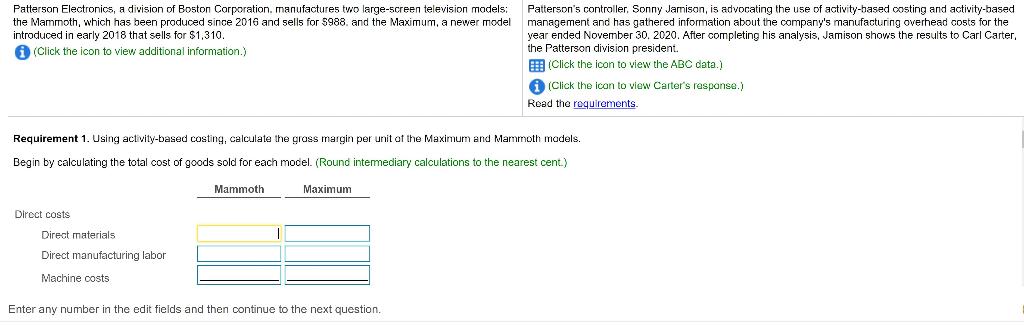

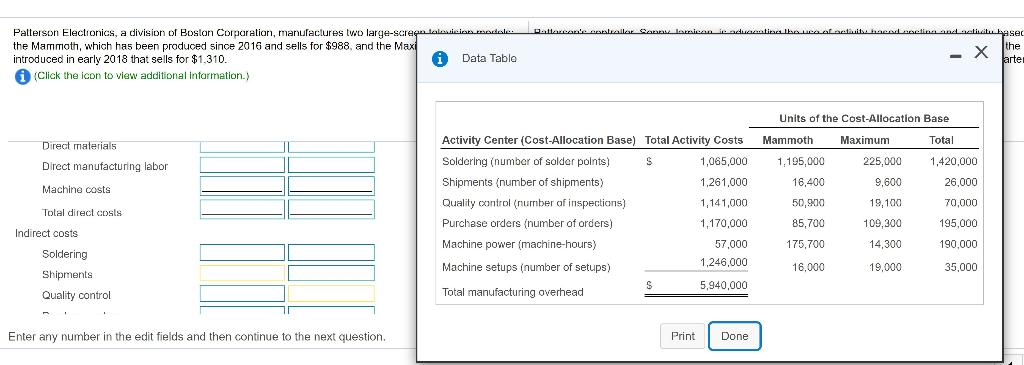

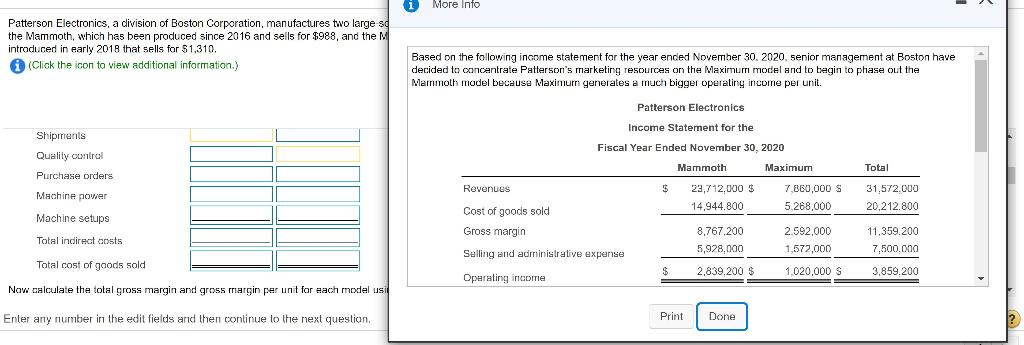

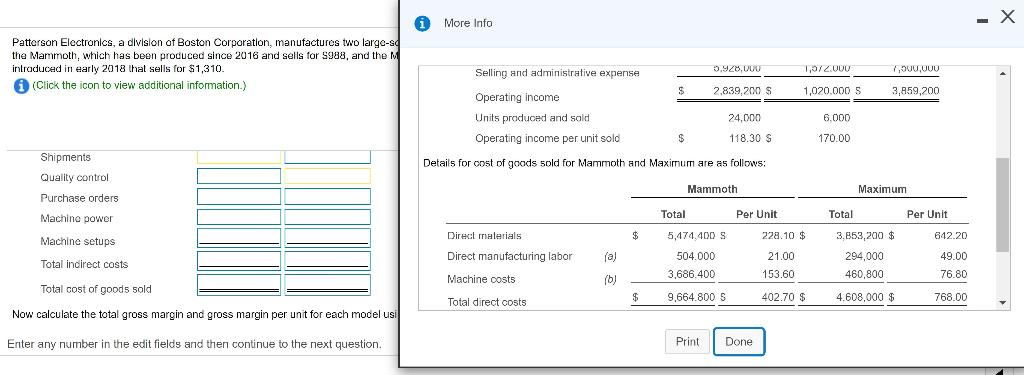

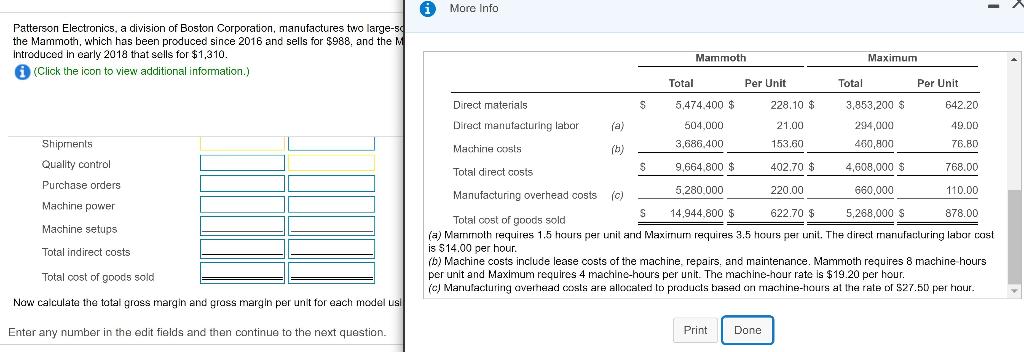

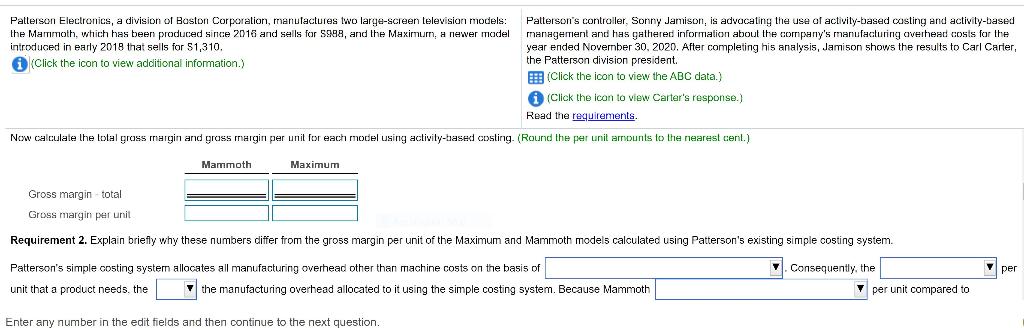

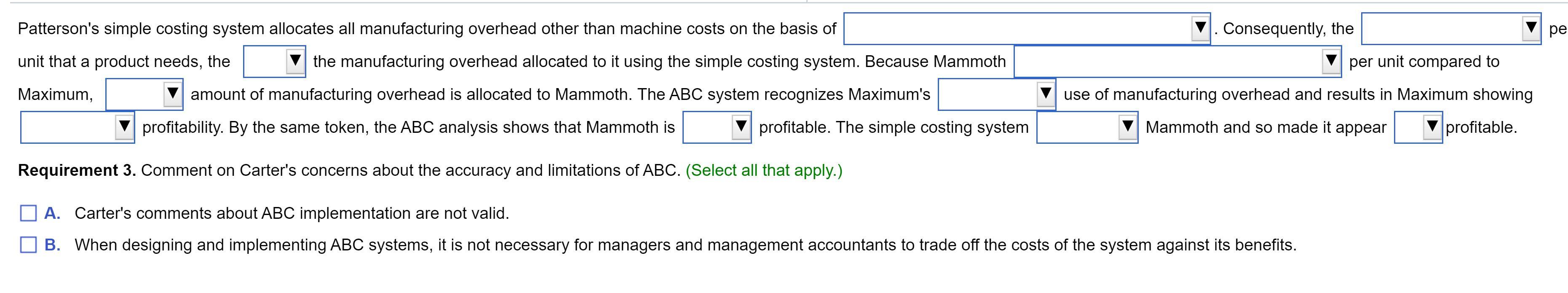

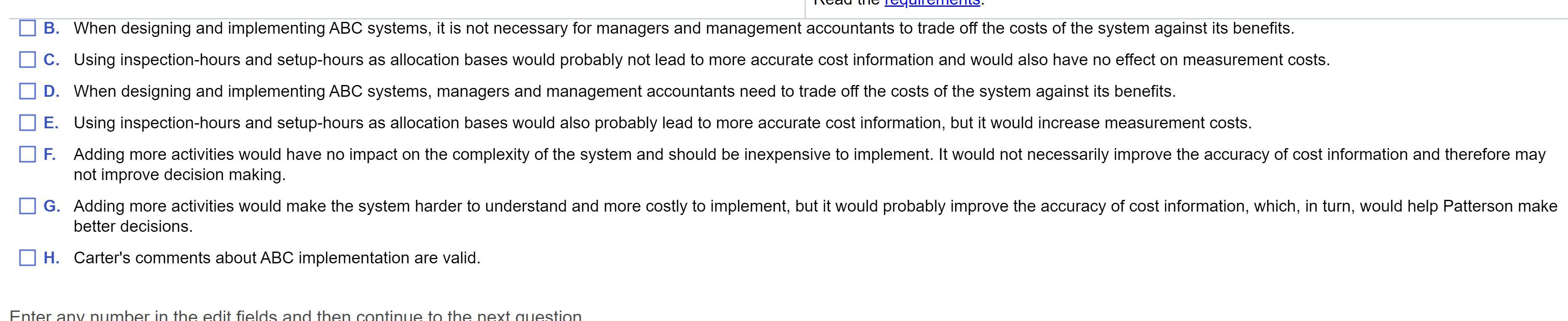

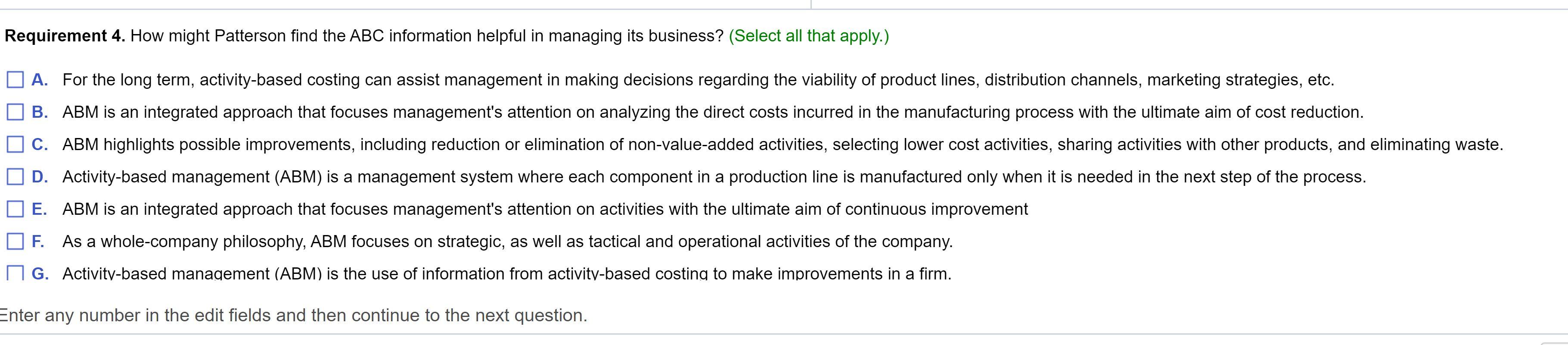

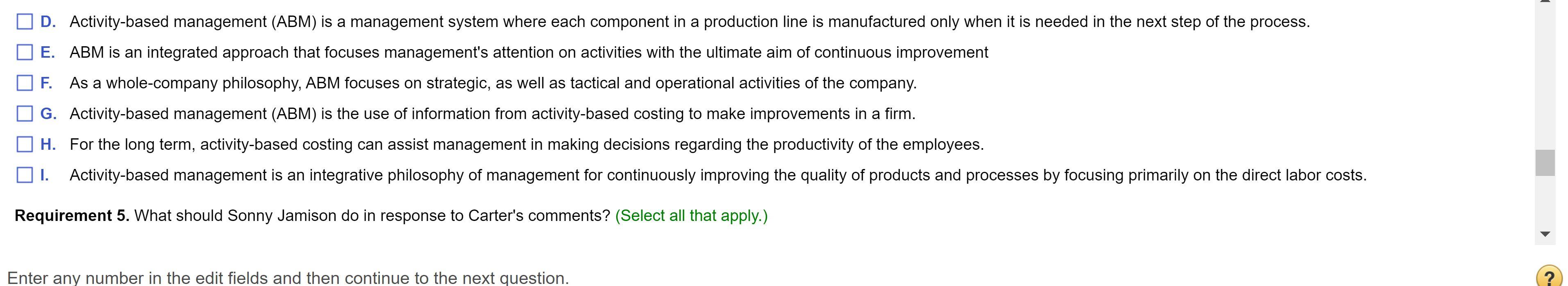

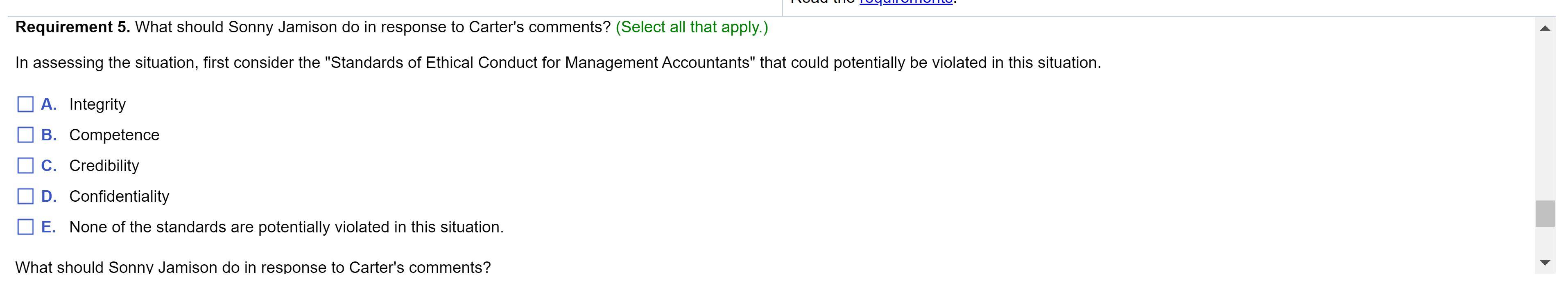

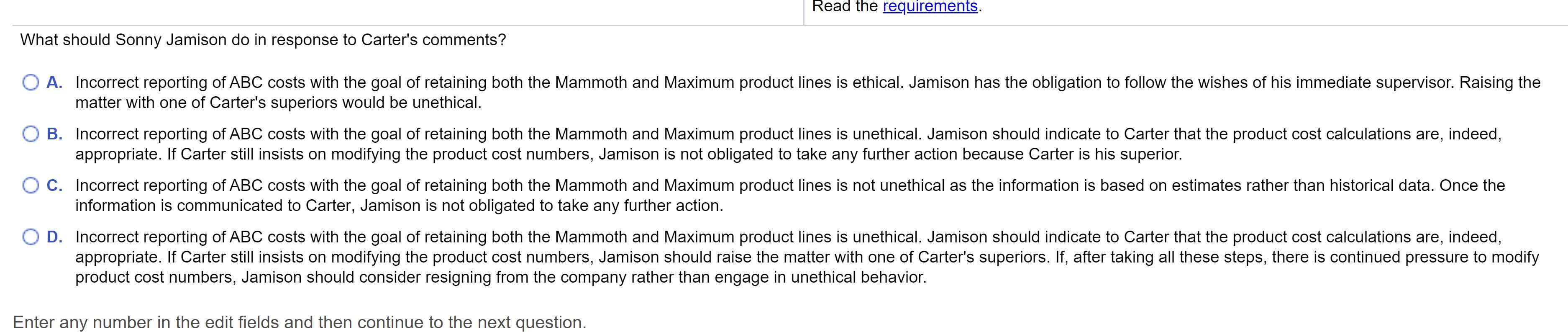

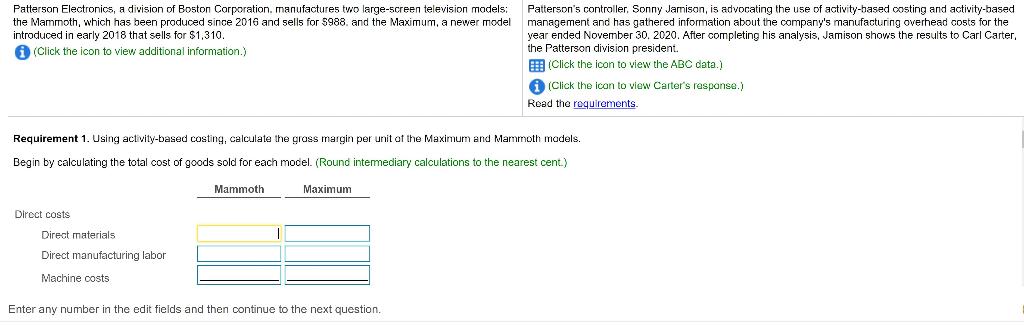

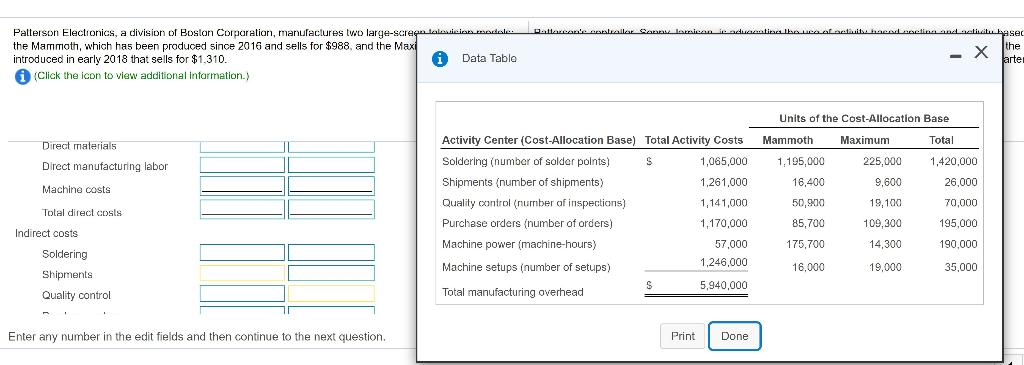

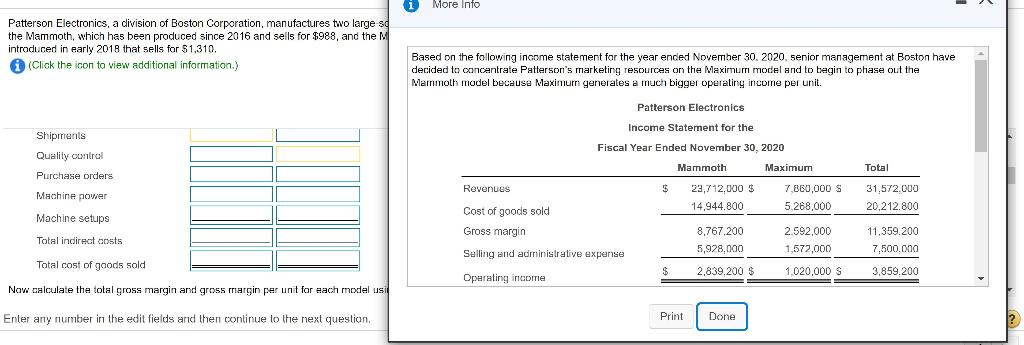

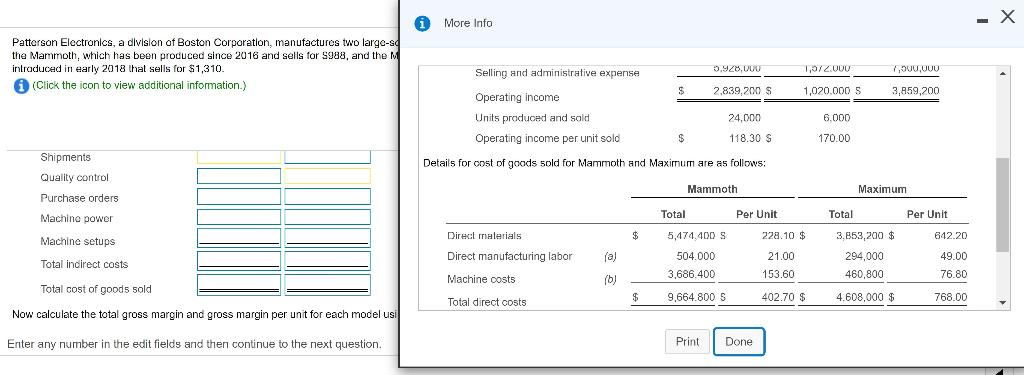

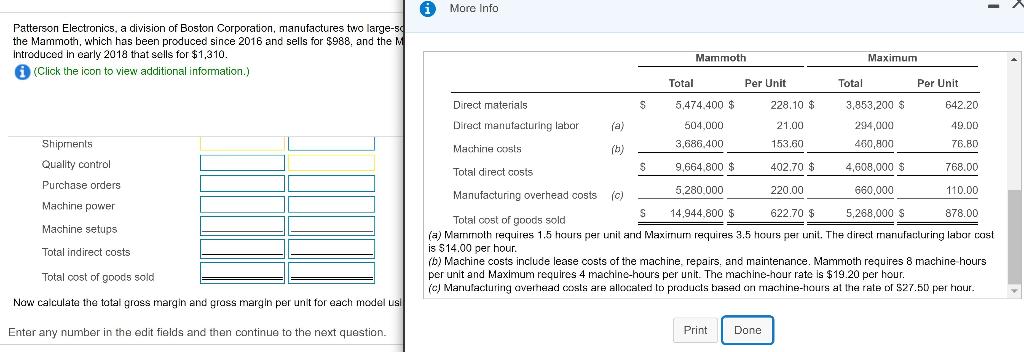

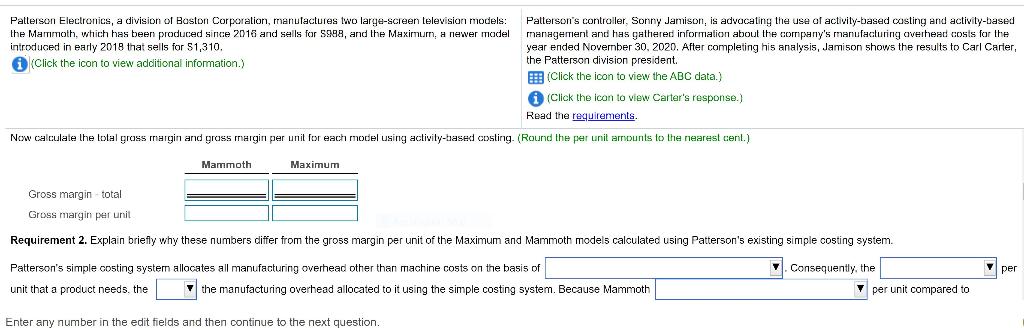

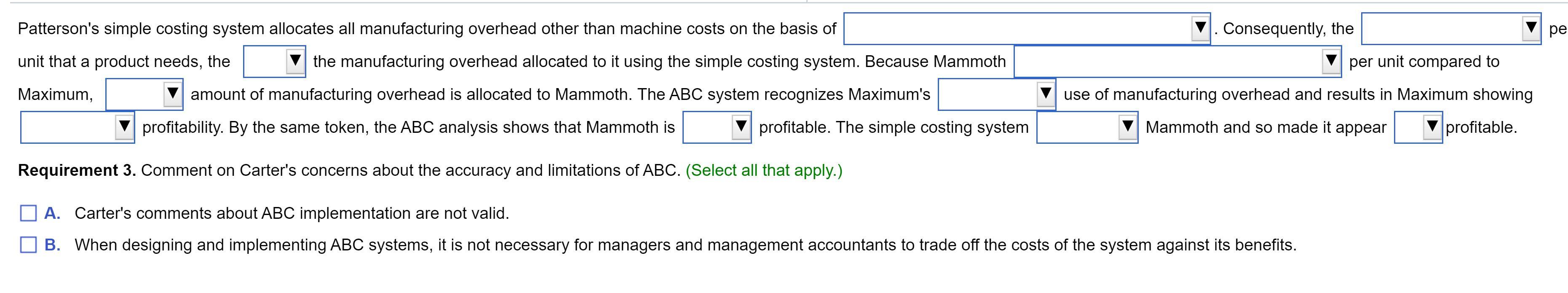

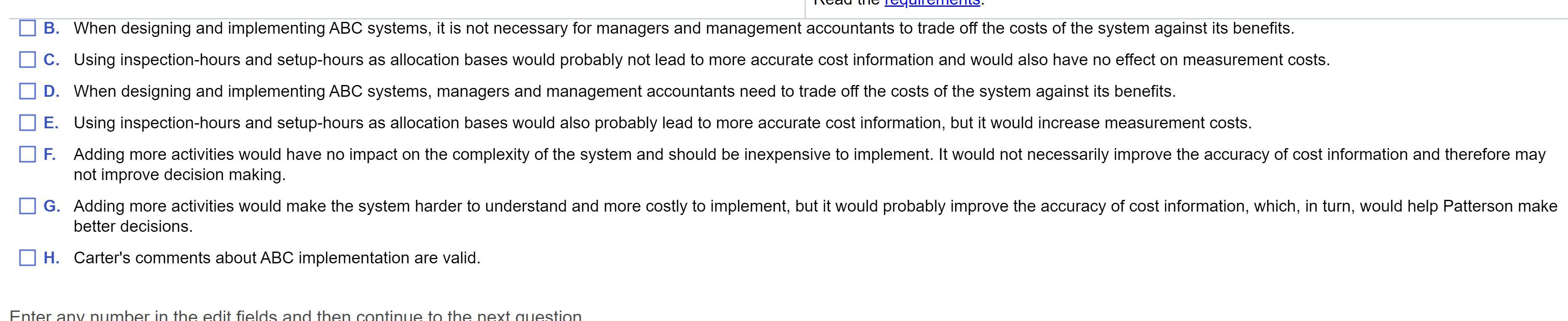

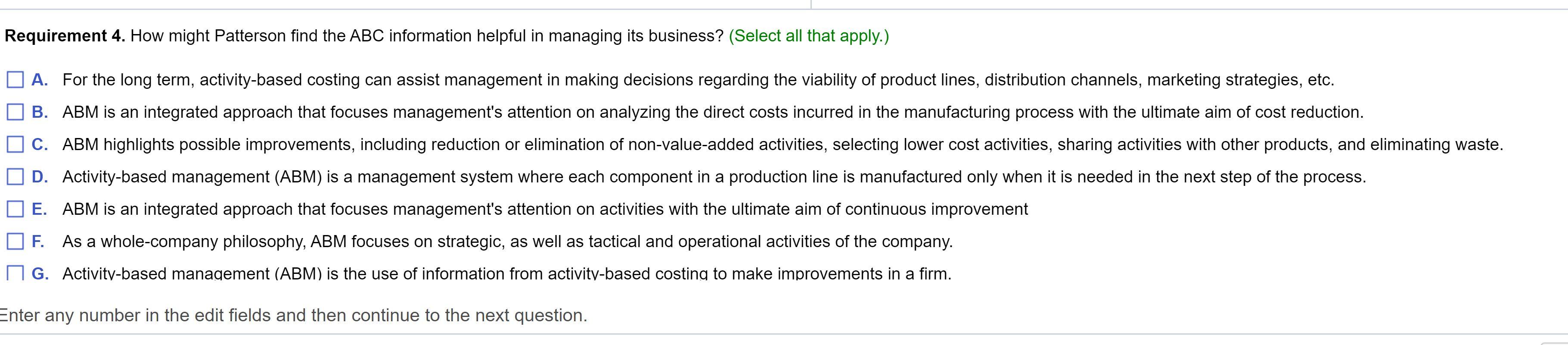

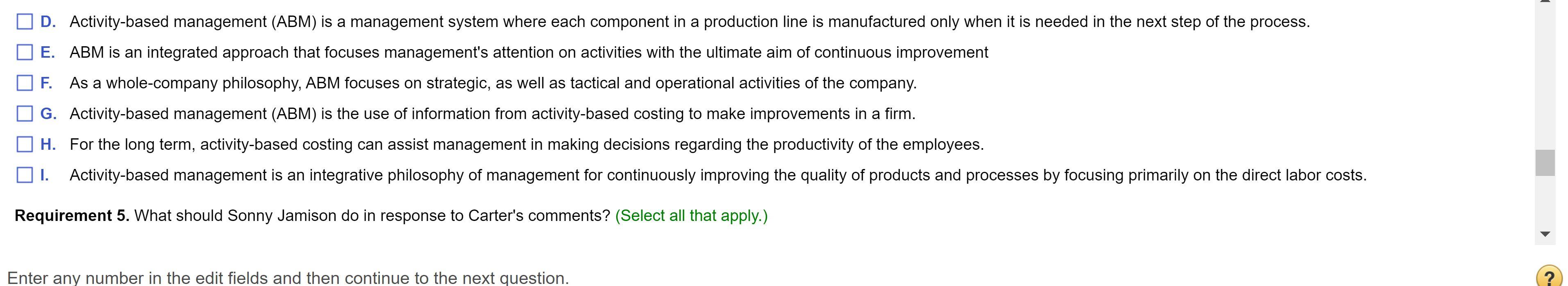

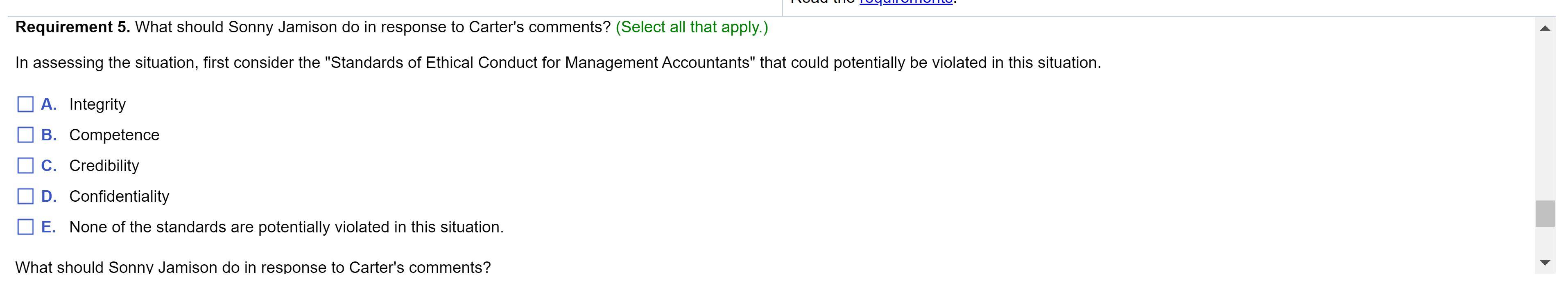

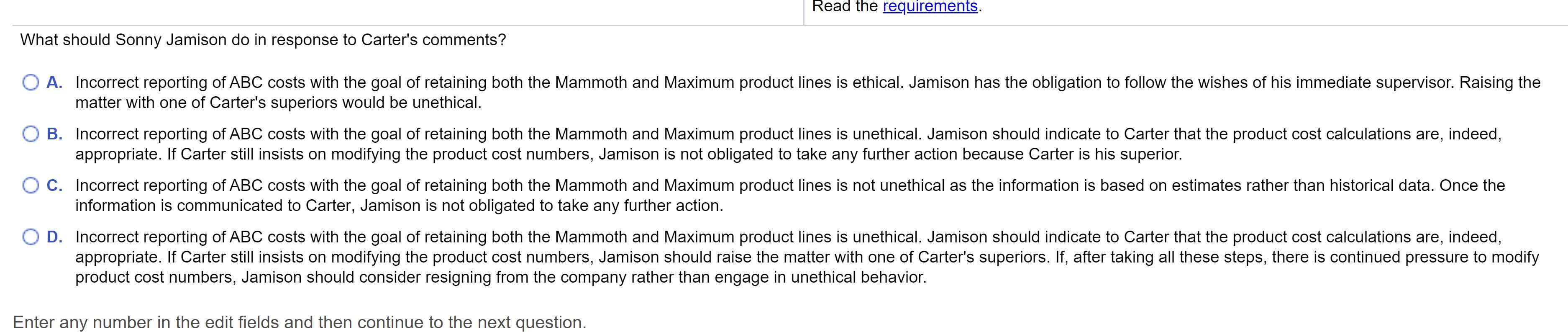

Patterson Electronics, a division of Boston Corporation, manufactures two large-screen television models: the Mammoth, which has been produced since 2016 and sells for $988. and the Maximum, a newer model introduced in early 2018 that sells for $1,310, (Click the icon to view additional information.) Patterson's controller. Sonny Jarison, is advocating the use of activity-based costing and activity-based management and has gathered information about the company's manufacturing overhead costs for the year ended November 30. 2020. After completing his analysis, Jamison shows the results to Carl Carter, the Patterson division president. Click the icon to view the ABC data) (Click the icon to view Carter's response.) Road the requirements Requirement 1. Using activity-based costing, calculate the grass margin per unit of the Maximum and Mammoth models. Begin by