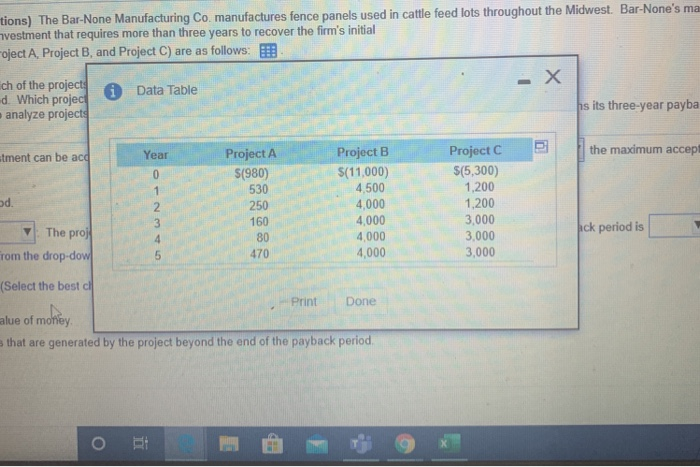

(Payback and discounted payback period calculations) The Bar None Manufacturing Co manufactures fonce panels used in cattle feed lots throughout the Midwest Bar None's management is considering the remont projects for next year but doesnt want to make any vestment that requires more than three years to recover the firm's Investment The cash flows for the three projects Project A Project and Prod C) are as follows a. Given Bar None's three-year payback period, which of the projects will quality for acceptance? b. Pank the Wee projects using their payback period which project looks the best using this thesion? Do you agree with this ranking Why or why not? c. If Bor None uses a discount rate of 94 percent to analyze projects, what is the discounted payback period for each of the three project? If the firm still maintains projects should the firm undertake? they payback policy for the discounted payback, which a. Given the cash fow Information in the table the payback period of Project A y ears (Founds two decimal places) the firm requires a 3-year payback before an investment can be accepted the drop-down menus) should Project A because its payback period is the maximum acceptable payback period (Select from the The payback period of Project B y ears (Round to two decimal places) should Y Project because its payback period is If the firm requires a 3 year payback before an investment can be accepted the drop-down menus.) the mamum acceptable payback period (Select from the The payback period of Project is years. (Round to two decimal places) (Payback and discounted payback period calculations) The BlaNone Manufacturing Co. manufactures fonce panels used in cattle feed lots throughout the Midwest Bar None's management is considering the investment projects for next year but doesn't want to make any investment that requires more than three years to recover the initial investment. The cash flows for the three projects (Project A Project and Project C) e as follows a. Given Bar None's three-year payback period, which of the projects will all for acceptance? b. Rank the three projects using the payback period which project looks the best using this creion? Do you agree with this ranking? Who why not? c. Bar None uses a discount rate of 9.4 percent to analyze projects, what is the discounted payback period for each of the three projech? If the m ill maintains its three year payback policy for the discounted payback, which projects should them undertake? In the firm requires a year payback before anvestment can be accepted the should Project because its payback period the maximum acceptable payback period led from the drop-down menus) b. Rank the three projects using the payback period The project with the shortest payback period is The project with the second shortest payback periods The project with the longest payback period is Therefore the project which looks best using the payback criterionis (Select from the drop-down menus) Do you agree with this ranking? Why or why not? (Select the best choice below) O A No, the payback method ignores the time value of money B. No, the payback method ignores cash flows that are generated by the project beyond the end of the payback period O tions) The Bar-None Manufacturing Co. manufactures fence panels used in cattle feed lots throughout the Midwest. Bar-None's ma vestment that requires more than three years to recover the firm's initial oject A, Project B, and Project C) are as follows: . ch of the projecta d. Which project analyze projects i - X Data Table is its three-year payba tment can be acq Year P the maximum Project $(980) 530 250 160 d Project B S(11,000) 4,500 4,000 4,000 4,000 4,000 Project C $(5,300) 1.200 1.200 3,000 3,000 3,000 The proj from the drop-dow ick period is 470 (Select the best Print Done alue of money that are generated by the project beyond the end of the payback period