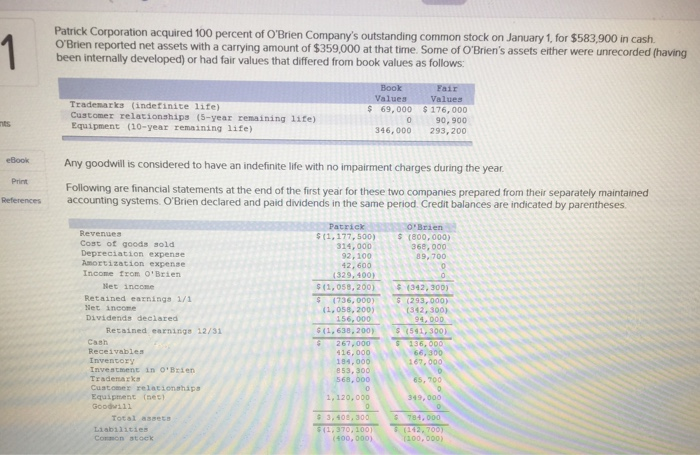

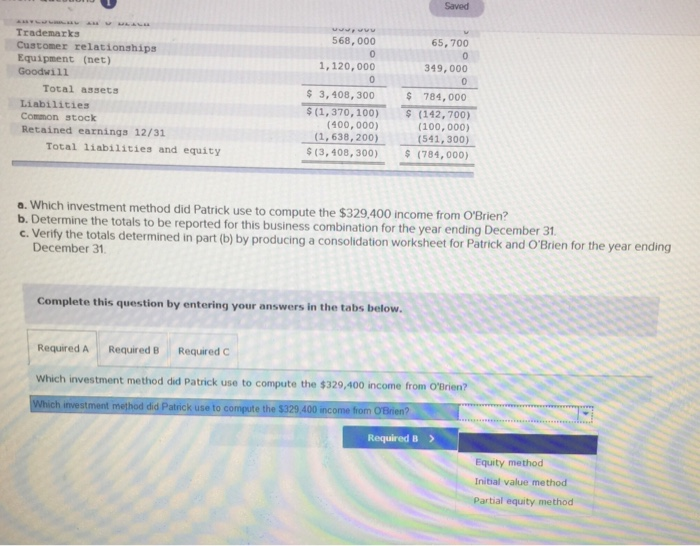

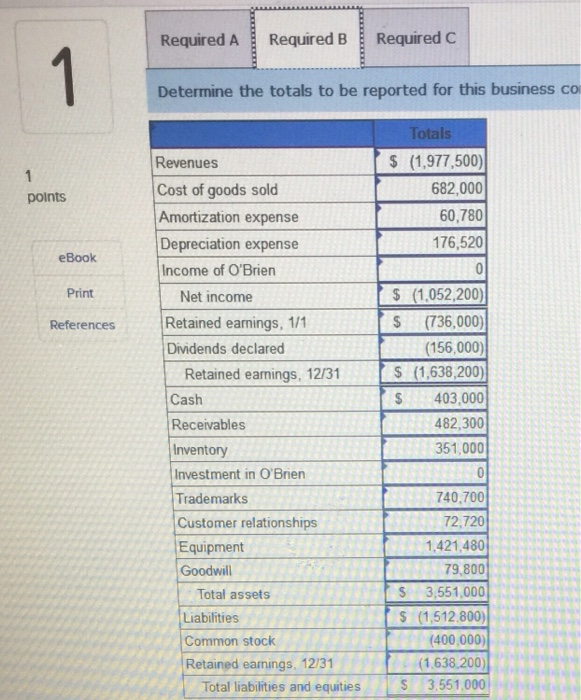

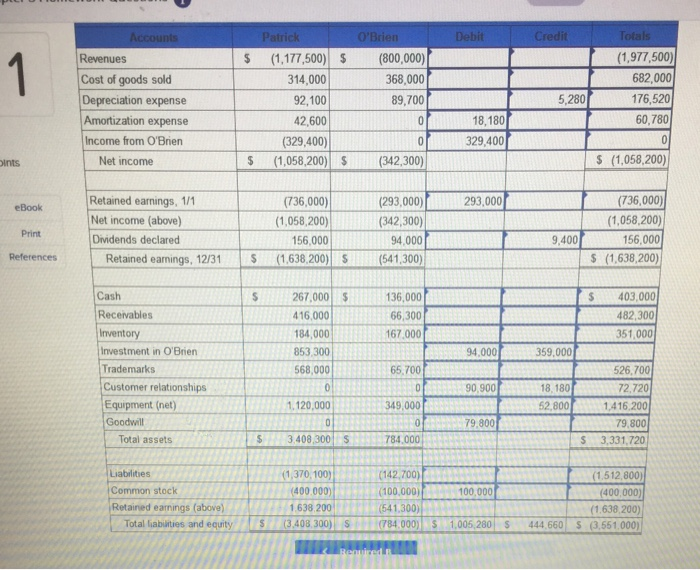

Patrick Corporation acquired 100 percent of O'Brien Company's outstanding common stock on January 1, for $583,900 in cash. O'Brien reported net assets with a carrying amount of $359,000 at that time. Some of O'Brien's assets either were unrecorded (having been internally developed) or had fair values that differed from book values as follows Trademarks (indefinite life) Customer relationships (5-year remaining life) Equipment (10-year remaining life) Values Values s 69, 000 $ 176,000 0 90,900 46,000 293, 200 eBook Any goodwill is considered to have an indefinite life with no impairment charges during the year Print Following are financial statements at the end of the first year for these two companies prepared from their separately maintained accounting systems. O'Brien declared and paid dividends in the same period. Credit balances are indicated by parentheses References Revenues Cost of goods sold Depreciation expense Amortization expense Incone fxom o'Brien (1,177,500)$ (800, 000) 368,000 89,700 314, 000 92,100 42,600 (329, 400) Net incone 12,058,200) (342,300) Retained earnings 1/1 Net ineome Dividends declared 1736, 000) (1, 058,200)(342,300) Retained earnings 12/31 (1,638,200) (541, 300) 36,00 66,300 Cash 267,000 416,000 184,000 Receivabies Inventory Investment in O'Bzien Tradenarks Customex relationships Equipment (aec) Goodwi11 1,120,000 Total assets 3,40,300 S 784,000 11ab13ities (400, 000) (100,000) Saved Trademarks Customer relationships Equipment (net) Goodwi11 568, 000 1, 120,000 s 3, 408, 300 65, 700 349,000 784, 000 Total assets $ Liabilities Common stock $ (1,370, 100) (142,700 (100,000) (1, 638, 200) (541,300) s (3, 408, 300) (784,000) (400,000) Retained earnings 12/31 Total liabilities and equity a. Which investment method did Patrick use to compute the $329,400 income from O b. Determine the totals to be reported for this business c. Verify the totals determined in part (b) by producing a consolidation worksheet for Patrick and determined in part (b) by producing a consolidation worksheet for