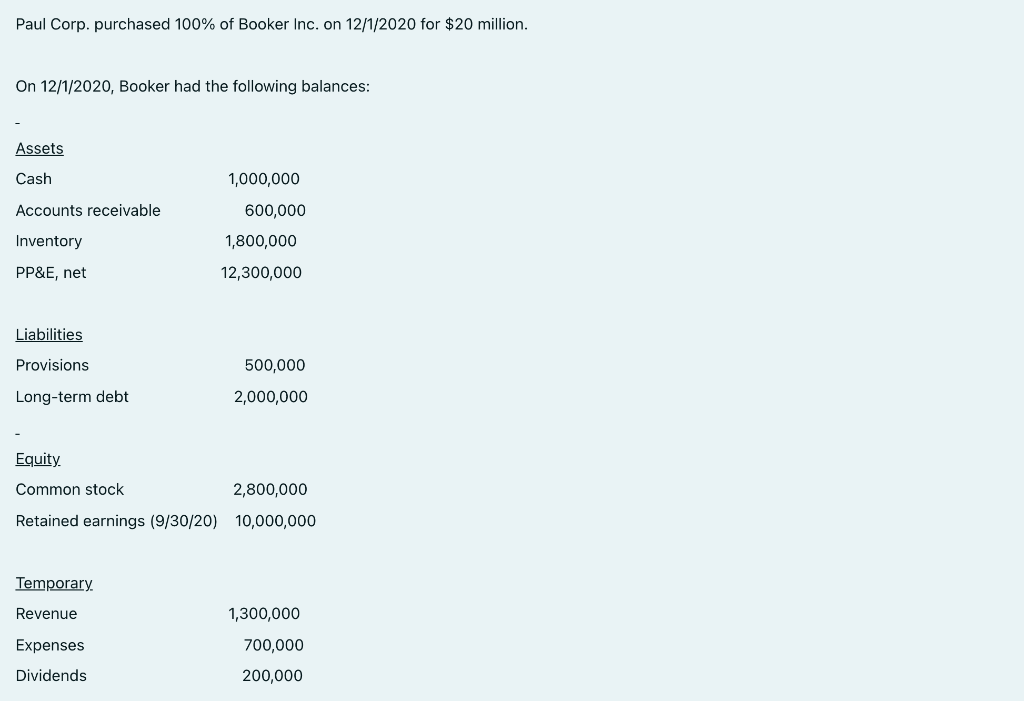

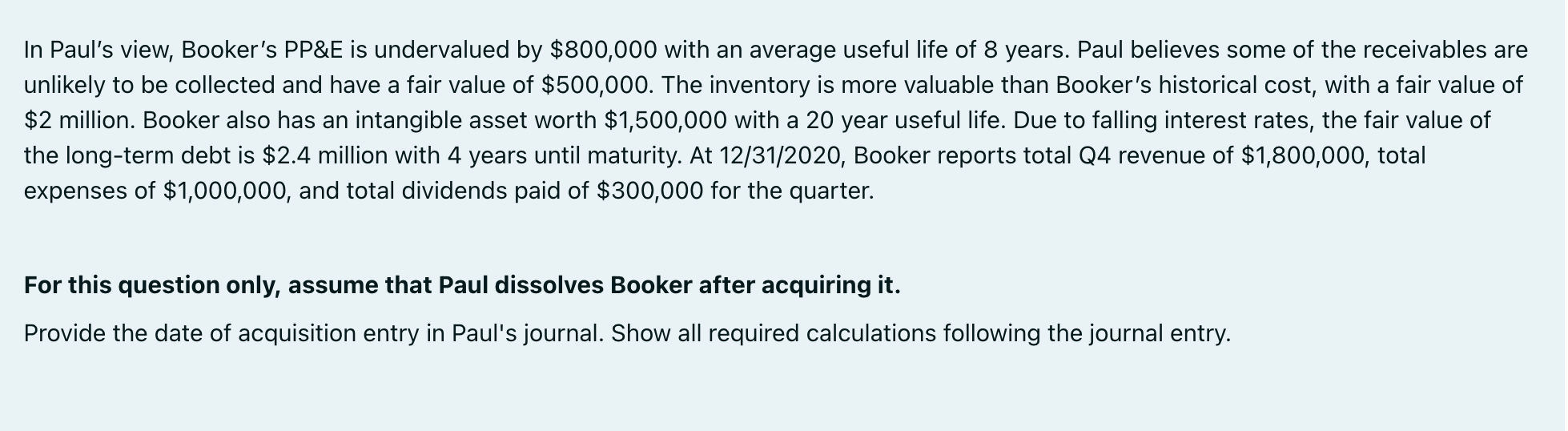

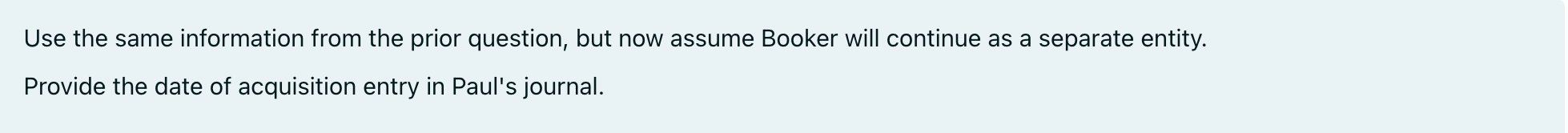

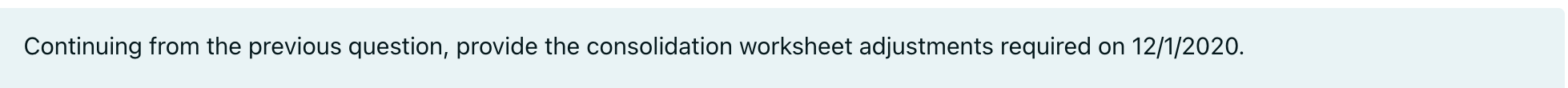

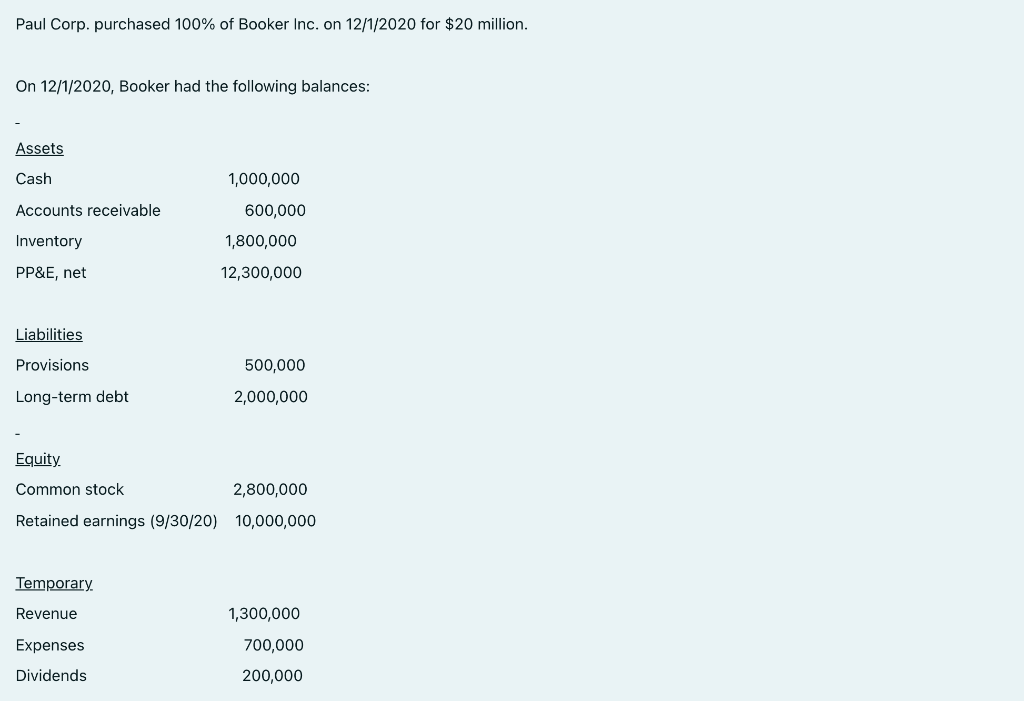

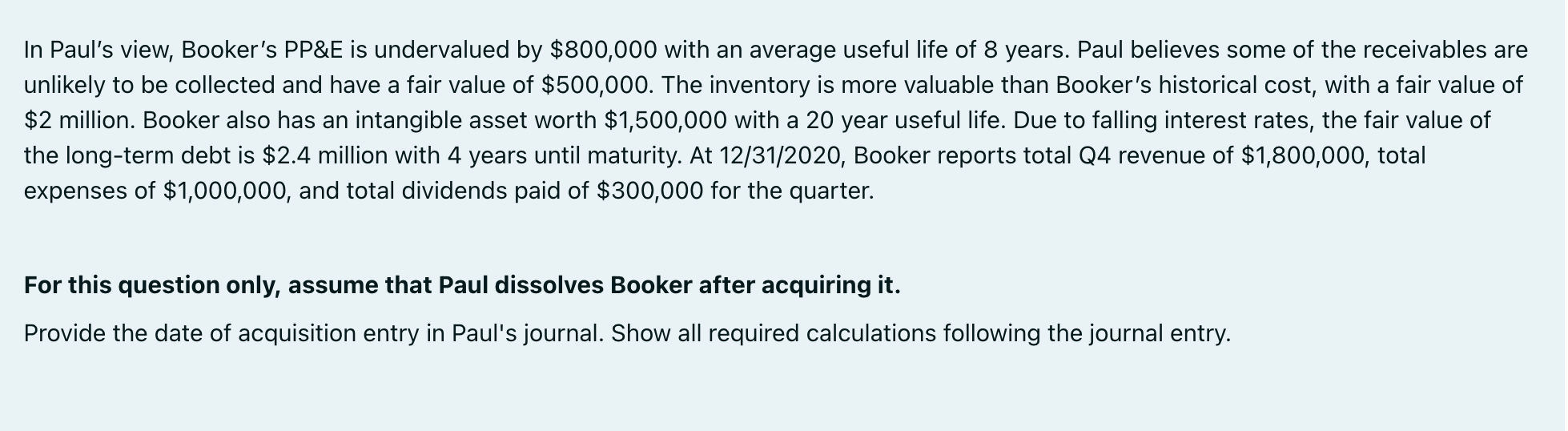

Paul Corp. purchased 100% of Booker Inc. on 12/1/2020 for $20 million. On 12/1/2020, Booker had the following balances: Assets Cash 1,000,000 Accounts receivable Inventory 600,000 1,800,000 12,300,000 PP&E, net Liabilities Provisions 500,000 Long-term debt 2,000,000 Equity Common stock 2,800,000 Retained earnings (9/30/20) 10,000,000 Temporary Revenue 1,300,000 Expenses 700,000 Dividends 200,000 In Paul's view, Booker's PP&E is undervalued by $800,000 with an average useful life of 8 years. Paul believes some of the receivables are unlikely to be collected and have a fair value of $500,000. The inventory is more valuable than Booker's historical cost, with a fair value of $2 million. Booker also has an intangible