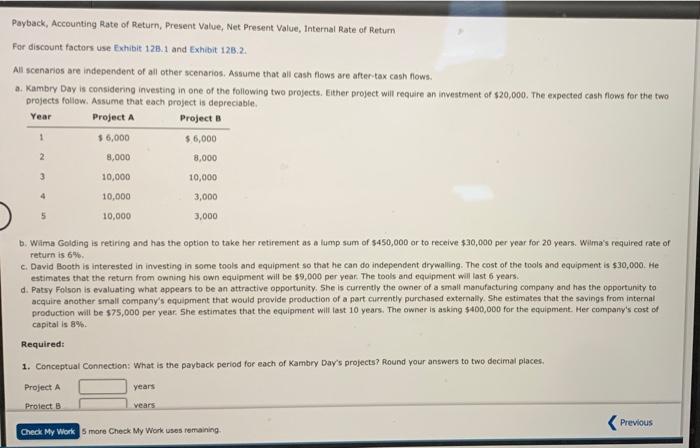

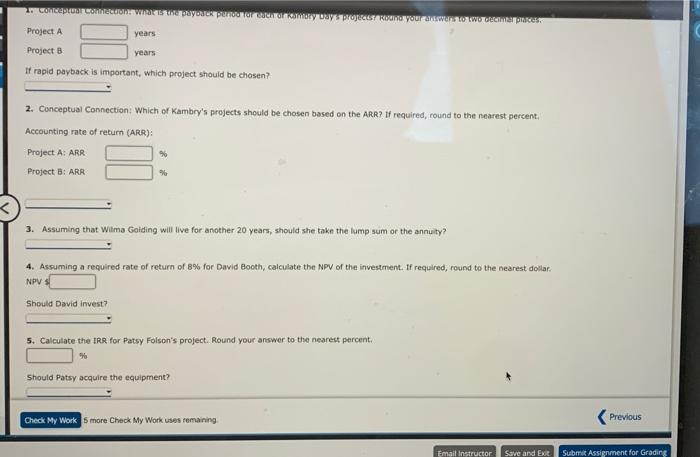

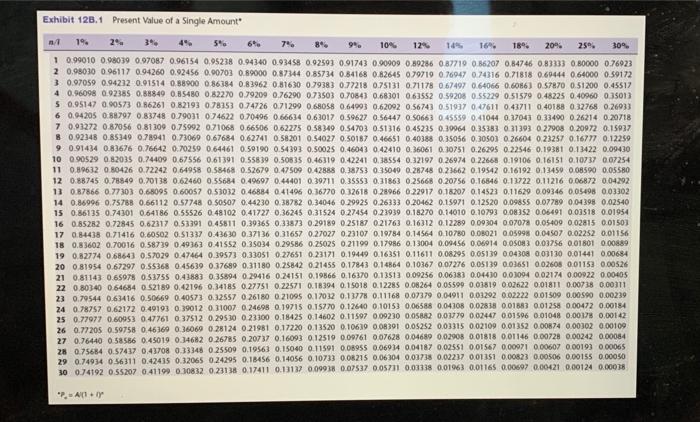

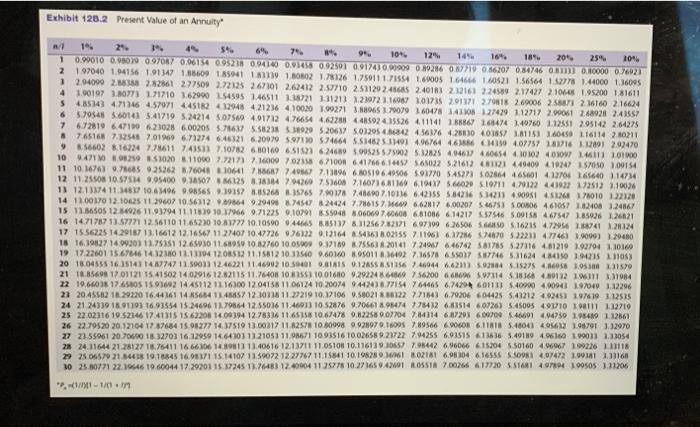

Payback, Accounting Rate of Return, Present Value, Net Present Valve, Internal Rate of Return For discount factors use Exhibit 128.1 and Exhibit 120.2. All scenarios are independent of all other scenarios. Assume that all cash flows are after tax cash flows. . Kambry Day is considering investing in one of the following two projects. Either project will require an investment of $20,000. The expected cash flows for the two projects follow. Assume that each project is depreciable Project A Project B 1 $ 6,000 $6,000 Year 2 8,000 8,000 3 10,000 10,000 4 10,000 10,000 3,000 3,000 b. Wima Golding is retiring and has the option to take her retirement as a fump sum of $450,000 or to receive $30,000 per year for 20 years. Wilma's required rate of return is 6% c. David Booth is interested in investing in some tools and equipment so that he can do independent drywalling. The cost of the tools and equipment is $30,000. He estimates that the return from owning his own equipment will be $9,000 per year. The tools and equipment will last 6 years. d. Patsy Folson is evaluating what appears to be an attractive opportunity. She is currently the owner of a small manufacturing company and has the opportunity to acquire another small company's equipment that would provide production of a part currently purchased externally. She estimates that the savings from internal production will be $75,000 per year. She estimates that the equipment will last 10 years. The owner is asking $400,000 for the equipment. Her company's cost of capital is 8% Required: 1. Conceptual Connection: What is the payback period for each of Kambry Day's projects? Round your answers to two decimal places, Project A years Proiect B Vears Previous Check My Work 5 more Check My Work uses remaining, years TESCO VISITOR pentrum sro Oures to WUCHUN Project A Project B It rapid payback is important, which project should be chosen? years 2. Conceptual Connection: Which of Kambry's projects should be chosen based on the ARR? If required, round to the nearest percent, Accounting rate of return (ARR): % Project A: ARR Project B: ARR 3. Assuming that Wilma Golding will live for another 20 years, should she take the lump sum or the annuity? 4. Assuming a required rate of return of % for David Booth, calculate the NPV of the investment. If required, round to the nearest dollar. NPS Should David invest? 5. Calculate the IRR for Patsy Folson's project. Round your answer to the nearest percent. Should Patsy acquire the equipment? Check My Work Smore Check My Work uses remaining Previous Email Instructor Save and Ext Submit Assignment for Grading Exhibit 128.1 Present Value of a Single Amount 76 n1 1% 24. 