Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Paul and Donna Decker are married taxpayers, ages 44 and 42, who file a joint return for Year 1. Paul and Donna have two

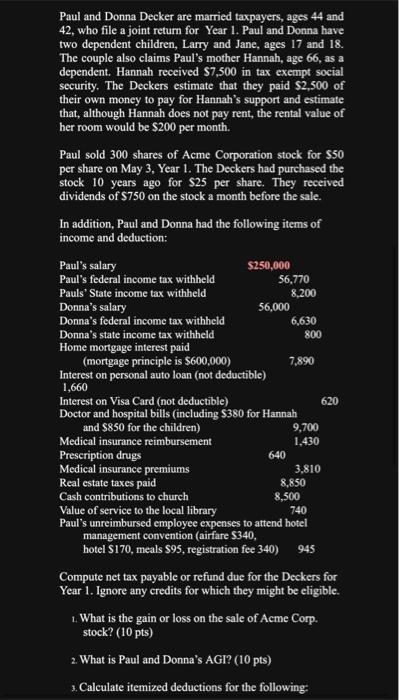

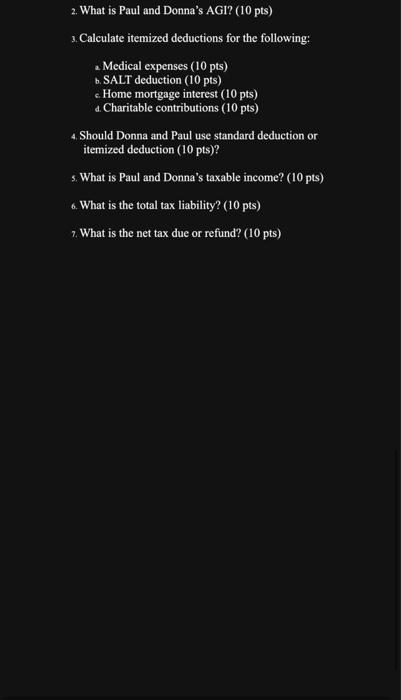

Paul and Donna Decker are married taxpayers, ages 44 and 42, who file a joint return for Year 1. Paul and Donna have two dependent children, Larry and Jane, ages 17 and 18. The couple also claims Paul's mother Hannah, age 66, as a dependent. Hannah received $7,500 in tax exempt social security. The Deckers estimate that they paid $2,500 of their own money to pay for Hannah's support and estimate that, although Hannah does not pay rent, the rental value of her room would be $200 per month. Paul sold 300 shares of Acme Corporation stock for $50 per share on May 3, Year 1. The Deckers had purchased the stock 10 years ago for $25 per share. They received dividends of $750 on the stock a month before the sale. In addition, Paul and Donna had the following items of income and deduction: Paul's salary Paul's federal income tax withheld Pauls' State income tax withheld Donna's salary Donna's federal income tax withheld Donna's state income tax withheld Home mortgage interest paid (mortgage principle is $600,000) Interest on personal auto loan (not deductible) 1,660 $250,000 Prescription drugs Medical insurance premiums Real estate taxes paid Cash contributions to church 56,770 56,000 8,200 640 6,630 Interest on Visa Card (not deductible) Doctor and hospital bills (including $380 for Hannah and $850 for the children) Medical insurance reimbursement 7,890 800 9,700 1,430 3,810 8,850 8,500 Value of service to the local library 740 Paul's unreimbursed employee expenses to attend hotel management convention (airfare $340, hotel $170, meals $95, registration fee 340) 945 620 Compute net tax payable or refund due for the Deckers for Year 1. Ignore any credits for which they might be eligible. 1. What is the gain or loss on the sale of Acme Corp. stock? (10 pts) 2. What is Paul and Donna's AGI? (10 pts) 3. Calculate itemized deductions for the following: 2. What is Paul and Donna's AGI? (10 pts) 3. Calculate itemized deductions for the following: a Medical expenses (10 pts) b. SALT deduction (10 pts) c. Home mortgage interest (10 pts) d. Charitable contributions (10 pts) 4. Should Donna and Paul use standard deduction or itemized deduction (10 pts)? s. What is Paul and Donna's taxable income? (10 pts) 6. What is the total tax liability? (10 pts) 7. What is the net tax due or refund? (10 pts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Gain or Loss on Acme Corp Stock Purchase price per share 25 Selling price per share 50 Number of shares sold 300 Cost basis of stock 25share 300 sha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started