calculating the total cost of goods sold for each model. (Round intemediary calculations to the nearest cent.) Mammoth Maximum Direct costs Direct materials Direct manufacturing labor Machine costs Enter any number in the edit fields and then continue to the next question. Set Patterson Electronics, a division of Boston Corporation, manufactures two large-screen alicia dese the Mammoth, which has been produced since 2016 and sells for $988, and the Maxi introduced in early 2018 that sells for $1.310. Data Tabla (Click the icon to view additional information.) - X the arte Units of the Cost-Allocation Base Mammoth Maximum Total Direct materials 225,000 Direct manufacturing labor 1,420,000 1.195,000 16,400 9,600 26,000 Machine costs 19,100 70,000 Tolal direct costs Activity Center (Cost-Allocation Base) Total Activity Costs Soldering (number of solder points) $ 1,065,000 Shipments (number of shipments) 1,261,000 Quality control (number of inspections) 1,141,000 Purchase orders (number of orders) 1,170,000 Machine power (machine-hours) 57,000 Machine setups (number of setups) 1,246,000 $ Total manufacturing overhead 5,940,000 50,900 85,700 109,300 Indirect costs 195,000 190,000 175,700 14,300 Soldering 16.000 19,000 35,000 Shipments Quality control Enter any number in the edit fields and then continue to the next question. Print Done i More Info Patterson Electronics, a division of Boston Corporation, manufactures two large sd the Mammoth, which has been produced since 2016 and sells for $988, and the M introduced in early 2018 that sells for $1,310. (Click the icon to view additional information.) Based on the following income statement for the year ended November 30, 2020. senior management at Boston have decided to concentrate Patterson's marketing resources on the Maximurni model and to begin to phase out the Marmoth model because Maximum generates a much