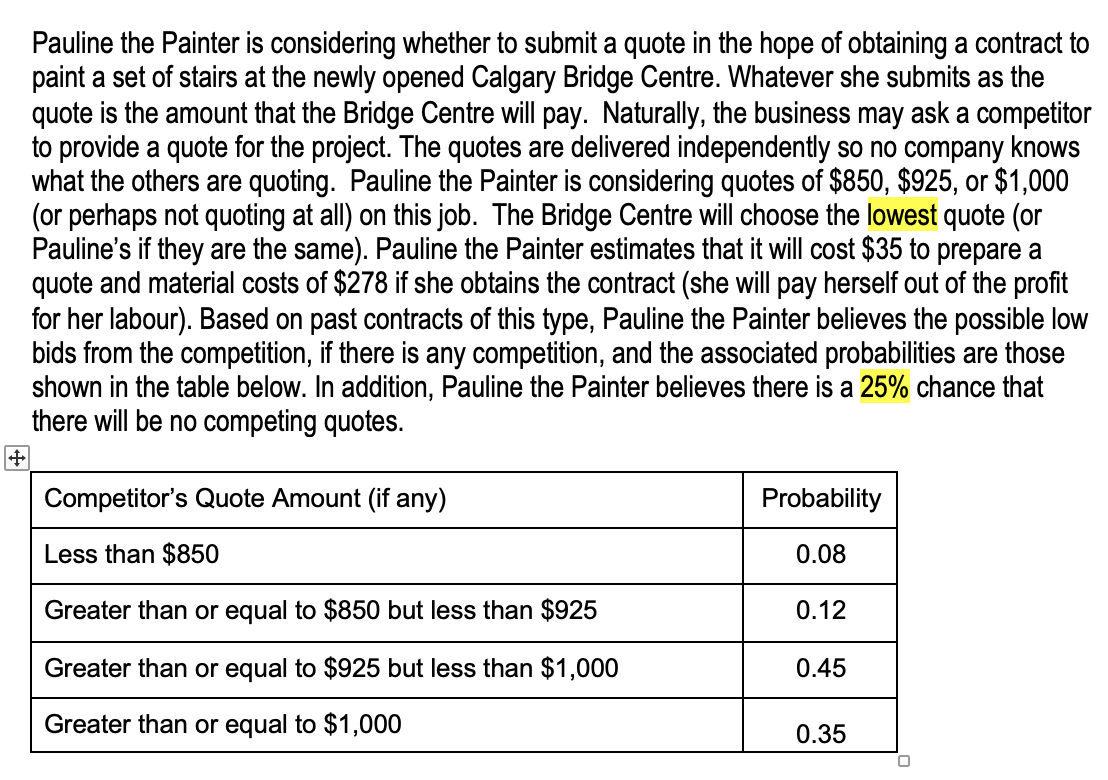

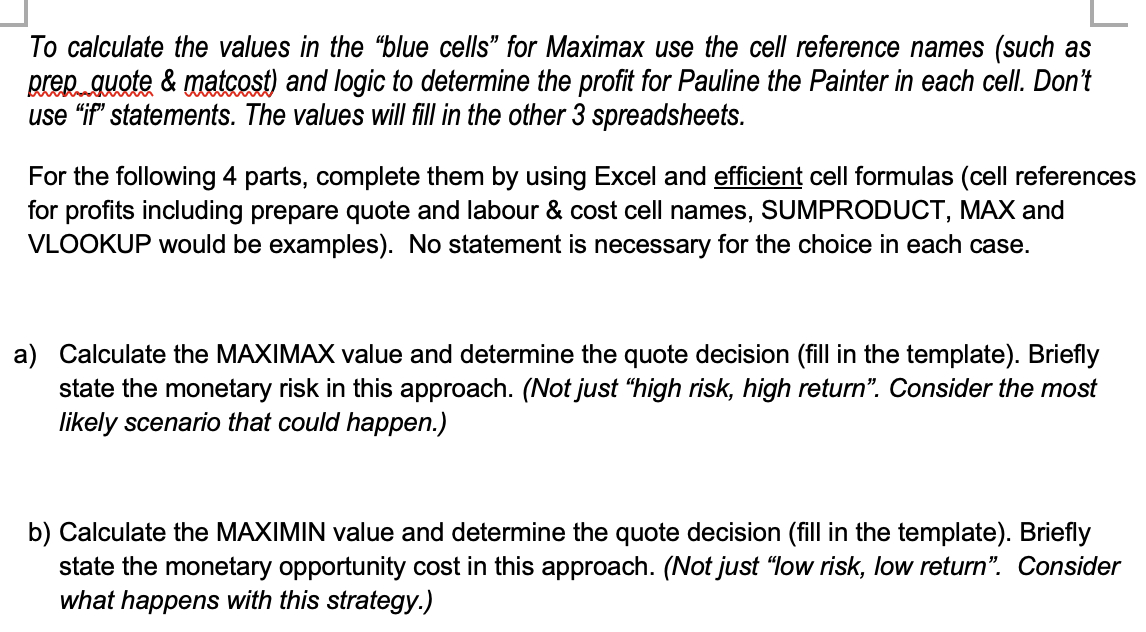

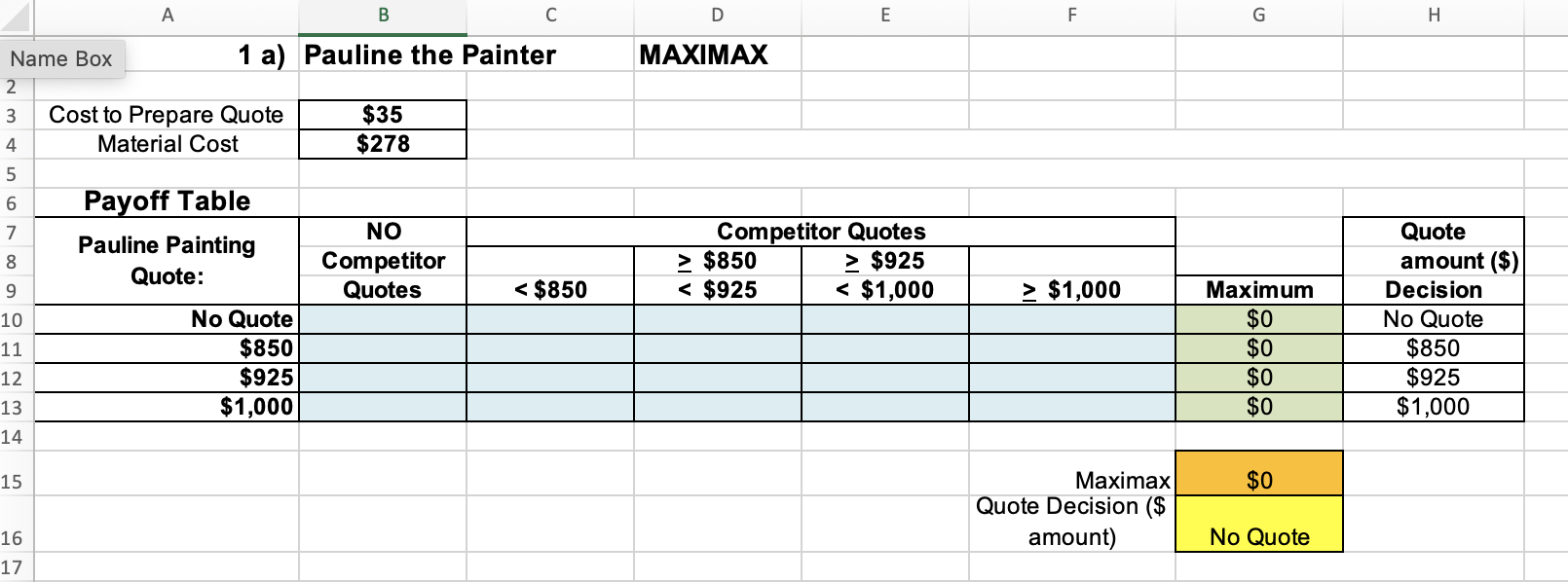

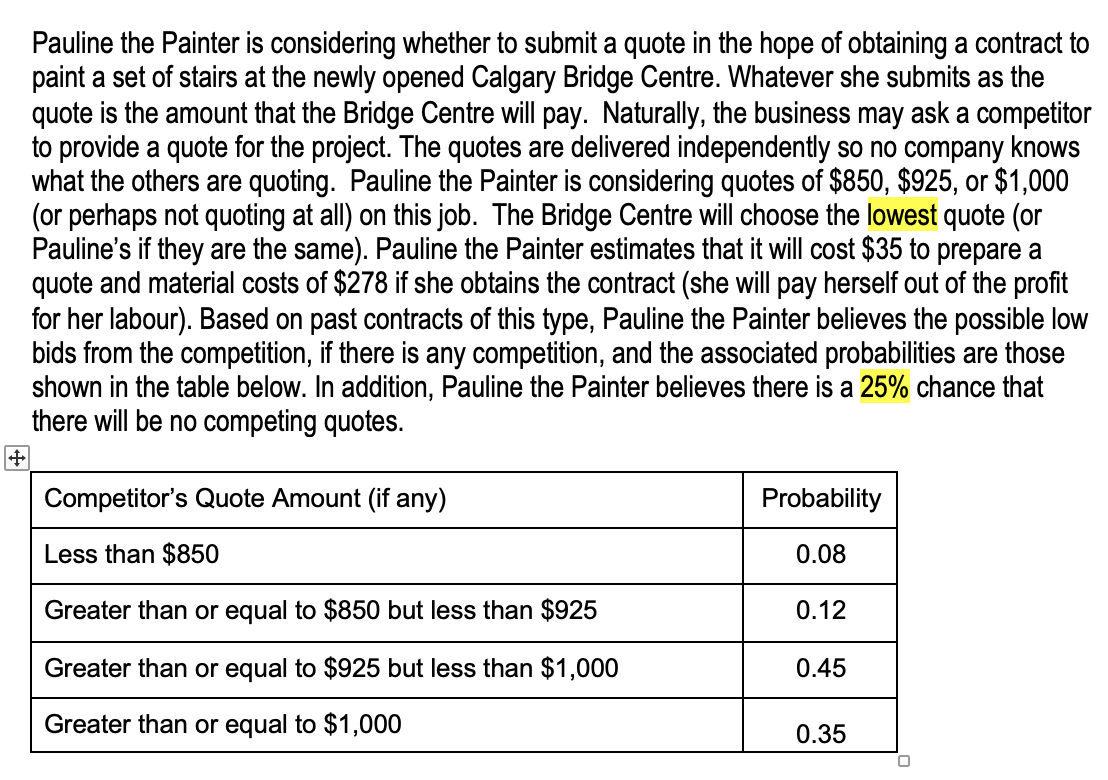

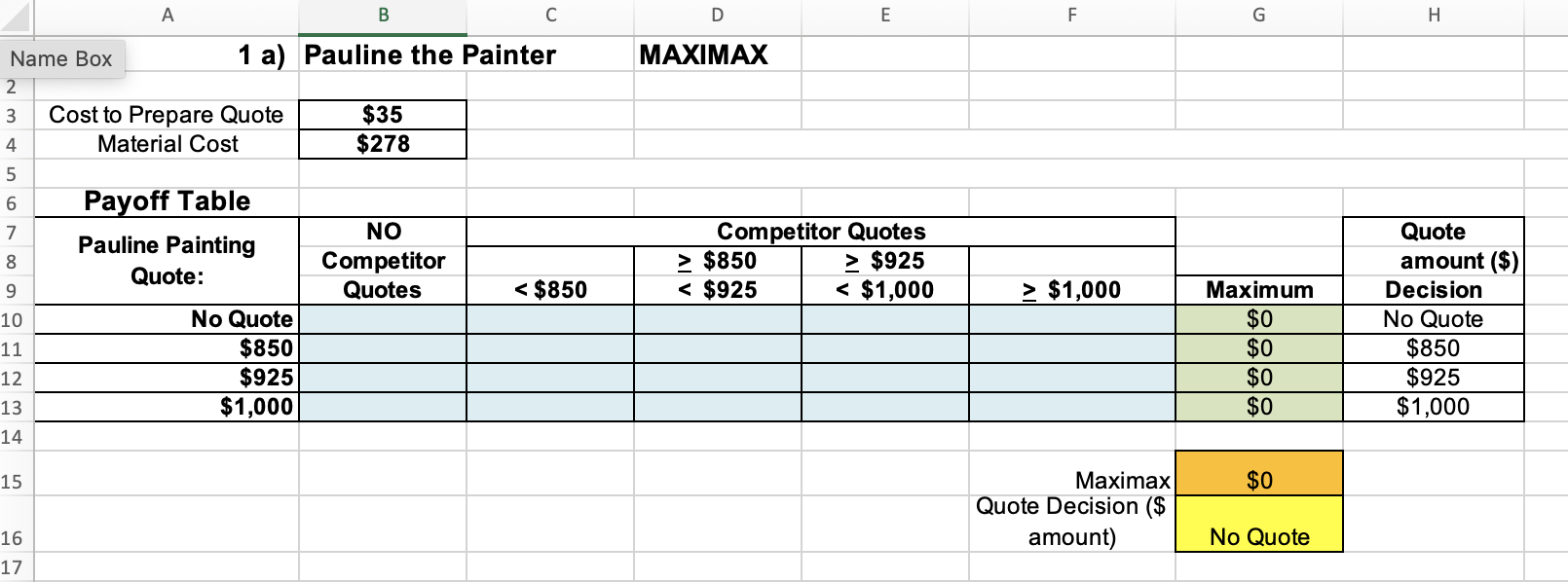

Pauline the Painter is considering whether to submit a quote in the hope of obtaining a contract to paint a set of stairs at the newly opened Calgary Bridge Centre. Whatever she submits as the quote is the amount that the Bridge Centre will pay. Naturally, the business may ask a competitor to provide a quote for the project. The quotes are delivered independently so no company knows what the others are quoting. Pauline the Painter is considering quotes of $850, $925, or $1,000 (or perhaps not quoting at all) on this job. The Bridge Centre will choose the lowest quote (or Pauline's if they are the same). Pauline the Painter estimates that it will cost $35 to prepare a quote and material costs of $278 if she obtains the contract (she will pay herself out of the profit for her labour). Based on past contracts of this type, Pauline the Painter believes the possible low bids from the