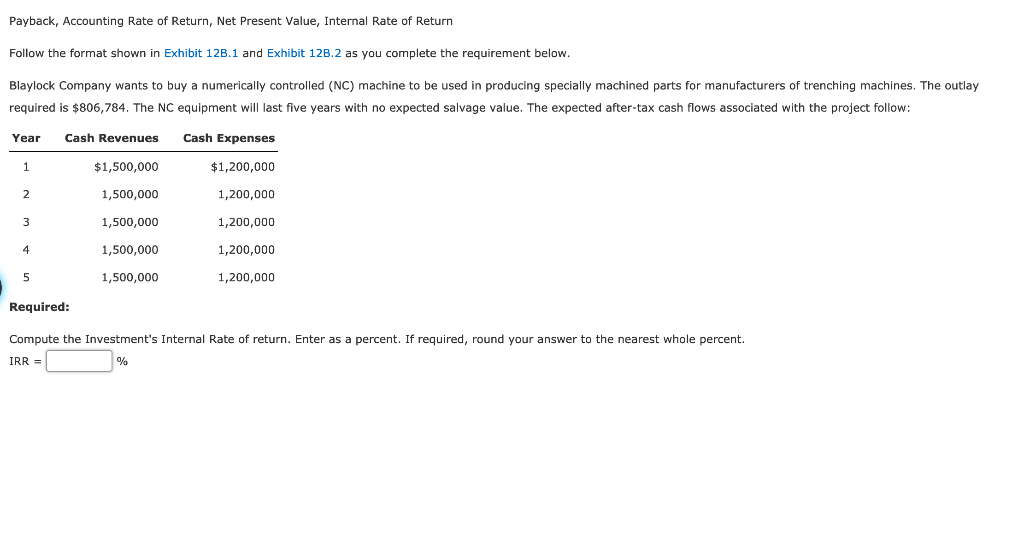

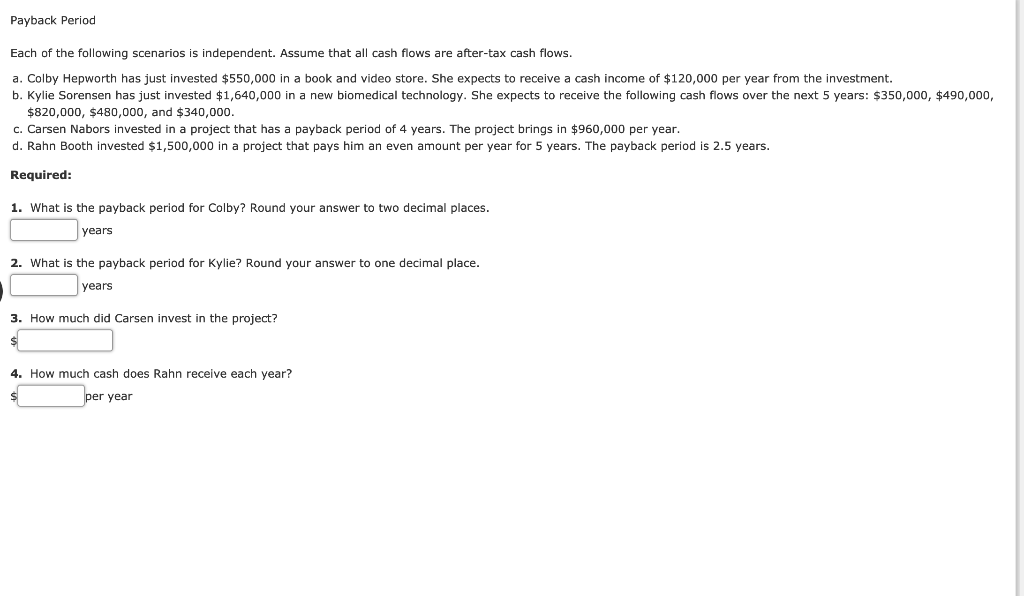

Payback, Accounting Rate of Return, Net Present Value, Internal Rate of Return Follow the format shown in Exhibit 123.1 and Exhibit 120.2 as you complete the requirement below. Blaylock Company wants to buy a numerically controlled (NC) machine to be used in producing specially machined parts for manufacturers of trenching machines. The outlay required is $806,784. The NC equipment will last five years with no expected salvage value. The expected after-tax cash flows associated with the project follow: Year Cash Revenues Cash Expenses $1,500,000 $1,200,000 2 1,500,000 1,200,000 1,200,000 1,500,000 1,500,000 1,200,000 1,500,000 1,200,000 Required: Compute the Investment's Internal Rate of return. Enter as a percent. If required, round your answer to the nearest whole percent. IRR = % Payback Period Each of the following scenarios is independent. Assume that all cash flows are after-tax cash flows. a. Colby Hepworth has just invested $550,000 in a book and video store. She expects to receive a cash income of $120,000 per year from the investment. b. Kylie Sorensen has just invested $1,640,000 in a new biomedical technology. She expects to receive the following cash flows over the next 5 years: $350,000, $490,000, $820,000, $480,000, and $340,000. c. Carsen Nabors invested in a project that has a payback period of 4 years. The project brings in $960,000 per year. d. Rahn Booth invested $1,500,000 in a project that pays him an even amount per year for 5 years. The payback period is 2.5 years. Required: 1. What is the payback period for Colby? Round your answer to two decimal places. years 2. What is the payback period for Kylie? Round your answer to one decimal place. years 3. How much did Carsen invest in the project? 4. How much cash does Rahn receive each year? per year Payback, Accounting Rate of Return, Net Present Value, Internal Rate of Return Follow the format shown in Exhibit 123.1 and Exhibit 120.2 as you complete the requirement below. Blaylock Company wants to buy a numerically controlled (NC) machine to be used in producing specially machined parts for manufacturers of trenching machines. The outlay required is $806,784. The NC equipment will last five years with no expected salvage value. The expected after-tax cash flows associated with the project follow: Year Cash Revenues Cash Expenses $1,500,000 $1,200,000 2 1,500,000 1,200,000 1,200,000 1,500,000 1,500,000 1,200,000 1,500,000 1,200,000 Required: Compute the Investment's Internal Rate of return. Enter as a percent. If required, round your answer to the nearest whole percent. IRR = % Payback Period Each of the following scenarios is independent. Assume that all cash flows are after-tax cash flows. a. Colby Hepworth has just invested $550,000 in a book and video store. She expects to receive a cash income of $120,000 per year from the investment. b. Kylie Sorensen has just invested $1,640,000 in a new biomedical technology. She expects to receive the following cash flows over the next 5 years: $350,000, $490,000, $820,000, $480,000, and $340,000. c. Carsen Nabors invested in a project that has a payback period of 4 years. The project brings in $960,000 per year. d. Rahn Booth invested $1,500,000 in a project that pays him an even amount per year for 5 years. The payback period is 2.5 years. Required: 1. What is the payback period for Colby? Round your answer to two decimal places. years 2. What is the payback period for Kylie? Round your answer to one decimal place. years 3. How much did Carsen invest in the project? 4. How much cash does Rahn receive each year? per year