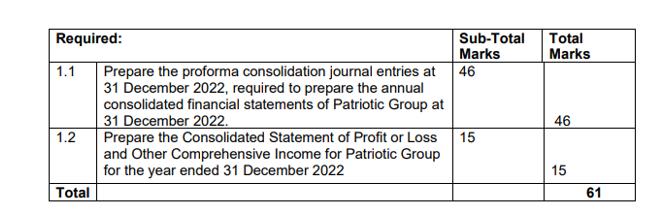

Question

Patriotic Limited is a Namibian listed company which was incorporated in 2010. The company manufactures uniforms graduation. The company has been performing well since incorporation

Patriotic Limited is a Namibian listed company which was incorporated in 2010. The company manufactures uniforms graduation. The company has been performing well since incorporation and decided to expand its operations by acquiring Sovereign a raw material producing company on 1 January 2016. Patriotic also found itself with free cash flows in June 2022 and decided to acquire another interest in Citizen Limited another company in the same line of industry with it which produces political regalia and Namibian traditional regalia. Patriotic is required to produce consolidated financial statements for it and its subsidiaries i.e. the Patriotic Group. You are a technical accountant for the Patriotic Group and the following draft financial statements of Patriotic Limited, Sovereign Limited, and Citizen Limited for the year ended 31 December 2022

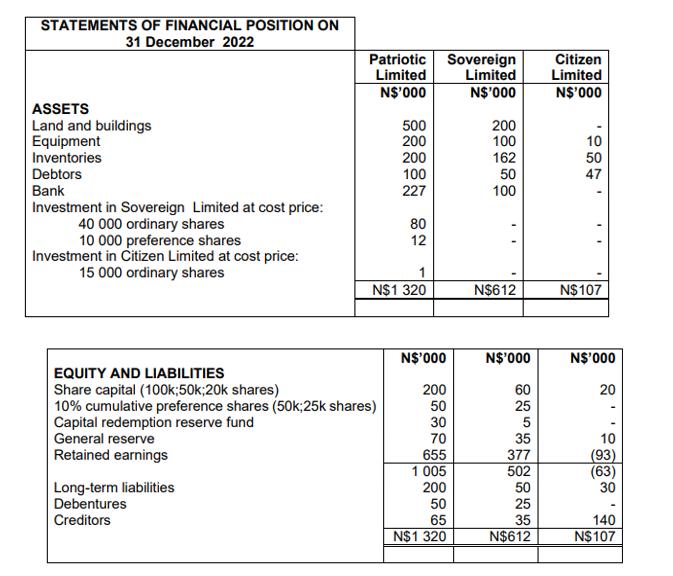

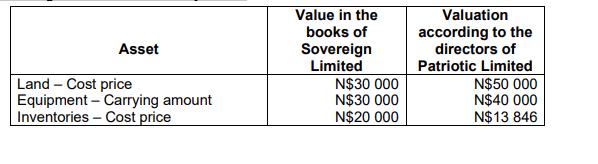

Additional information: 1 Patriotic Limited purchased the ordinary shares in Sovereign Limited on 1 January 2016. Patriotic Limited’s investment in Sovereign meets the definition of control in terms of IFRS 10: Consolidated financial statements. The acquisition also meets the definition of a business combination in accordance with IFRS 3: Business combinations. Sovereign Limited’s general reserve and retained earnings amounted to N$15 000 and N$65 000 respectively. Sovereign Limited also had a capital redemption reserve fund to the value of N$5 000 on 1 January 2016: The directors of Patriotic Limited placed the following values on the assets of Sovereign Limited on 1 January 2016:

These assets were not revalued in the books of the subsidiary. The remaining useful life of the above-mentioned equipment on 1 January 2016 was 9 years and depreciation on equipment is calculated using the straight-line method. The abovementioned land was sold by the subsidiary on 30 June 2019 at a profit of N$5 000.

2 Patriotic Limited purchased its interest in the cumulative preference shares of Sovereign Limited on 1 January 2022. On 1 January 2022 the preference dividends in respect of the 2021 financial year were in arrears.

3 Patriotic Limited purchased its interest in the ordinary shares of Citizen Limited on 30 June 2022. Patriotic Limited’s investment in Citizen meets the definition of control in terms of IFRS 10: Consolidated financial statements and satisfies the conditions for a business combination in accordance with IFRS 3: Business Combination. The monthly sales and associated cost of sales of Citizen Limited increased, with 10% from 1 April 2022. The operating expenses of Citizen Limited were incurred evenly throughout the year. A management fee of N$2 000 per month was paid to Patriotic Limited from 1 July 2022. Patriotic Limited guarantees the liabilities of Citizen Limited.