bigger operating income per unit. Patterson Electronics Income Statement for the Shipments Quality control Fiscal Year Ended November 30, 2020 Mammoth Maximum Total Purchase orders Revenues $ Machine power 23,712,000 $ 14,944.800 7.860,000 S 5.268,000 31,572.000 20,212.800 Machine setups Cost of goods sold Gross margin Selling and administrative expense Total indirect costs 8,767,200 5,928,000 2.592,000 1,572,000 11,359.200 7,500,000 Total cost of goods sold $ 2,839,200 $ 1.020,000 S 3,859.200 Operating income Now calculate the total gross margin and gross margin per unit for each model usi Enter any number in the edit fields and then continue to the next question. Print Done More Info Patterson Electronics, a division of Boston Corporation, manufactures two large-se the Mammoth, which has been produced since 2016 and sells for 1988, and the M intraduced in early 2018 that sells for $1,310 (Click the icon to view additional information.) Selling and administrative expense 3.928,000 1,372.000 7,000,000 $ 2,839,200 $ 1,020.000 S 3,259,200 Operating income Units produced and sold Operating income per unit sold 24,000 6.000 $ 118.30 S 170.00 Details for cost of goods sold for Mammoth and Maximum are as follows: Shipments Quality control Purchase orders Machine power Mammoth Maximum Total Per Unit Total Per Unit Direct materials $ Machine setups 5,474.400 S 228.10 $ 642.20 Direct manufacturing labor Total indirect costs (a) (b) 504.000 3,686.400 3,853,200 $ 294,000 460,800 21.00 153,60 49.00 76.80 Machine costs Total cost of goods sold $ 9,664.800 S Total direct costs 402.70 $ 768.00 4.608,000 $ Now calculate the total gross margin and gross margin per unit for each model usi Enter any number in the edit fields and then continue to the next question. Print Done i More Info Patterson Electronics, a division of Boston Corporation, manufactures two large-sc