Answered step by step

Verified Expert Solution

Question

1 Approved Answer

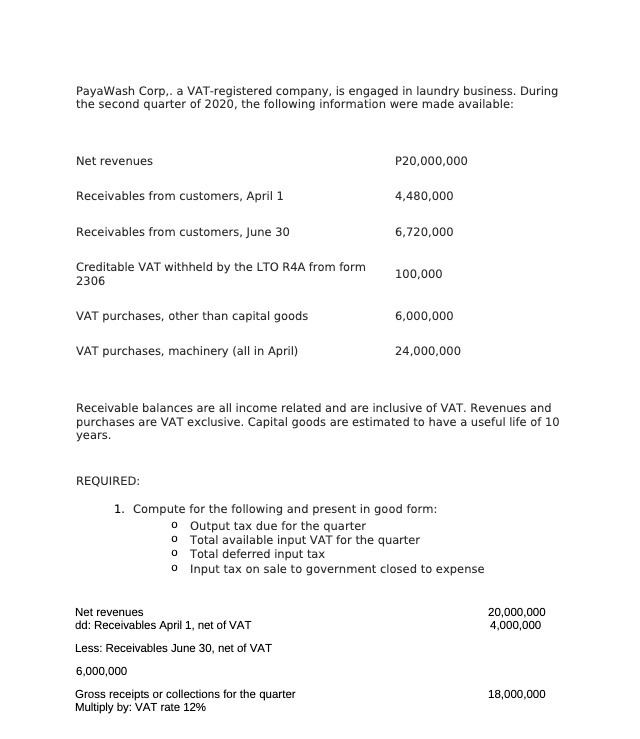

PayaWash Corp,. a VAT-registered company, is engaged in laundry business. During the second quarter of 2020, the following information were made available: Net revenues

PayaWash Corp,. a VAT-registered company, is engaged in laundry business. During the second quarter of 2020, the following information were made available: Net revenues Receivables from customers, April 1 Receivables from customers, June 30 Creditable VAT withheld by the LTO R4A from form 2306 VAT purchases, other than capital goods VAT purchases, machinery (all in April) REQUIRED: P20,000,000 4,480,000 Net revenues dd: Receivables April 1, net of VAT Less: Receivables June 30, net of VAT 6,000,000 Gross receipts or collections for the quarter Multiply by: VAT rate 12% 6,720,000 100,000 6,000,000 Receivable balances are all income related and are inclusive of VAT. Revenues and purchases are VAT exclusive. Capital goods are estimated to have a useful life of 10 years. 24,000,000 1. Compute for the following and present in good form: o Output tax due for the quarter o Total available input VAT for the quarter o Total deferred input tax o Input tax on sale to government closed to expense 20,000,000 4,000,000 18,000,000

Step by Step Solution

★★★★★

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 Compute for the following and present in good form Output tax due ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started