Patrick and O'Brien for the year ending combination for the year ending December 31 December 31 Complete this question by entering your answers in the tabs below Required ARequired B Required Which investment method did Patrick use to compute the $329,400 income from Which investment method did Patick use to compute the $329,400 income from O'Brien? O'Brien? Required B Equity method Initial value method Partial equity method Required A Required BRequired C Determine the totals to be reported for this business co Totals Revenues Cost of goods sold Amortization expense Depreciation expense Income of O'Brien S (1,977,500) 682,000 60,780 176,520 points eBook Print References $ (1,052,200) S(736,000) (156,000) S (1,638,200) S 403,000 482,300 351,000 Net income Retained earnings, 1/1 Dividends declared Retained eamings, 12/31 Cash Receivables Inventory Investment in O'Brien Trademarks Customer relationships Equipment Goodwill 740,700 72,720 1.421,480 79,800 S 3,551,000 S (1,512.800) (400,000) (1,638.200) Total assets Liabilities Common stock Retained earnings, 12/31 Total liabilities and equities S 3,551,000 Cost of goods sold Depreciation expense Amortization expense Income from O'Brien 5 (1.17500) (800,000) 368,000 89,700 314,000 92,100 42,600 (1,977,500) 682,000 176,520 60,780 5,280 18,180 329,400) $ (1,058,200) 29,400 ints Net income $ (1,058.200) (342.300) $ (1,058,200) Retained earnings, 1/1 Net income (above) Dividends declared (293,000) (342,300) 94,000 Retained earnings, 1231 (1.638200) S541.300) (736,000) (1,058.200) 156,000 293,000 (736,000) eBook (1,058,200) 156,000 S (1,638,200) Print 9,400 References 267,000 S 416,000 184,000 853.300 568,000 Cash 136,000 66,300 167.000 S 403,000 Recervables Inventory Investment in O'Briern Trademarks Customer relationships Equipment (net) Goodwill 482,300 351,000 94,000 359,000 65,700 526,700 2,720 1,416.200 79,800 S 3,331,720 90,900 18, 180 1,120,000 349,000 52,800 79,800 Total assets 3.408,300 S784.000 Liabilities Common stock Retairned earnings (above) (1.512,800) (400,000) (1.638,200) (3,408.300) S(784.000) S 1,005,280 $ 444 660 S (3,551.000) (1,370,100) (400 000) 1638.200 (142,700) (100,000) 541.300) 100,000 Total liabilities and equity