Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Payback method. Im needing some help to ensure I am doing it right. The first sheet are the 3 problems I need help with. The

Payback method. Im needing some help to ensure I am doing it right. The first sheet are the 3 problems I need help with. The other 2 are the examples/info provided. Thank you

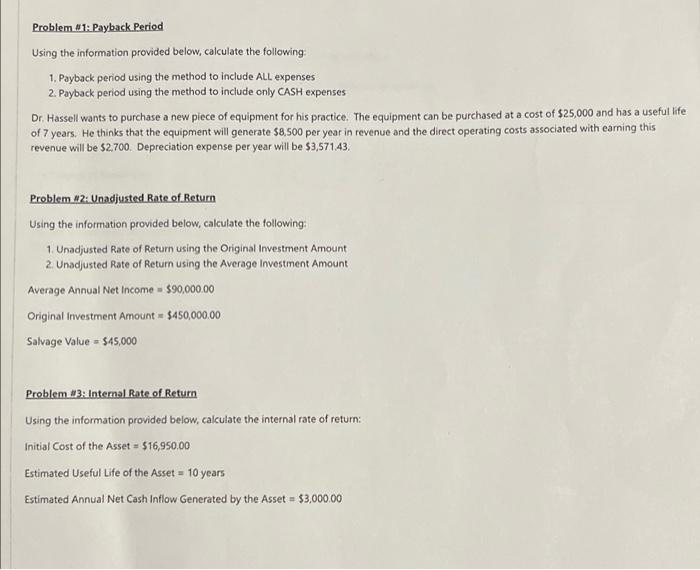

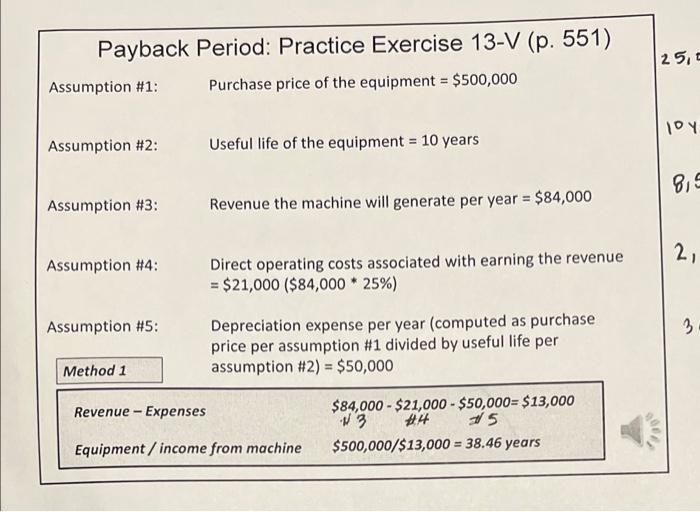

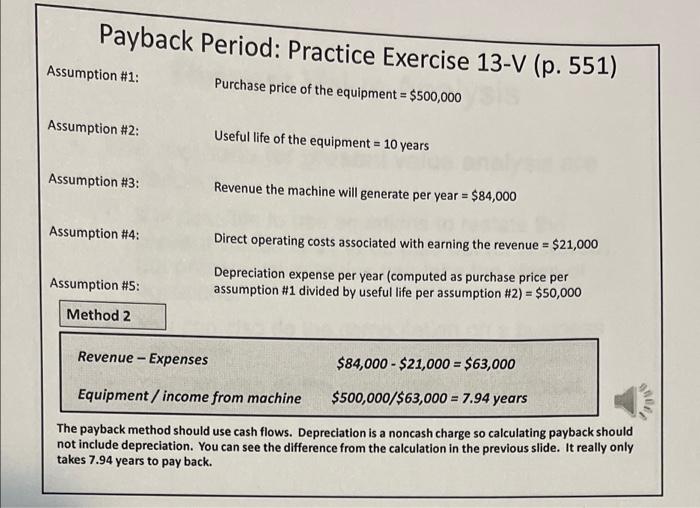

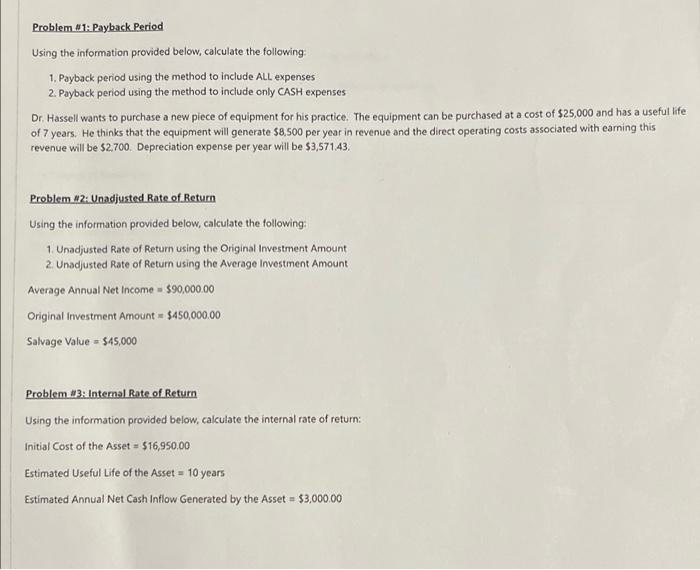

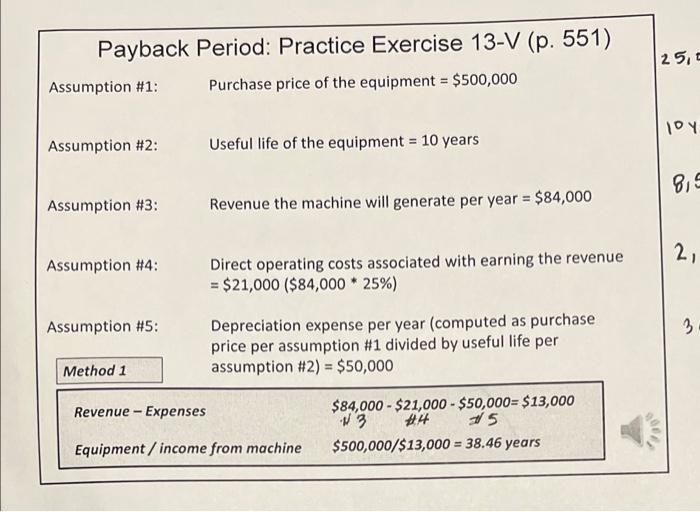

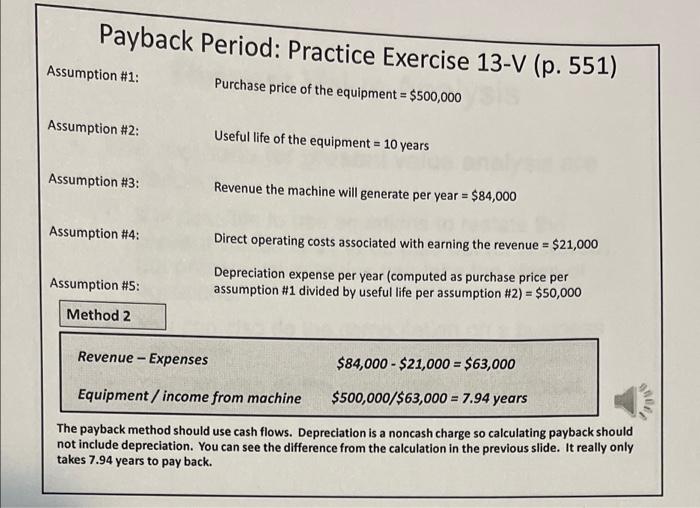

Problem #1: Payback Period Using the information provided below, calculate the following 1. Payback period using the method to include All expenses 2. Payback period using the method to include only CASH expenses Dr. Hassell wants to purchase a new piece of equipment for his practice. The equipment can be purchased at a cost of $25,000 and has a useful life of 7 years. He thinks that the equipment will generate $8,500 per year in revenue and the direct operating costs associated with earning this revenue will be $2,700 Depreciation expense per year will be $3,571,43, Problem #2: Unadjusted Rate of Return Using the information provided below, calculate the following: 1 Unadjusted Rate of Return using the Original Investment Amount 2. Unadjusted Rate of Return using the Average Investment Amount Average Annual Net Income - $90,000.00 Original Investment Amount - $450,000.00 Salvage Value = $45,000 Problem #3: Internal Rate of Return Using the information provided below, calculate the internal rate of return; Initial Cost