4 Sovereign Limited sells its inventories to Patriotic Limited at cost price plus 10%. These items are also inventories in the books of Patriotic Limited. Total sales from Sovereign Limited to Patriotic Limited during the current financial year amounted to N$400 000. All the closing inventories of Patriotic Limited were purchased from Sovereign Limited. Opening inventories to the value of N$50 000 were purchased from Sovereign Limited during the 2021 financial year.

5 Patriotic Limited sold equipment they manufactured to Sovereign Limited on 1 January 2019, at N$20 000 (cost price plus 25%). Sovereign Limited provides for depreciation on equipment at 10% per year using the straight-line method.

6 Citizen Limited bought some of its inventories from Patriotic Limited since 1 July 2022 at cost price plus 30%. These items are also inventories in the books of Patriotic Limited. At year end Citizen Limited had inventories with a cost price of N$10 000 on hand that was purchased from Patriotic Limited. Citizen Limited already wrote the inventories off to their net realisable value of N$8 000. Total sales from Patriotic Limited to Citizen Limited during the current financial year amounted to N$20 000.

7 Assume a tax rate of 32%. Secondary tax on companies can be ignored.

8 Patriotic elected to measure Non-controlling interest at the proportionate share of the net identifiable assets’ and Patriotic (parent) solely guarantees any insolvent subsidiary.

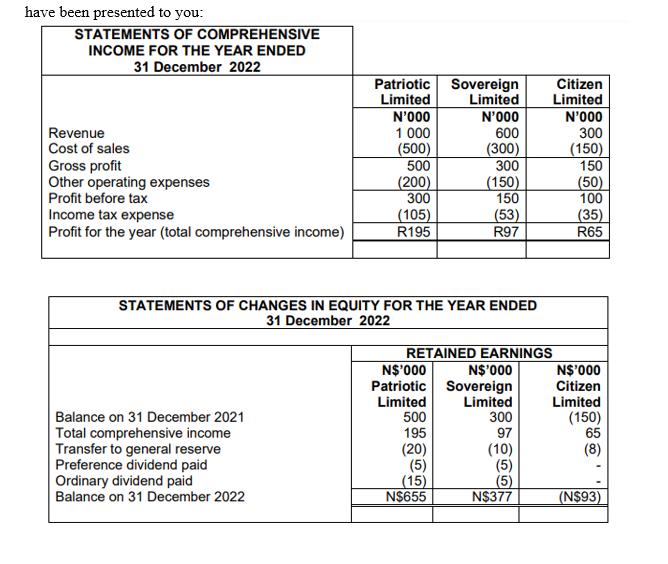

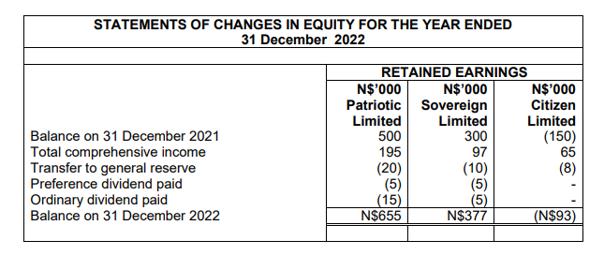

have been presented to you: STATEMENTS OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 December 2022 Patriotic Limited Sovereign Limited N'000 N'000 Revenue Cost of sales 1 000 600 (500) (300) Citizen Limited N'000 300 (150) Gross profit 500 300 150 Other operating expenses (200) (150) (50) Profit before tax 300 150 100 Income tax expense (105) (53) (35) Profit for the year (total comprehensive income) R195 R97 R65 STATEMENTS OF CHANGES IN EQUITY FOR THE YEAR ENDED 31 December 2022 Balance on 31 December 2021 Total comprehensive income Transfer to general reserve Preference dividend paid Ordinary dividend paid Balance on 31 December 2022 RETAINED EARNINGS N$'000 Patriotic N$'000 Sovereign N$'000 Citizen Limited Limited Limited 500 300 (150) 195 97 65 (20) (10) (8) (5) (5) (15) (5) N$655 N$377 (N$93)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started