Answered step by step

Verified Expert Solution

Question

1 Approved Answer

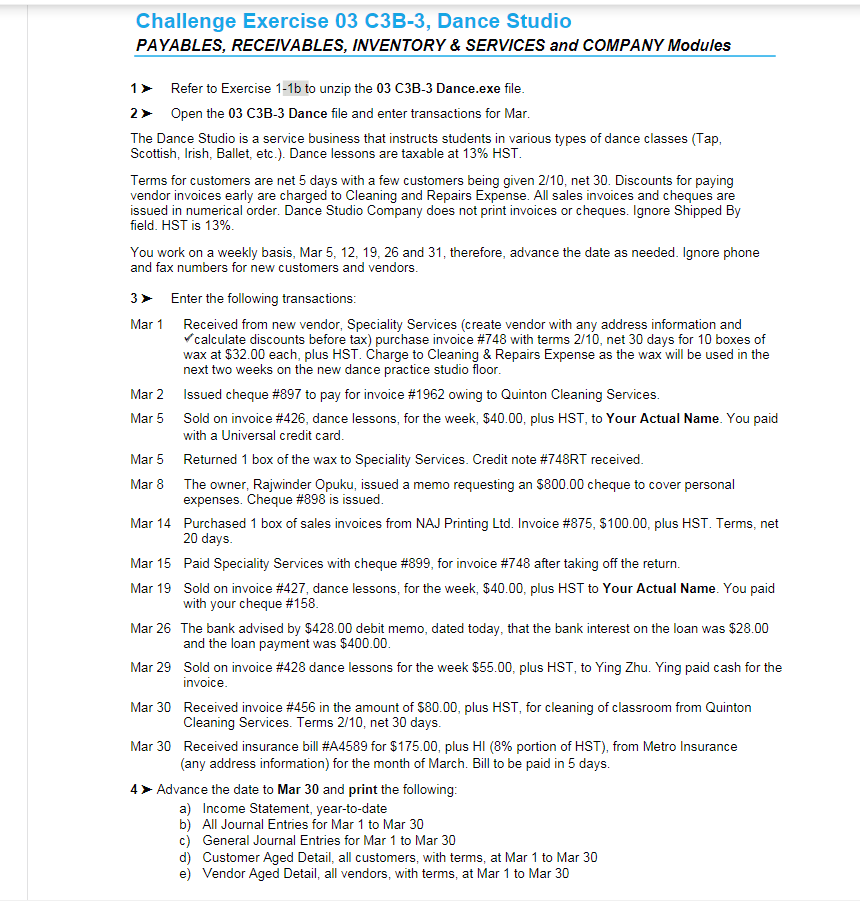

PAYABLES, RECEIVABLES, INVENTORY & SERVICES and COMPANY Modules 1) Refer to Exercise 1-1b to unzip the 03 C3B-3 Dance.exe file. 2 Open the 03 C3B-3

PAYABLES, RECEIVABLES, INVENTORY \& SERVICES and COMPANY Modules 1) Refer to Exercise 1-1b to unzip the 03 C3B-3 Dance.exe file. 2 Open the 03 C3B-3 Dance file and enter transactions for Mar. The Dance Studio is a service business that instructs students in various types of dance classes (Tap, Scottish, Irish, Ballet, etc.). Dance lessons are taxable at 13% HST. Terms for customers are net 5 days with a few customers being given 2/10, net 30 . Discounts for paying vendor invoices early are charged to Cleaning and Repairs Expense. All sales invoices and cheques are issued in numerical order. Dance Studio Company does not print invoices or cheques. Ignore Shipped By field. HST is 13%. You work on a weekly basis, Mar 5,12,19,26 and 31, therefore, advance the date as needed. Ignore phone and fax numbers for new customers and vendors. 3) Enter the following transactions: Mar 1 Received from new vendor, Speciality Services (create vendor with any address information and calculate discounts before tax) purchase invoice #748 with terms 2/10, net 30 days for 10 boxes of wax at $32.00 each, plus HST. Charge to Cleaning \& Repairs Expense as the wax will be used in the next two weeks on the new dance practice studio floor. Mar 2 Issued cheque \#897 to pay for invoice \#1962 owing to Quinton Cleaning Services. Mar 5 Sold on invoice \#426, dance lessons, for the week, $40.00, plus HST, to Your Actual Name. You paid with a Universal credit card. Mar 5 Returned 1 box of the wax to Speciality Services. Credit note \#748RT received. Mar 8 The owner, Rajwinder Opuku, issued a memo requesting an $800.00 cheque to cover personal expenses. Cheque \#898 is issued. Mar 14 Purchased 1 box of sales invoices from NAJ Printing Ltd. Invoice \#875, $100.00, plus HST. Terms, net 20 days. Mar 15 Paid Speciality Services with cheque \#899, for invoice \#748 after taking off the return. Mar 19 Sold on invoice \#427, dance lessons, for the week, $40.00, plus HST to Your Actual Name. You paid with your cheque \#158. Mar 26 The bank advised by $428.00 debit memo, dated today, that the bank interest on the loan was $28.00 and the loan payment was $400.00. Mar 29 Sold on invoice \#428 dance lessons for the week $55.00, plus HST, to Ying Zhu. Ying paid cash for the invoice. Mar 30 Received invoice \#456 in the amount of $80.00, plus HST, for cleaning of classroom from Quinton Cleaning Services. Terms 2/10, net 30 days. Mar 30 Received insurance bill \#A4589 for $175.00, plus HI (8\% portion of HST), from Metro Insurance (any address information) for the month of March. Bill to be paid in 5 days. 4- Advance the date to Mar 30 and print the following: a) Income Statement, year-to-date b) All Journal Entries for Mar 1 to Mar 30 c) General Journal Entries for Mar 1 to Mar 30 d) Customer Aged Detail, all customers, with terms, at Mar 1 to Mar 30 e) Vendor Aged Detail, all vendors, with terms, at Mar 1 to Mar 30

