Answered step by step

Verified Expert Solution

Question

1 Approved Answer

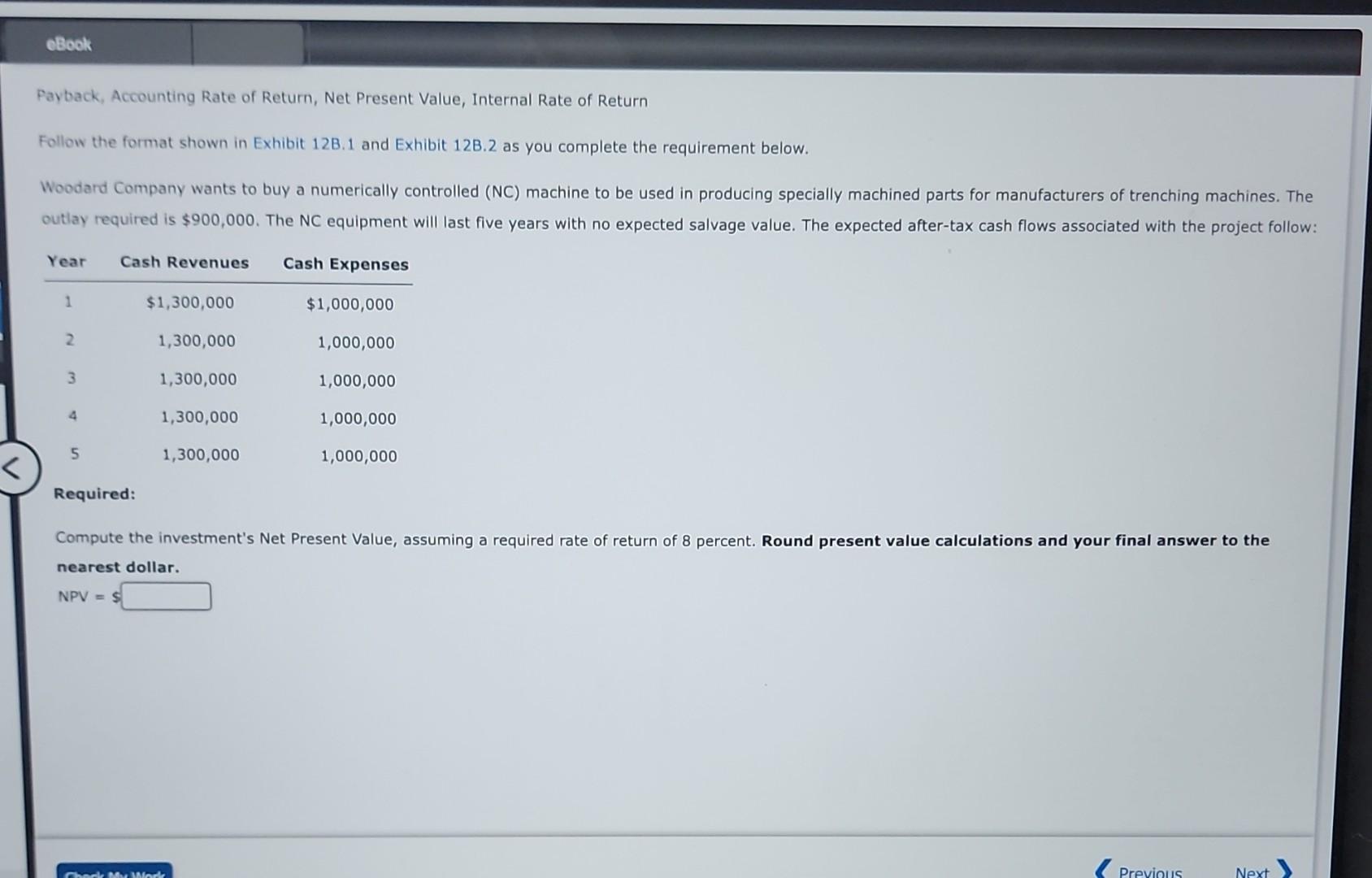

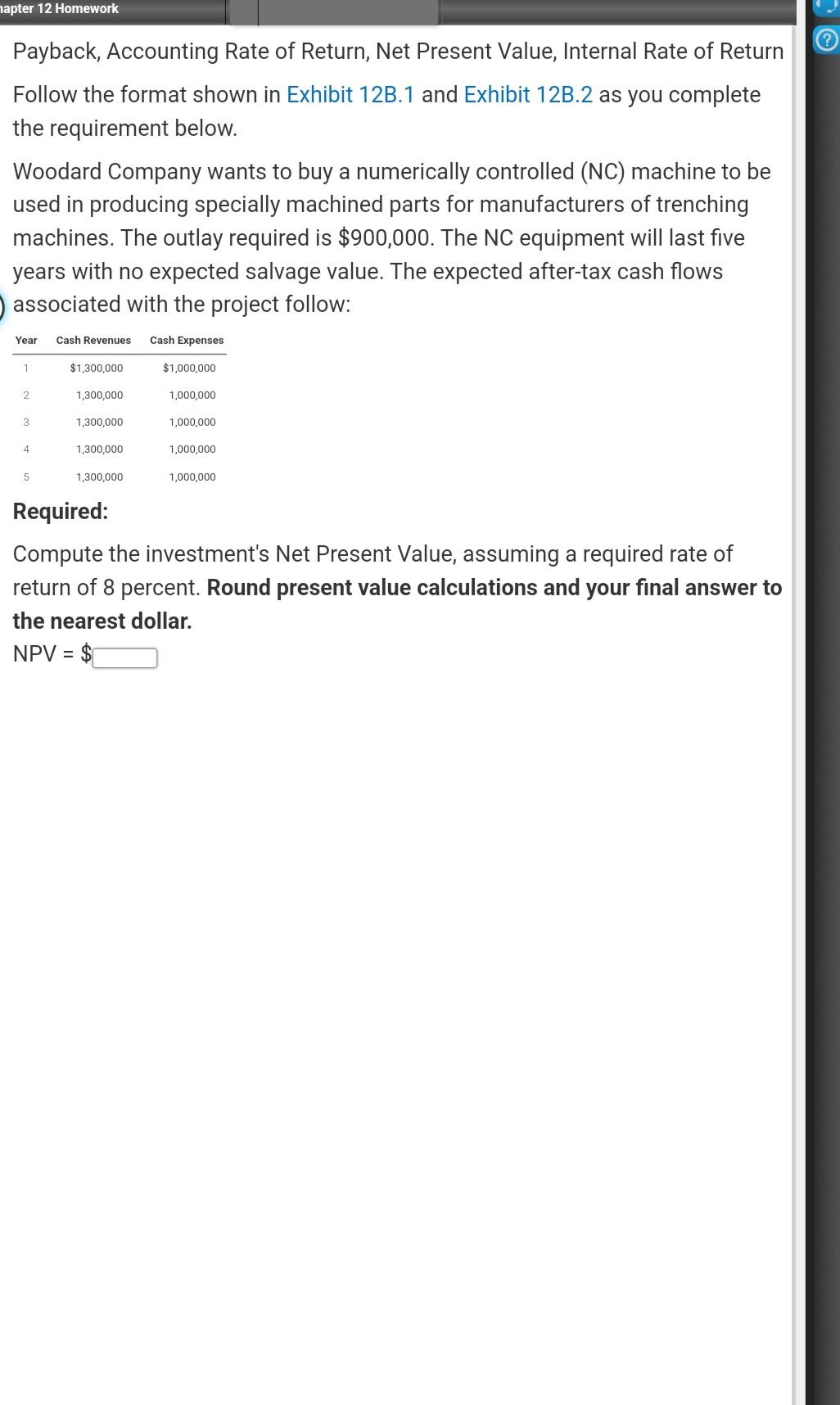

Payback, Accounting Rate of Return, Net Present Value, Internal Rate of Return Follow the format shown in Exhibit 12B.1 and Exhibit 12B.2 as you complete

Payback, Accounting Rate of Return, Net Present Value, Internal Rate of Return Follow the format shown in Exhibit 12B.1 and Exhibit 12B.2 as you complete the requirement below. Woodard Company wants to buy a numerically controlled (NC) machine to be used in producing specially machined parts for manufacturers of trenching machines. The outlay required is $900,000. The NC equipment will last five years with no expected salvage value. The expected after-tax cash flows associated with the project follow: Required: Compute the investment's Net Present Value, assuming a required rate of return of 8 percent. Round present value calculations and your final answer to the nearest dollar. NPV=$ Payback, Accounting Rate of Return, Net Present Value, Internal Rate of Return Follow the format shown in Exhibit 12B.1 and Exhibit 12B.2 as you complete the requirement below. Woodard Company wants to buy a numerically controlled (NC) machine to be used in producing specially machined parts for manufacturers of trenching machines. The outlay required is $900,000. The NC equipment will last five years with no expected salvage value. The expected after-tax cash flows associated with the project follow: Required: Compute the investment's Net Present Value, assuming a required rate of return of 8 percent. Round present value calculations and your final answer to the nearest dollar. NPV=$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started