36 56 10% 12% 149 16 1896 2046 25%, 309 1 099010 0.98019 0.97087 0.96154 0,05238 0.94340 0.93458 0.92503 091743 0.90909 0.80286 087719 086207 0.84746 0.83333 080000 0.76923 2 0.98030 096117 0.94260 0.92456 0.90703 0.89000 0.87344 0.85734 0.84168 0.82645 079719 0.76947 0.74316 0.71818 0.69444 0.64000 0.59172 30.97059 0.94212 0.01514 0.88900 086384 0.83962 0.81630 0.79383 0.77218 0.75131 0.71178 067497 0.64066 0.6086) 0.57870 0.51200 0.45517 4 0.96098 0.92385 0.88849 0.85480 0.82270 0.79209 0.76290 0.73503 0.7084) 0.68301 063552 0.59208 0.55229 0.51579 0.48225 0.40960 015013 50.95147 0.00573 0.86261 0.82193 0.78353 0.74726 0.71299 0.68058 0.64003 0.62092 0.56743 051937 0.47611 0.43711 0.40188 0.32768 0.26933 60.94205 0.88797 0.83748 0.79031 0.74622 0.70496 0.66634 0.63017 0.59627 0.56447 0 50663 0.45559 0.41044 0.37043 0.33490 0.26214 0.20718 7 0.93272 0.87056 0.81309 0.75992 071068 0 66506 0.62275 0.58349 054703 0.51316 0.45235 0.30064 0.35383 0:31393 0 27908 0.20972 0.15037 $ 0.92348 0.85349 0.78941 0.73060 0.67684 0.62741 0.58201 0.54027 0.50187 0.46651 0.40388 0.35056 0.30503 0.26604 0.23257 0.16777 0.12259 9 0.91434 0.83676 0.76642 0.70259 064461 0.59190 0.54393 0.50025 0.46043 0.42410 0.36061 0.30751 0.26295 0.22546 0.19381 0.13422 0.09430 10 090529 082035 0.74409 0.67556 0.61391 0.55839 0.50835 0.46319 0.42241 0.38554 0.32197 0.26974 0 22668 0:19106 0.16151 0.10737 0.07254 11 0.89632 0.80426 0.72242 0.64958 0.58468 0.52679 0.47509 0.42888 0.38753 0-35049 0.26748 0.23662 0.19542 0.16192 0.13459 0.08590 0.05580 12 0.88745 0.78849 0.70138 0.62460 0.55684 0.49697 0.44401 0.39711 0.35553 0.31863 025668 0.20756 0.16846 0.11722 0.11216 0.06872 0.04292 13 087866 0.77303 0.68095 0.60057 053032 0.46884 041496 0.36770 0 32618 0.28966 0.22917 018207 0.14523 0.11629 0.09346 0.05498 0.03302 14 0.86996 0.75788 0.66112 0.57748 0 50507 0.44230 0.38782 0.34046 0.29925 0.26333 0.20462 0.15971 0.12520 0.09855 0.07789 0.04398 0.02540 15 0.86135 0.74301 0.64186 0.55526 0.48102 0.41727 0.36245 0.31524 0.27454 0.23939 0.18270 0.14010 0.10793 0.08352 0.06491 0.03518 0.01954 16 085282 0.72845 0.62317 0.53391 0.45811 0.39365 0.33873 0.29189 0.25187 021763 0.16312 0.12289 009304 0.07078 0.05409 0.02815 0.01503 17 0.84438 0.71416 0.60502 0.51337 0.43630 0.37136 0.31657 0.27027 0.23107 0.19784 0.14564 0.10780 0.00021 0.05998 0.04507 0.02252 0.01156 18 0.83602 0.70016 0.58739 0.49363 0.41552 0.35034 0.29586 0.25025 0.21199 0.17986 0.13004 0.09456 006014 O OSOB3 0.03756 0.01801 0.00889 19 0.82774 0.68643 0.57029 0.47464 0.39573 0.33051 0.27651 0.23171 0.19449 0.16351 0.11611 0.08295 