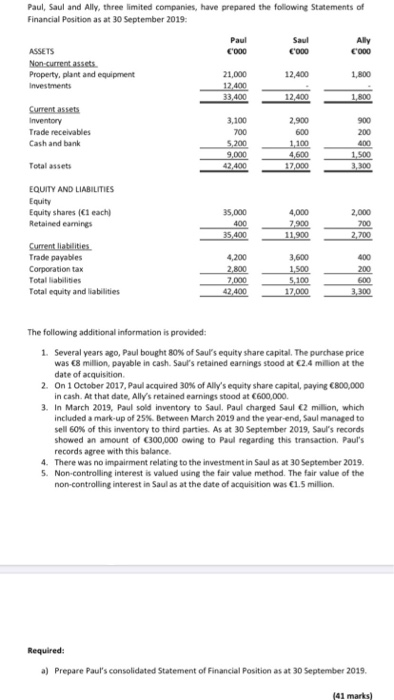

Paul, Saul and Ally, three limited companies, have prepared the following Statements of Financial Position as at 30 September 2019: Paul Saul Ally ASSETS C000 C000 C000 Non-current assets. Property, plant and equipment 21,000 12,400 1,800 Investments 12.400 33.400 12.400 1,800 Current assets Inventory 3,100 2,900 Trade receivables 700 600 200 Cash and bank 5,200 1.100 400 9,000 4,600 1,500 Total assets 42.400 17,000 3,300 35,000 400 35,400 4,000 7.900 11.900 2,000 700 2,700 EQUITY AND LIABILITIES Equity Equity shares (Cleachi Retained earnings Current liabilities Trade payables Corporation tax Total abilities Total equity and liabilities 4,200 2,800 2.000 42,400 3,600 1,500 5.100 17.000 400 200 600 3,300 The following additional information is provided: 1. Several years ago, Paul bought 80% of Saul's equity share capital. The purchase price was 8 million, payable in cash. Saul's retained earnings stood at 2.4 million at the date of acquisition 2. On 1 October 2017, Paul acquired 30% of Ally's equity share capital, paying 800,000 in cash. At that date, Ally's retained earnings stood at 600,000 3. In March 2019, Paul sold inventory to Saul. Paul charged Saul 2 million, which included a mark-up of 25%. Between March 2019 and the year-end, Saul managed to sell 60% of this inventory to third parties. As at 30 September 2019, Saul's records showed an amount of C300,000 owing to Paul regarding this transaction. Paul's records agree with this balance 4. There was no impairment relating to the investment in Saul as at 30 September 2019. 5. Non-controlling interest is valued using the fair value method. The fair value of the non-controlling interest in Saul as at the date of acquisition was 61.5 million Required: a) Prepare Paul's consolidated Statement of Financial Position as at 30 September 2019. (41 marks) Paul, Saul and Ally, three limited companies, have prepared the following Statements of Financial Position as at 30 September 2019: Paul Saul Ally ASSETS C000 C000 C000 Non-current assets. Property, plant and equipment 21,000 12,400 1,800 Investments 12.400 33.400 12.400 1,800 Current assets Inventory 3,100 2,900 Trade receivables 700 600 200 Cash and bank 5,200 1.100 400 9,000 4,600 1,500 Total assets 42.400 17,000 3,300 35,000 400 35,400 4,000 7.900 11.900 2,000 700 2,700 EQUITY AND LIABILITIES Equity Equity shares (Cleachi Retained earnings Current liabilities Trade payables Corporation tax Total abilities Total equity and liabilities 4,200 2,800 2.000 42,400 3,600 1,500 5.100 17.000 400 200 600 3,300 The following additional information is provided: 1. Several years ago, Paul bought 80% of Saul's equity share capital. The purchase price was 8 million, payable in cash. Saul's retained earnings stood at 2.4 million at the date of acquisition 2. On 1 October 2017, Paul acquired 30% of Ally's equity share capital, paying 800,000 in cash. At that date, Ally's retained earnings stood at 600,000 3. In March 2019, Paul sold inventory to Saul. Paul charged Saul 2 million, which included a mark-up of 25%. Between March 2019 and the year-end, Saul managed to sell 60% of this inventory to third parties. As at 30 September 2019, Saul's records showed an amount of C300,000 owing to Paul regarding this transaction. Paul's records agree with this balance 4. There was no impairment relating to the investment in Saul as at 30 September 2019. 5. Non-controlling interest is valued using the fair value method. The fair value of the non-controlling interest in Saul as at the date of acquisition was 61.5 million Required: a) Prepare Paul's consolidated Statement of Financial Position as at 30 September 2019. (41 marks)