competition, if there is any competition, and the associated probabilities are those shown in the table below. In addition, Pauline the Painter believes there is a 25% chance that there will be no competing quotes. To calculate the values in the "blue cells" for Maximax use the cell reference names (such as prep guote \& matcost) and logic to determine the profit for Pauline the Painter in each cell. Don't use "if" statements. The values will fill in the other 3 spreadsheets. For the following 4 parts, complete them by using Excel and efficient cell formulas (cell references for profits including prepare quote and labour \& cost cell names, SUMPRODUCT, MAX and VLOOKUP would be examples). No statement is necessary for the choice in each case. a) Calculate the MAXIMAX value and determine the quote decision (fill in the template). Briefly state the monetary risk in this approach. (Not just "high risk, high return". Consider the most likely scenario that could happen.) b) Calculate the MAXIMIN value and determine the quote decision (fill in the template). Briefly state the monetary opportunity cost in this approach. (Not just "low risk, low return". Consider what happens with this strategy.) Payoff Table Pauline the Painter is considering whether to submit a quote in the hope of obtaining a contract to paint a set of stairs at the newly opened Calgary Bridge Centre. Whatever she submits as the quote is the amount that the Bridge Centre will pay. Naturally, the business may ask a competitor to provide a quote for the project. The quotes are delivered independently so no company knows what the others are quoting. Pauline the Painter is considering quotes of $850, $925, or $1,000 (or perhaps not quoting at all) on this job. The Bridge Centre will choose the lowest quote (or Pauline's if they are the same). Pauline the Painter estimates that it will cost $35 to prepare a quote and material costs of $278 if she obtains the contract (she will pay herself out of the profit for her labour). Based on past contracts of this type, Pauline the Painter believes the possible low bids from the competition, if there is any competition, and the associated probabilities are those shown in the table below. In addition, Pauline the Painter believes there is a 25% chance that there will be no competing quotes. To calculate the values in the "blue cells" for Maximax use the cell reference names (such as prep guote \& matcost) and logic to determine the profit for Pauline the Painter in each cell. Don't use "if" statements. The values will fill in the other 3 spreadsheets. For the following 4 parts, complete them by using Excel and efficient cell formulas (cell references for profits including prepare quote and labour \& cost cell names, SUMPRODUCT, MAX and VLOOKUP would be examples). No statement is necessary for the choice in each case. a) Calculate the MAXIMAX value and determine the quote decision (fill in the template). Briefly state the monetary risk in this approach. (Not just "high risk, high return". Consider the most likely scenario that could happen.) b) Calculate the MAXIMIN value and determine the quote decision (fill in the template). Briefly state the monetary opportunity cost in this approach. (Not just "low risk, low return". Consider what happens with this strategy.) Payoff Table