Question

Paul Dirac Enterprises actively manages its cost of funds and finances its operations by issuing floating rate debt. The company recently issued a a 3-year

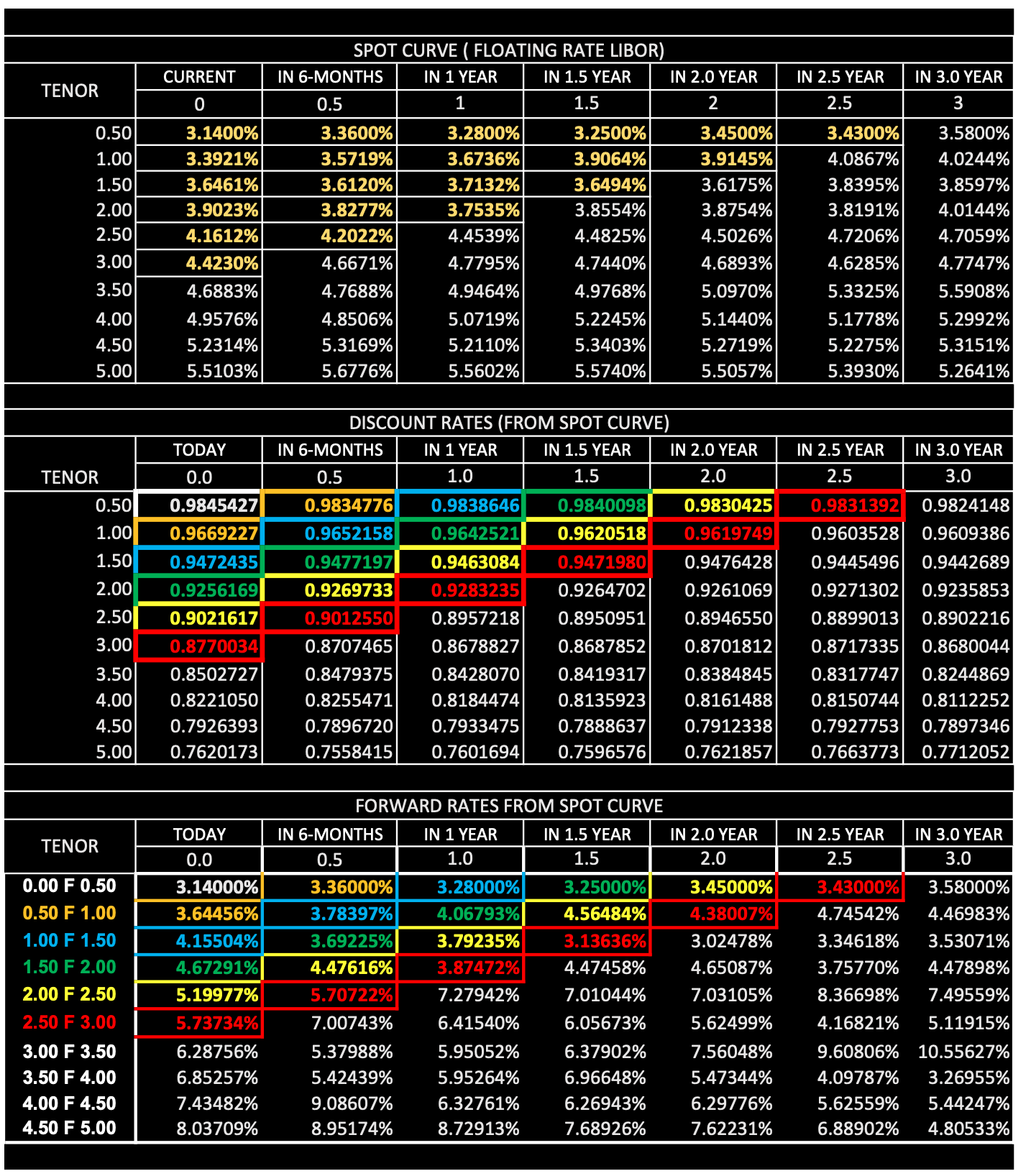

Paul Dirac Enterprises actively manages its cost of funds and finances its operations by issuing floating rate debt. The company recently issued a a 3-year floating rate bond based on LIBOR with 6-month resets (CURRENT floating rate LIBOR spot curve). The firms risk management team forecasts an increase in 6-mo LIBOR over the next 3-years. In order to protect themselves against increases in 6-Month LIBOR, the firm has decided to swap their 3 year floating rate bond to a 3 year fixed rate bond. The current 6-Month LIBOR spot curve and the future 6-Month LIBOR spot curves (over the next 3 years) are given in the table below. Furthermore, for every 6-Month LIBOR spot curve, the discount rates and 6-Month forward rates are also calculated.