0.05139 0.04308 0.03130 0.01441 0.00684 20 0.81954 0.67297 0.55368 0.45639 0.37689 0.31180 0.25842 0.21455 0.17843 0.14864 0.10367 0.07276 0.05139 0.03651 0.02608 0.01153 0.00526 21 081143 065978 0.53755 041883 0.35894 0.29416 0.24151 0.19866 0.16370 0.13513 0.09256 0.06383 0.04430 0.03094 0.02174 0.00922 0.00405 22 0.80340 0.64684 O 52189 0.42196 0.34185 0.27751 0.22571 0.18394 0.15018 0.12285 0.08264 0.05599 0.01819 002622 0.01811 0.00738 0.00311 23 0.79544 0.63416 0.50669 0.40573 0.32557 0.26180 0 21095 0.17032 0.11778 0.11168 0.07379 0.04911 0.01292 0.02222 0.01509 0.00590 0.00219 24 0.78757 0.62172 0.49193 0 39012 031007 0.24698 0.19715 0.15770 0.12640 0.10153 006588 0.04108 0.02838 0.01683 0.01258 0.00472 0.00184 25 0.77977 0.60953 0.47761 0 37512 0.295 30 0.23300 0.18425 0.14602 0.11597 0.09230 0.05882 0.0379 0.02447 001596 0.01048 0.00178 0.00142 26 0.77205 0.59758 0.46369 036069 0.28124 021981 0.17220 0.13520 0.10639 0.08191 0.05252 0.03315 0.02109 0.01352 0.00874 0.00302 0.00109 27 0.76440 0.58586 0.45019 0.34682 0.26785 0.20737 0.16093 0.12519 0.09761 0.07628 0.04689 0.02908 0.01818 0.01146 0.00728 0.00242 0.00084 28 0.75684 0.57437 0.43708 0.33348 0 25509 0.19563 0.15040 0.11591 0.08955 0.06914 0.04187 0.02551 0.01567 0.00971 0.00607 0.00193 0.00065 29 0.74934 0.56311 0.42435 0.32065 0.24295 0.18456 0.14056 0.10733 0.08215 0.06104 0.03738 0.02237 0.01151 0.00823 0.00506 0.00155 0.00050 30 0.74192 0.55207 0.41199 0.10832 0.23138 0.17411 0.13117 0.09938 0.07537 0.05711 0.03338 0.01963 001165 0.00697 0.00421 0.00124 0.00038 "A. Exhibit 120.2 Present Value of an Annuity 1 19 24 49 5% 79 9 104 12 144 164 18% 204 10% 1 0.00010 0.0309 0.97087 0.96154 095238 0.0410 0.00 0.92501 0.91747909 0.0206 07 086207 0.44/46 0000 0.76921 2 197040 1.94156 1.91147 148609115941 11119 120802 1.78126 1.75011 1.71554 1.60005 164666160521 1.56564 12778 1.44000 1.16005 1 2.94090 2.88388 2.82861 2.77509 272525 267101 2.62412 257710 2.51129245685 240183 232161 2.24509 2.17427 2.10643 195200 1.81611 4 1.00197 3.10773 171710 1.62990 254595 146511 2.48721 131213 121972 16067 101735 201371 2.70818 2.69006258673 216160 2.16624 $4,8514) 471146 457971445182 412948 4.21236 4 10020 3.90271 3.88965 170079 3.60478 3438 128429 112717 2.99061 2.68028 2.415SY 63.70545 5.60141 5.41719 5.24214 3.07540 4.91712 476654 4.6328844859245526 411141151867 168474 1.40760 1.12551 2.95142 2.64275 76.72819 6.47100623028 6.00205571632 5.58235 24929 5.20637 5012956.68424.56176 42610 40187 181153 160450 116114 2 0211 87.65168 712548 7.01969 6.71274 6.46321 6.20079 5.97110 5.74664 5.51452 531491 496764 46 04110 407757 116 12091 2.92470 9.56602 8.16224778611 743511 7.10782 6.80160 65199 624689 3.0952552 5.32825 494617 460654 4 1012 4010 