the Mammoth, which has been produced since 2016 and sells for $988, and the M Introduced in carly 2018 that sells for $1,310. (Click the icon to view additional information.) Mammoth Maximum Total Per Unit Total Per Unit Shipments Quality control Purchase orders Machine power Direct materials S 5.474.400 $ 228.10 $ 3,853,200 $ 642.20 Direct manufacturing labor (a) 504,000 21.00 294,000 49.00 Machine costs (b) 3,686.400 153,60 460,800 76.80 Total direct costs S 9,664,800 $ 402.70 $ 4,608,000 $ 768.00 Manufacturing overhead costs (c) 5,280.000 220.00 660,000 110.00 S 14,944,800 $ Total cost of goods sold 622.70 $ 5,268,000 $ 878.00 (a) Mammoth requires 1.5 hours per unit and Maximum requires 3.5 hours per unit. The direct manufacturing latar cast is $14.00 per hour. (6) Machine costs include lease costs of the machine, repairs, and maintenance. Mammoth requires 8 machine hours per unit and Maximum requires 4 machine-hours per unit. The machine-hour rate is $19.20 per hour. (c) Manufacturing overhead costs are allocated to products based on machine-tours at the rate of $27.50 per hour. Machine setups Total indirect costs Total cost of goods sold Now calculate the total gross margin and gross margin per unit for each model us Enter any number in the edit fields and then continue to the next question. Print Done Patterson Electronics, a division of Baston Corporation, manufactures two large-screen television models: Patterson's controller, Sonny Jamison, is advocating the use of activity-based casting and activity-based the Mammoth, which has been produced since 2016 and sells for $998, and the Maximurn, a newer middel management and has gathered information about the company's manufacturing averhead costs for the introduced in early 2018 that sells for $1,310. year ended November 30, 2020. After completing his analysis, Jamison shows the results to Carl