Answered step by step

Verified Expert Solution

Question

1 Approved Answer

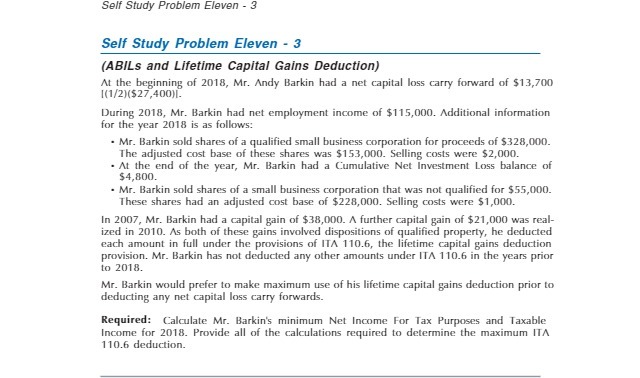

Self Study Problem Eleven - 3 Self Study Problem Eleven - 3 (ABILS and Lifetime Capital Gains Deduction) At the beginning of 2018, Mr.

Self Study Problem Eleven - 3 Self Study Problem Eleven - 3 (ABILS and Lifetime Capital Gains Deduction) At the beginning of 2018, Mr. Andy Barkin had a net capital loss carry forward of $13,700 [(1/2)($27,400). During 2018, Mr. Barkin had net employment income of $115,000. Additional information for the year 2018 is as follows: Mr. Barkin sold shares of a qualified small business corporation for proceeds of $328,000. The adjusted cost base of these shares was $153,000. Selling costs were $2,000. At the end of the year, Mr. Barkin had a Cumulative Net Investment Loss balance of $4,800. Mr. Barkin sold shares of a small business corporation that was not qualified for $55,000. These shares had an adjusted cost base of $228,000. Selling costs were $1,000. In 2007, Mr. Barkin had a capital gain of $38,000. A further capital gain of $21,000 was real- ized in 2010. As both of these gains involved dispositions of qualified property, he deducted each amount in full under the provisions of ITA 110.6, the lifetime capital gains deduction provision. Mr. Barkin has not deducted any other amounts under ITA 110.6 in the years prior to 2018. Mr. Barkin would prefer to make maximum use of his lifetime capital gains deduction prior to deducting any net capital loss carry forwards. Required: Calculate Mr. Barkin's minimum Net Income For Tax Purposes and Taxable Income for 2018. Provide all of the calculations required to determine the maximum ITA 110.6 deduction.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started