Answered step by step

Verified Expert Solution

Question

1 Approved Answer

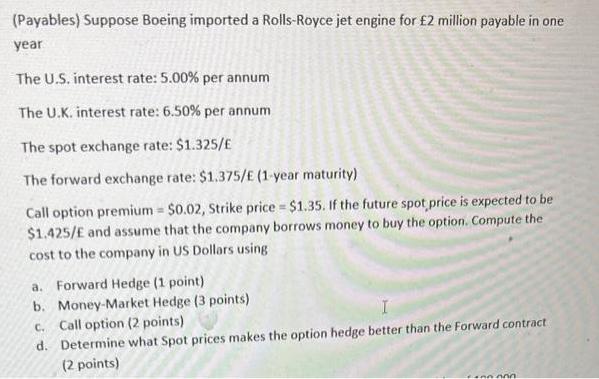

(Payables) Suppose Boeing imported a Rolls-Royce jet engine for 2 million payable in one year The U.S. interest rate: 5.00% per annum The U.K.

(Payables) Suppose Boeing imported a Rolls-Royce jet engine for 2 million payable in one year The U.S. interest rate: 5.00% per annum The U.K. interest rate: 6.50% per annum The spot exchange rate: $1.325/ The forward exchange rate: $1.375/ (1-year maturity) Call option premium = $0.02, Strike price = $1.35. If the future spot price is expected to be $1.425/E and assume that the company borrows money to buy the option. Compute the cost to the company in US Dollars using a. Forward Hedge (1 point) b. Money-Market Hedge (3 points) c. Call option (2 points) d. Determine what Spot prices makes the option hedge better than the Forward contract (2 points) +00 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Forward Hedge The cost to the company in US dollars using the forward hedge is calculated as follows First we need to calculate the forward exchange rate adjusted for interest rate differentials F S ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started