Carter, Click the icon to view additional information.) the Patterson division president. (Click the icon to view the ABC data.) (Click the icon to view Carter's response.) Read the requirements Now calculate the total gross margin and grass margin per unit for each model using activity-based costing. (Round the per unit amounts to the nearest cent.) Mammoth Maximum Gross margin total Gross margin per unit Requirement 2. Explain briefly why these numbers differ from the gross margin per unit of the Maximum and Mammoth models calculated using Patterson's existing simple costing system. . Consequently, the per Patterson's simple costing system allocates all manufacturing overhead other than machine costs on the basis of unit that a product needs, the the manufacturing overhead allocated to it using the simple costing system. Because Mammoth per unit compared to Enter any number in the edit fields and then continue to the next question. Patterson's simple costing system allocates all manufacturing overhead other than machine costs on the basis of V. Consequently, the pe V per unit compared to unit that a product needs, the the manufacturing overhead allocated to it using the simple costing system. Because Mammoth Maximum, amount of manufacturing overhead is allocated to Mammoth. The ABC system recognizes Maximum's v profitability. By the same token, the ABC analysis shows that Mammoth is profitable. The simple costing system use of manufacturing overhead and results in Maximum showing Mammoth and so made it appear profitable. . Requirement 3. Comment on Carter's concerns about the accuracy and limitations of ABC. (Select all that apply.) A. Carter's comments about ABC implementation are not valid. B. When designing and implementing ABC systems, it is not necessary for managers and management accountants to trade off the costs of the system against its