PAYABLES, RECEIVABLES, INVENTORY \& SERVICES and COMPANY Modules 1) Refer to Exercise 1-1b to unzip the 03 C3B-3 Dance.exe file. 2 Open the 03 C3B-3 Dance file and enter transactions for Mar. The Dance Studio is a service business that instructs students in various types of dance classes (Tap, Scottish, Irish, Ballet, etc.). Dance lessons are taxable at 13% HST. Terms for customers are net 5 days with a few customers being given 2/10, net 30 . Discounts for paying vendor invoices early are charged to Cleaning and Repairs Expense. All sales invoices and cheques are issued in numerical order. Dance Studio Company does not print invoices or cheques. Ignore Shipped By field. HST is 13%. You work on a weekly basis, Mar 5,12,19,26 and 31, therefore, advance the date as needed. Ignore phone and fax numbers for new customers and vendors. 3) Enter the following transactions: Mar 1 Received from new vendor, Speciality Services (create vendor with any address information and calculate discounts before tax) purchase invoice #748 with terms 2/10, net 30 days for 10 boxes of wax at $32.00 each, plus HST. Charge to Cleaning \& Repairs Expense as the wax will be used in the next two weeks on the new dance practice studio floor. Mar 2 Issued cheque \#897 to pay for invoice \#1962 owing to Quinton Cleaning Services. Mar 5 Sold on invoice \#426, dance lessons, for the week, $40.00, plus HST, to Your Actual Name. You paid with a Universal credit card. Mar 5 Returned 1 box of the wax to Speciality Services. Credit note \#748RT received. Mar 8 The owner, Rajwinder Opuku, issued a memo requesting an $800.00 cheque to cover personal expenses. Cheque \#898 is issued. Mar 14 Purchased 1 box of sales invoices from NAJ Printing Ltd. Invoice \#875, $100.00, plus HST. Terms, net 20 days. Mar 15 Paid Speciality Services with cheque \#899, for invoice \#748 after taking off the return. Mar 19 Sold on invoice \#427, dance lessons, for the week, $40.00, plus HST to Your Actual Name. You paid with your cheque \#158. Mar 26 The bank advised by $428.00 debit memo, dated today, that the bank interest on the loan was $28.00 and the loan payment was $400.00. Mar 29 Sold on invoice \#428 dance lessons for the week $55.00, plus HST, to Ying Zhu. Ying paid cash for the invoice. Mar 30 Received invoice \#456 in the amount of $80.00, plus HST, for cleaning of classroom from Quinton Cleaning Services. Terms 2/10, net 30 days. Mar 30 Received insurance bill \#A4589 for $175.00, plus HI (8\% portion of HST), from Metro Insurance (any address information) for the month of March. Bill to be paid in 5 days. 4- Advance the date to Mar 30 and print the following: a) Income Statement, year-to-date b) All Journal Entries for Mar 1 to Mar 30 c) General Journal Entries for Mar 1 to Mar 30 d) Customer Aged Detail, all customers, with terms, at Mar 1 to Mar 30 e) Vendor Aged Detail, all vendors, with terms, at Mar 1 to Mar 30 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started