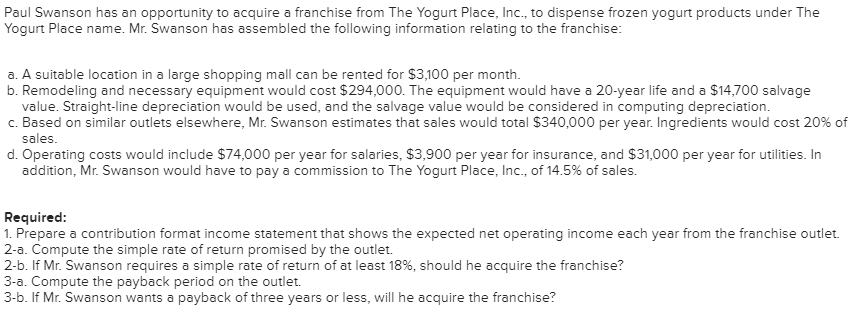

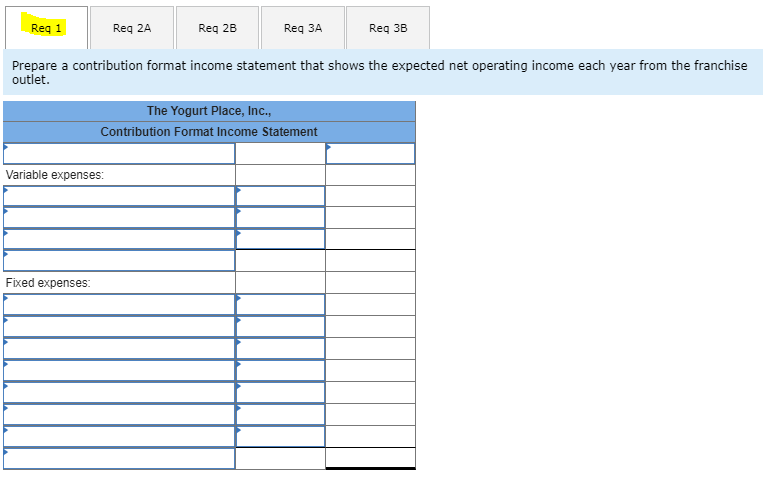

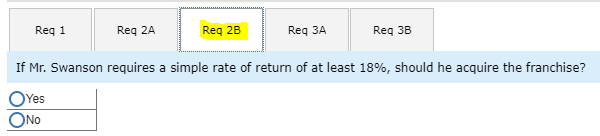

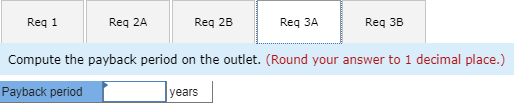

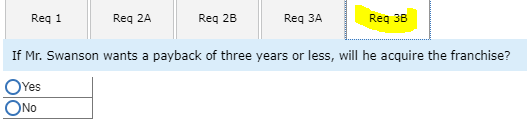

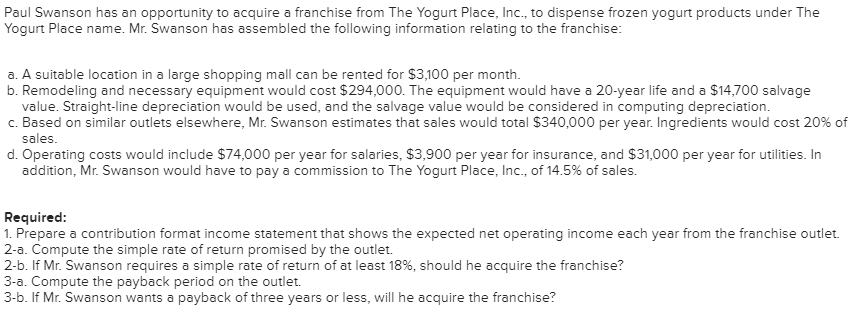

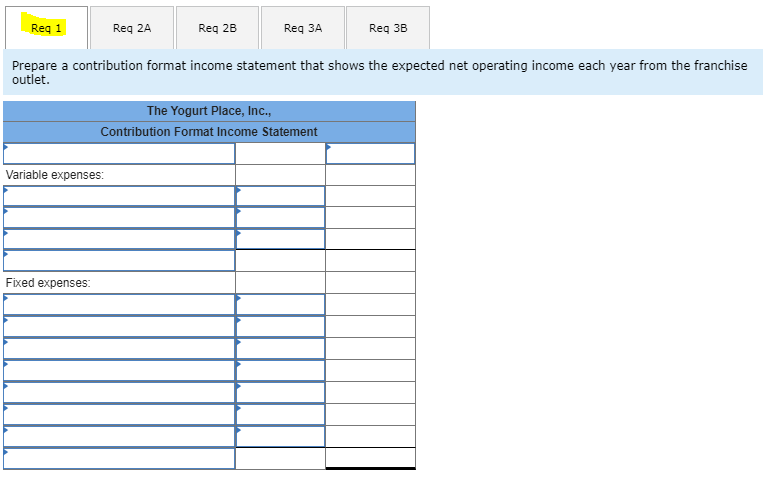

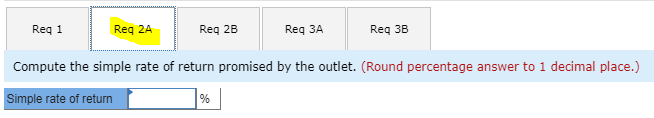

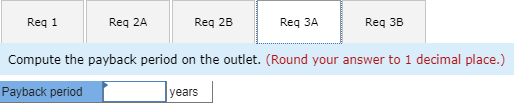

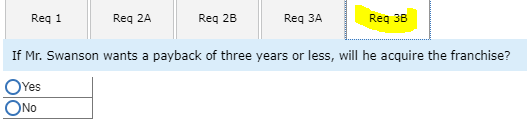

Paul Swanson has an opportunity to acquire a franchise from The Yogurt Place, Inc., to dispense frozen yogurt products under The Yogurt Place name. Mr. Swanson has assembled the following information relating to the franchise: a. A suitable location in a large shopping mall can be rented for $3,100 per month. b. Remodeling and necessary equipment would cost $294,000. The equipment would have a 20-year life and a $14,700 salvage value. Straight-line depreciation would be used, and the salvage value would be considered in computing depreciation. c. Based on similar outlets elsewhere, Mr. Swanson estimates that sales would total $340,000 per year. Ingredients would cost 20% of sales. d. Operating costs would include $74,000 per year for salaries, $3,900 per year for insurance, and $31,000 per year for utilities. In addition, Mr. Swanson would have to pay a commission to The Yogurt Place, Inc., of 14.5% of sales. Required: 1. Prepare a contribution format income statement that shows the expected net operating income each year from the franchise outlet. 