Answered step by step

Verified Expert Solution

Question

1 Approved Answer

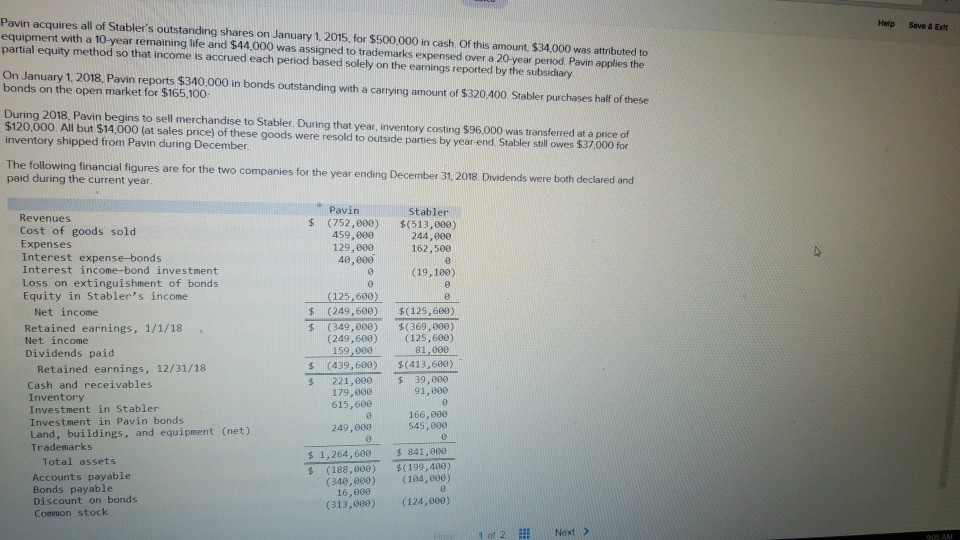

Pavin acquires all of Stabler's outstanding shares on January 1, 2015, for $500,000 in cash, Of this amount, $34,000 was attributed to equipment with a

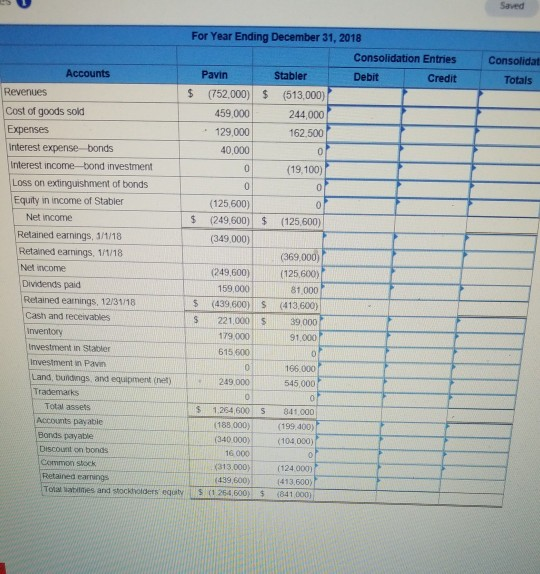

Pavin acquires all of Stabler's outstanding shares on January 1, 2015, for $500,000 in cash, Of this amount, $34,000 was attributed to equipment with a 10-year remaining life and $44,000 was assigned to trademarks expensed over a 20-year period. Pavin applies the partial equity method so that income is accrued each period based solely on the earnings reported by the subsidiary. Help Save & Exlt On January 1. 2018, Pavin reports $340,000 in bonds outstanding with a carrying amount of $320,400. Stabler purchases half of these bonds on the open market for $165,100 During 2018, Pavin begins to sell merchandse to Stabler. During that year, inventory costing $96.000 was transferred at a price of $120.000 All but $14 000 (at sales price) of these goods were resold to outside parties by year end Stabler stll owes $37.000 for inventory shipped from Pavin during December. The following financial figures are for the two companies for the year ending December 31, 2018 Dividends were both declared and paid during the current year Pavin Stabler s (752,e00) $(513,000) 244,800 162,500 Revenues Cost of goods sold Expenses Interest expense-bonds Interest income-bond investment Loss on extinguishment of bonds Equity in Stablern's income 459,608 129,000 40,080 (19,100) (125,600) $ (249,600)$(125,608) $ (349,000)$(369,000) (249,600) (125,600) Net income Retained earnings, 1/1/18 Net income Dividends paid 159,004o 81,000 $ (439,600)$(413,68a) Retained earnings, 12/31/18 Cash and receivables Inventory Investment in Stabler Investment in Pavin bonds Land, buildings, and equipment (net) Trademarks 221,000 39,606 91,000 179,e00 615,608 166,000 545,000 249,000 $ 1,264, 600 841,0eg $ (188,600) $(199,400) Total assets Accounts payable Bonds payable Discount on bonds Common stock (340,800) (104,800) 16,880 (313,000 (124,000) 1 or 2 EEE Next > Pavin acquires all of Stabler's outstanding shares on January 1, 2015, for $500,000 in cash, Of this amount, $34,000 was attributed to equipment with a 10-year remaining life and $44,000 was assigned to trademarks expensed over a 20-year period. Pavin applies the partial equity method so that income is accrued each period based solely on the earnings reported by the subsidiary. Help Save & Exlt On January 1. 2018, Pavin reports $340,000 in bonds outstanding with a carrying amount of $320,400. Stabler purchases half of these bonds on the open market for $165,100 During 2018, Pavin begins to sell merchandse to Stabler. During that year, inventory costing $96.000 was transferred at a price of $120.000 All but $14 000 (at sales price) of these goods were resold to outside parties by year end Stabler stll owes $37.000 for inventory shipped from Pavin during December. The following financial figures are for the two companies for the year ending December 31, 2018 Dividends were both declared and paid during the current year Pavin Stabler s (752,e00) $(513,000) 244,800 162,500 Revenues Cost of goods sold Expenses Interest expense-bonds Interest income-bond investment Loss on extinguishment of bonds Equity in Stablern's income 459,608 129,000 40,080 (19,100) (125,600) $ (249,600)$(125,608) $ (349,000)$(369,000) (249,600) (125,600) Net income Retained earnings, 1/1/18 Net income Dividends paid 159,004o 81,000 $ (439,600)$(413,68a) Retained earnings, 12/31/18 Cash and receivables Inventory Investment in Stabler Investment in Pavin bonds Land, buildings, and equipment (net) Trademarks 221,000 39,606 91,000 179,e00 615,608 166,000 545,000 249,000 $ 1,264, 600 841,0eg $ (188,600) $(199,400) Total assets Accounts payable Bonds payable Discount on bonds Common stock (340,800) (104,800) 16,880 (313,000 (124,000) 1 or 2 EEE Next >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started