benefits. B. When designing and implementing ABC systems, it is not necessary for managers and management accountants to trade off the costs of the system against its benefits. C. Using inspection-hours and setup-hours as allocation bases would probably not lead to more accurate cost information and would also have no effect on measurement costs. D. When designing and implementing ABC systems, managers and management accountants need to trade off the costs of the system against its benefits. E. Using inspection-hours and setup-hours as allocation bases would also probably lead to more accurate cost information, but it would increase measurement costs. F. Adding more activities would have no impact on the complexity of the system and should be inexpensive to implement. It would not necessarily improve the accuracy of cost information and therefore may not improve decision making. G. Adding more activities would make the system harder to understand and more costly to implement, but it would probably improve the accuracy of cost information, which in turn, would help Patterson make better decisions. H. Carter's comments about ABC implementation are valid. Enter any number in the edit fields and then continue to the next question Requirement 4. How might Patterson find the ABC information helpful in managing its business? (Select all that apply.) O A. For the long term, activity-based costing can assist management in making decisions regarding the viability of product lines, distribution channels, marketing strategies, etc. B. ABM is an integrated approach that focuses management's attention on analyzing the direct costs incurred in the manufacturing process with the ultimate aim of cost reduction. C. ABM highlights possible improvements, including reduction or elimination of non-value-added activities, selecting lower cost activities, sharing activities with