2-a. Compute the simple rate of return promised by the outlet. 2-b. If Mr. Swanson requires a simple rate of return of at least 18%, should he acquire the franchise? 3-a. Compute the payback period on the outlet. 3-b. If Mr. Swanson wants a payback of three years or less, will he acquire the franchise? Reg 1 Req 2A Reg 2B Req 3A Reg 3B Prepare a contribution format income statement that shows the expected net operating income each year from the franchise outlet. The Yogurt Place, Inc., Contribution Format Income Statement Variable expenses: Fixed expenses: Req 1 Regi Reg 2A Reqaa | Reg ze Reg 2B Req 3A REG 3A Reg 3B REGIE Compute the simple rate of return promised by the outlet. (Round percentage answer to 1 decimal place.) Simple rate of return % Req 1 Reg 1 Req 2A Reg za Reg 2B Reg 28 Req 3A Reg 3a Reg 3B Reg 38 If Mr. Swanson requires a simple rate of return of at least 18%, should he acquire the franchise? Yes ONO Req 1 Reg 1 Req 2A Reg za Reg 2B Reg 28 Req 3A Reg 3a Reg 3B Reg 38 If Mr. Swanson requires a simple rate of return of at least 18%, should he acquire the franchise? Yes ONO Req 1 Req 2A Req 2B Req 3A Reg 3B Compute the payback period on the outlet. (Round your answer to 1 decimal place.) Payback period years Req 1 Req 2A Req 2B Req 3A Reg 3B If Mr. Swanson wants a payback of three years or less, will he acquire the franchise? Yes ONO