Question

Patrick Poh is a Singapore equities fund manager and manages a fund with total assets worth S$100 million. He adopts an enhanced indexing strategy and

Patrick Poh is a Singapore equities fund manager and manages a fund with total assets worth S$100 million. He adopts an enhanced indexing strategy and hopes to deliver excess return above the STI index return.

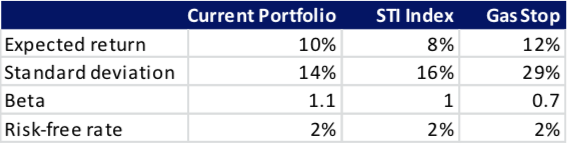

He is considering the inclusion of a utilities stock, Gas Stop, into his portfolio. He has compiled the following information:

QUESTION:

Since the returns on the current portfolio resemble the returns on a broad market index, we can approximate the correlation of returns between the current portfolio and Gas Stop to be the same as that between Gas Stop and the market.

-

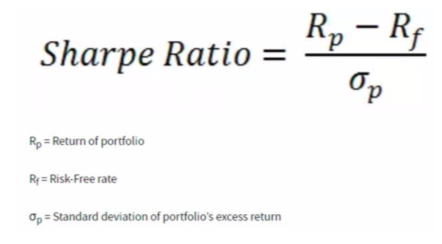

Analyse if the addition of Gas Stop to the existing portfolio improves the Sharpe ratio.

-

If yes, propose the recommended allocation to Gas Stop and his existing portfolio. Analyse other benefits that can be expected if Gas Stop is added into the portfolio.

Please help thank you.

Expected return Standard deviation Beta Risk-free rate Current Portfolio 10% 14% 1.1 2% STI Index 8% 16% 1 2% Gas Stop 12% 29% 0.7 2% Rp - Rf Sharpe Ratio = Op Rp = Return of portfolio R = Risk-Free rate Op = Standard deviation of portfolio's excess returnStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started