other products, and eliminating waste. D. Activity-based management (ABM) is a management system where each component in a production line is manufactured only when it is needed in the next step of the process. E. ABM is an integrated approach that focuses management's attention on activities with the ultimate aim of continuous improvement F. As a whole-company philosophy, ABM focuses on strategic, as well as tactical and operational activities of the company. I G. Activity-based management (ABM) is the use of information from activity-based costing to make improvements in a firm. Enter any number in the edit fields and then continue to the next question. D. Activity-based management (ABM) is a management system where each component in a production line is manufactured only when it is needed in the next step of the process. E. ABM is an integrated approach that focuses management's attention on activities with the ultimate aim of continuous improvement As a whole-company philosophy, ABM focuses on strategic, as well as tactical and operational activities of the company. G. Activity-based management (ABM) is the use of information from activity-based costing to make improvements in a firm. H. For the long term, activity-based costing can assist management in making decisions regarding the productivity of the employees. I. Activity-based management is an integrative philosophy of management for continuously improving the quality of products and processes by focusing primarily on the direct labor costs. Requirement 5. What should Sonny Jamison do in response to Carter's comments? (Select all that apply.) Enter any number in the edit fields and then continue to the next question. Requirement 5. What should Sonny Jamison do in response to Carter's comments? (Select all that apply.) In assessing the situation, first consider the "Standards of Ethical Conduct