4111 101000 109.4710250 8100 811000 7.721737.16000 7021 671001 6.417666.14457 61022 5.21612 4112 449409 4107 157050 1.00154 11 10.1676) 978085 025262 3.76048 10641786872417 7.13896 6.805196.40506 6917204273 5.02564 460 412706 6560 14714 12 11.250 10 57514 905400916507 6125 8.18184 7.94260 7.500 7160716,81169 6.19417 5.66020 5.19711 420122 441921 172513 1.10026 13 121317411.34837 10.43496 9.08565.39357 3.35263 & 15765 7.40178 7486907.10136 6.421555.8426 1421) 40051 451 1710 1.22120 14 11.00170 12.10625 11.29607 10.56312 864 9.29490 8.74547 824424 76157 M 6,62817 6.00207 546753 .00806 461057 282408 1.24867 15 1.3650S 12.5.4926 11.93794 11.11539 10.37966 9.71225 9.10791 859948 806667.60608 6.81086 6.14217 5.57546 5.09188 467547 85926 126821 16 14 71767 1157771 12.56110 1165210 10.31777 10.10500044645885117 8.31256702171 697199 6.26506 SO S16215 4.72954 1741 3.28124 17 15 56225 14.29187 13.16612 12 16567 11 27407 10.47726 0.76122 9.12164 8 543618.02155 2.1191 6.17286 74870 5.22231 477461 1.90091 20480 18 16.19827 14.09201 11.7535112.650301168959 10.02760 10 0909 917189 8.75563 8 20141 7 247 646742 581785 5.27316 4.81219 92704 1.10160 19 17.22601 15.67146 14.12110 11111041208512 11.15812 10 140 0.601000011 16402716578 6.5507 SW7746 5.31624 484150 1215 11053 2018.04555 16.351481417747 12.00 12.46221 11.46092 10.500 0.81615 0.12855 1856 746044 6.621) 9184 1825 4 osa 3.05 31570 21 18.85698 170112115.415021402916 12.62115 11.76408 10.035510.016110 9.2922464860756200 66 5314 518368480112 1911 1984 22 19.660 17 4500S 1591692 14A5112 1116300 12.041581106124 10.20074 4420077154 764465 6.74294 601113 40900 9000 19010 1.12296 21 20.45582 10.29220 16:44161 14.568411.4885712103381127219 10.12106 9.58021301227.71441 6.79206 604425 543212 492453 197410 3.12535 24 21 24339 18.91193 1693554 15.24696 11.79864 12.5501611.46913 10.52876 9.706618.98474 175412 6.53514 607267 5.45095 4.91710 M 132719 25 22.02116 19.52346 17.41315 15 622051409394 12.76336 11.6515 10.62478 9.82258 0.07704 7.14114 617203 609700 46001 494759 1.95419 1.12861 26 22.79520 20.12104 17.87684 15.08277 14.37519 13.00317 11.82578 10.80998 9.92807 0.16095 789566 660R 61118 54804) LOSG2 1.98791 1.12970 27 2355961 2070600 18.32703 16. 12959 14.643031121051 11.93671 1093516 10.02658 9 23722 794255 6.91515 613636 5.49189 496160 199031 1.13054 23 24.31644 2128127 16.76411 16 66806 14.89113 1140616 1213711 11 05108 10.11613930652 7.95442 6.96066 615204 50160 4.96967 199226 118 29 28.06570 71.54438 1016845 16.0 171 1S14107 11.59072122767 11.15841 10.198789 661 02181 6.98304 616556 55001 07472 190181113161 10 25.3077122.1964619.60044 17.29201 15.724 13.76483 12.09041125778 10.27 165 0.4201 ROSSIR 7.00266 &17720 5.161 497104 109505 1.11206 -1/-/