asset worth $1,500,000 with a 20 year useful life. Due to falling interest rates, the fair value of the long-term debt is $2.4 million with 4 years until maturity. At 12/31/2020, Booker reports total Q4 revenue of $1,800,000, total expenses of $1,000,000, and total dividends paid of $300,000 for the quarter. For this question only, assume that Paul dissolves Booker after acquiring it. Provide the date of acquisition entry in Paul's journal. Show all required calculations following the journal entry. Continuing from the previous question, provide the consolidation worksheet adjustments required on 12/1/2020. Paul Corp. purchased 100% of Booker Inc. on 12/1/2020 for $20 million. On 12/1/2020, Booker had the following balances: Assets Cash 1,000,000 Accounts receivable Inventory 600,000 1,800,000 12,300,000 PP&E, net Liabilities Provisions 500,000 Long-term debt 2,000,000 Equity Common stock 2,800,000 Retained earnings (9/30/20) 10,000,000 Temporary Revenue 1,300,000 Expenses 700,000 Dividends 200,000 In Paul's view, Booker's PP&E is undervalued by $800,000 with an average useful life of 8 years. Paul believes some of the receivables are unlikely to be collected and have a fair value of $500,000. The inventory is more valuable than Booker's historical cost, with a fair value of $2 million. Booker also has an intangible asset worth $1,500,000 with a 20 year useful life. Due to falling interest rates, the fair value of the long-term debt is $2.4 million with 4 years until maturity. At 12/31/2020, Booker reports total Q4 revenue of $1,800,000, total expenses of $1,000,000, and total dividends paid of $300,000 for the quarter. For this question only, assume that Paul dissolves Booker after acquiring it. Provide the date of acquisition entry in Paul's journal. Show all required calculations following the journal entry. Continuing from the previous question, provide the consolidation worksheet adjustments required on 12/1/2020