1) Based on the Current 6-Month LIBOR Spot Rate Curve, calculate all SWAP RATES. 2) What is the SWAP RATE Dirac will use to convert his floating rate bond into a fixed rate bond? 3) Create the Payoff Table and the Profit Diagram for the SWAP 4) Value the Swap at every reset date (end of every 6-Month period). 5) Provide all journal entries and t-accounts necessary to account for the swap over the following 3 year period.

CURRENT IN 6-MONTHS SPOT CURVE ( FLOATING RATE LIBOR) IN 1 YEAR IN 1.5 YEAR IN 2.0 YEAR IN 2.5 YEAR IN 3.0 YEAR TENOR 0 0.5 1 1.5 2 2.5 3 0.50 3.1400% 3.3600% 3.2800% 3.2500% 3.4500% 3.4300% 3.5800% 1.00 3.3921% 3.5719% 3.6736% 3.9064% 3.9145% 4.0867% 4.0244% 1.50 3.6461% 3.6120% 3.7132% 3.6494% 3.6175% 3.8395% 3.8597% 2.00 3.9023% 3.8277% 3.7535% 3.8554% 3.8754% 3.8191% 4.0144% 2.50 4.1612% 4.2022% 4.4539% 4.4825% 4.5026% 4.7206% 4.7059% 3.00 4.4230% 4.6671% 4.7795% 4.7440% 4.6893% 4.6285% 4.7747% 3.50 4.6883% 4.7688% 4.9464% 4.9768% 5.0970% 5.3325% 5.5908% 4.00 4.9576% 4.8506% 5.0719% 5.2245% 5.1440% 5.1778% 5.2992% 4.50 5.2314% 5.3169% 5.2110% 5.3403% 5.2719% 5.2275% 5.3151% 5.00 5.5103% 5.6776% 5.5602% 5.5740% 5.5057% 5.3930% 5.2641% DISCOUNT RATES (FROM SPOT CURVE) TENOR TODAY 0.0 IN 6-MONTHS IN 1 YEAR IN 1.5 YEAR IN 2.0 YEAR 0.50 0.9845427 0.5 0.9834776 1.0 1.5 2.0 0.9838646 0.9840098 0.9830425 1.00 0.9669227 0.9652158 1.50 0.9472435 0.9477197 2.00 0.9256169 0.9269733 2.50 0.9021617 0.9012550 0.8957218 0.9642521 0.9620518 0.9463084 0.9471980 0.9283235 0.9264702 0.8950951 0.9619749 IN 2.5 YEAR 2.5 0.9831392 0.9824148 0.9603528 0.9609386 IN 3.0 YEAR 3.0 0.9476428 0.9445496 0.9442689 0.9261069 0.9271302 0.9235853 0.8946550 0.8899013 0.8902216 3.00 0.8770034 0.8707465 0.8678827 0.8687852 0.8701812 0.8717335 0.8680044 3.50 0.8502727 0.8479375 0.8428070 0.8419317 0.8384845 4.00 0.8221050 0.8255471 0.8184474 0.8135923 0.8161488 4.50 0.7926393 0.7896720 0.7933475 0.7888637 0.7912338 5.00 0.7620173 0.7558415 0.7601694 0.7596576 0.7621857 0.8317747 0.8244869 0.8150744 0.8112252 0.7927753 0.7897346 0.7663773 0.7712052 FORWARD RATES FROM SPOT CURVE TENOR TODAY 0.0 IN 6-MONTHS IN 1 YEAR IN 1.5 YEAR IN 2.0 YEAR 0.5 1.0 1.5 0.00 F 0.50 3.14000% 3.36000% 3.28000% 3.25000% 2.0 3.45000% IN 2.5 YEAR 2.5 3.43000% IN 3.0 YEAR 3.0 3.58000% 0.50 F 1.00 3.64456% 3.78397% 4.06793% 4.56484% 4.38007% 4.74542% 4.46983% 1.00 F 1.50 4.15504% 3.69225% 3.79235% 3.13636% 3.02478% 3.34618% 3.53071% 1.50 F 2.00 4.67291% 4.47616% 3.87472% 4.47458% 4.65087% 3.75770% 4.47898% 2.00 F 2.50 5.19977% 5.70722% 7.27942% 7.01044% 7.03105% 8.36698% 7.49559% 2.50 F 3.00 5.73734% 7.00743% 6.41540% 6.05673% 5.62499% 4.16821% 5.11915% 3.00 F 3.50 6.28756% 5.37988% 5.95052% 6.37902% 7.56048% 9.60806% 10.55627% 3.50 F 4.00 6.85257% 5.42439% 5.95264% 6.96648% 4.00 F 4.50 7.43482% 9.08607% 6.32761% 4.50 F 5.00 8.03709% 8.95174% 8.72913% 6.26943% 7.68926% 5.47344% 6.29776% 4.09787% 3.26955% 5.62559% 5.44247% 7.62231% 6.88902% 4.80533%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started