for Management Accountants" that could potentially be violated in this situation. A. Integrity B. Competence C. Credibility D. Confidentiality E. None of the standards are potentially violated in this situation. What should Sonny Jamison do in response to Carter's comments? Read the requirements. What should Sonny Jamison do in response to Carter's comments? O A. Incorrect reporting of ABC costs with the goal of retaining both the Mammoth and Maximum product lines is ethical. Jamison has the obligation to follow the wishes of his immediate supervisor. Raising the matter with one of Carter's superiors would be unethical. O B. Incorrect reporting of ABC costs with the goal of retaining both the Mammoth and Maximum product lines is unethical. Jamison should indicate to Carter that the product cost calculations are, indeed, appropriate. If Carter still insists on modifying the product cost numbers, Jamison is not obligated to take any further action because Carter is his superior. O C. Incorrect reporting of ABC costs with the goal of retaining both the Mammoth and Maximum product lines is not unethical as the information is based on estimates rather than historical data. Once the information is communicated to Carter, Jamison is not obligated to take any further action. D. Incorrect reporting of ABC costs with the goal of retaining both the Mammoth and Maximum product lines is unethical. Jamison should indicate to Carter that the product cost calculations are, indeed, appropriate. If Carter still insists on modifying the product cost numbers, Jamison should raise the matter with one of Carter's superiors. If, after taking all these steps, there is continued pressure to modify product cost numbers, Jamison should consider resigning from the company rather than engage in unethical behavior. Enter any number in the edit fields and then continue to the next