system March 4 $ 635,000 Office building $1,550,000 March 1 Feb 1 . Equipment $ 164,000 sold in Dec for loss 1. PR Mfg owns 30% of the outstanding DMC Corporation (DMC) stock. DMC distributed a $128,000 dividend to PR Mfg. 2. Of the $20,000 interest income, $8,000 was from a City of Erie bond, $3,000 was from a Cleveland City bond, $12,000 was from a taxable corporate bond, and the remaining $7,000 was from a money market account. 3. Key man life insurance policies were purchased for Partrick and Robert. PR Mfg is the beneficiary of each policy. 4. This loss is from equipment that PR Mfg purchased in February and sold in December. 5. In the current year, PR Mfg made $55,000 of actual payments on warranties it provided to customers. The remainder is the accrued expense for the current year. 6. PR Mfg made $250,000 of cash contributions to qualified charities during the year. The donations are qualified charitable contributions. 7. Salaries expense is for all employees. Only one employee, Patrick, earned greater than $1,000,000 salary. Patrick's salary is $1,200,000. 8. PR Mfg made four equal Federal estimated tax payments totaling $360,000 REQUIRED: Prepare the December 31,2021 Income Statement for PR Manufacturing in proper format. Prepare a 2021 Form 1120 Corporate Income Tax Return. You do not have information to complete the balance sheet. You will need to complete the Form 4562 for depreciation. The M-1 reconciliation is required to be completed. There are no tax credits. The company paid federal estimated tax payments as noted in #8. Show supporting calculations for the charitable contribution deduction and the dividend received deduction. Patrick and Robert started a new manufacturing business March 1, 2021. The company, PR Manufacturing, is an accrual basis taxpayer with a calendar year-end. Advertising Expense Book Depreciation: Charitable donations $1,490,000 straight line 250,000 Cost of Goods Sold 26,930,000 Dividend Income 128,000 Late fees and fines 7,900 Interest income 30,000 34,000 Life insurance premiums on Patrick&Robert Loss from disposition of fixed assets 3,000 Meals 28,000 Other expenses 240,000 Payroll Tax expense 684,000 Political Contributions 25,000 Rent 92,000 Repairs and Maintenance 75,000 Revenue from sales $40,860,000 Salaries Expense 8,540,000 Season tickets, entertainment expense 55,000 Short-term capital loss (4,000) Tax Depreciation: maximize Warranty expenses 170,000 Purchased the following assets: Equipment November 1 $ 380,000 Machinery March 30 $ 430,000 Computer system March 4 $ 635,000 Office building $1,550,000 March 1 Feb 1 . Equipment $ 164,000 sold in Dec for loss 1. PR Mfg owns 30% of the outstanding DMC Corporation (DMC) stock. DMC distributed a $128,000 dividend to PR Mfg. 2. Of the $20,000 interest income, $8,000 was from a City of Erie bond, $3,000 was from a Cleveland City bond, $12,000 was from a taxable corporate bond, and the remaining $7,000 was from a money market account. 3. Key man life insurance policies were purchased for Partrick and Robert. PR Mfg is the beneficiary of each policy. 4. This loss is from equipment that PR Mfg purchased in February and sold in December. 5. In the current year, PR Mfg made $55,000 of actual payments on warranties it provided to customers. The remainder is the accrued expense for the current year. 6. PR Mfg made $250,000 of cash contributions to qualified charities during the year. The donations are qualified charitable contributions. 7. Salaries expense is for all employees. Only one employee, Patrick, earned greater than $1,000,000 salary. Patrick's salary is $1,200,000. 8. PR Mfg made four equal Federal estimated tax payments totaling $360,000 REQUIRED: Prepare the December 31,2021 Income Statement for PR Manufacturing in proper format. Prepare a 2021 Form 1120 Corporate Income Tax Return. You do not have information to complete the balance sheet. You will need to complete the Form 4562 for depreciation. The M-1 reconciliation is required to be completed. There are no tax credits. The company paid federal estimated tax payments as noted in #8. Show supporting calculations for the charitable contribution deduction and the dividend received deduction