of the Asset = $16,950.00 Estimated Useful Life of the Asset = 10 years Estimated Annual Net Cash Inflow Generated by the Asset = $3,000.00 25,0 Payback Period: Practice Exercise 13-V (p. 551) Assumption #1: Purchase price of the equipment = $500,000 loy Assumption #2: Useful life of the equipment = 10 years 8,5 Assumption #3: Revenue the machine will generate per year = $84,000 2 Assumption #4: Direct operating costs associated with earning the revenue = $21,000 ($84,000 * 25%) Assumption #5: 3 Depreciation expense per year (computed as purchase price per assumption #1 divided by useful life per assumption #2) = $50,000 Method 1 Revenue - Expenses $84,000 - $21,000 - $50,000= $13,000 #4 15 $500,000/$13,000 = 38.46 years W3 Equipment/ income from machine Payback Period: Practice Exercise 13-V (p. 551) Assumption #1: Purchase price of the equipment = $500,000 Assumption #2: Useful life of the equipment = 10 years Assumption #3: Revenue the machine will generate per year = $84,000 Assumption #4: Direct operating costs associated with earning the revenue = $21,000 Assumption #5: Depreciation expense per year (computed as purchase price per assumption #1 divided by useful life per assumption #2) = $50,000 Method 2 Revenue - Expenses $84,000 - $21,000 = $63,000 Equipment/ income from machine $500,000/$63,000 = 7.94 years The payback method should use cash flows. Depreciation is a noncash charge so calculating payback should not include depreciation. You can see the difference from the calculation in the previous slide. It really only takes 7.94 years to pay back

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started