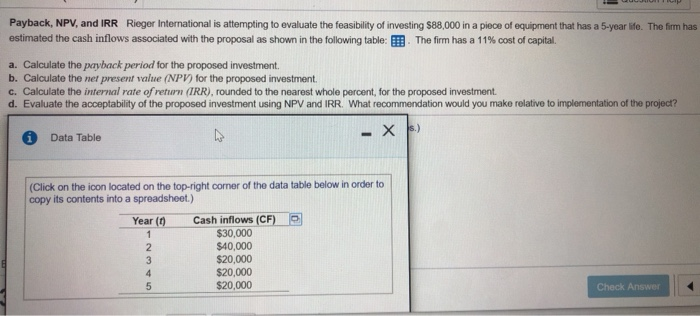

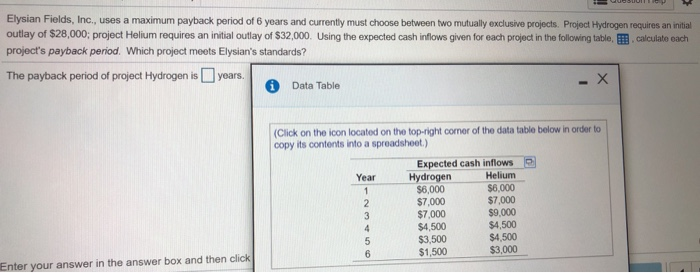

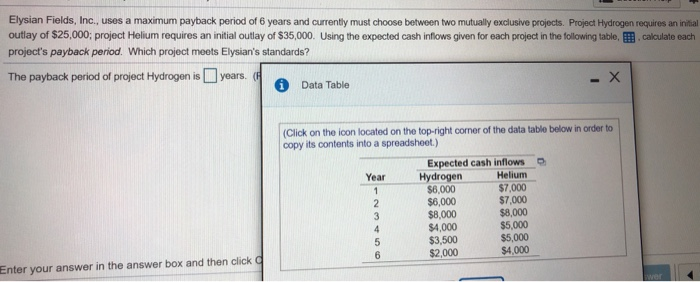

Payback, NPV, and IRR Rieger International is attempting to evaluate the feasibility of investing $88,000 in a piece of equipment that has a 5-year life. The firm has estimated the cash inflows associated with the proposal as shown in the following table: The firm has a 11% cost of capital a. Calculate the pryback period for the proposed investment. b. Calculate the nel present value (NPV) for the proposed investment. c. Calculate the internal rate of return (IRR), rounded to the nearest whole percent, for the proposed investment. d. Evaluate the acceptability of the proposed investment using NPV and IRR. What recommendation would you make relative to implementation of the project? i Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Year (1) Cash inflows (CF) $30,000 $40,000 $20,000 $20,000 $20,000 ch Check Answer Elysian Fields, Inc., uses a maximum payback period of 6 years and currently must choose between two mutually exclusive projects. Project Hydrogen requires an initial outlay of $28,000, project Helium requires an initial outlay of $32,000. Using the expected cash inflows given for each project in the following table calculate each project's payback period. Which project meets Elysian's standards? The payback period of project Hydrogen is years. Data Table X (Click on the icon located on the top right corner of the data table below in order to copy its contents into a spreadsheet) Year Expected cash inflows Hydrogen Helium $6,000 $6,000 $7,000 $7,000 $7.000 $9.000 $4,500 $4,500 $3.500 $4.500 $1,500 $3,000 Enter your answer in the answer box and then click Elysian Fields, Inc., uses a maximum payback period of 6 years and currently must choose between two mutually exclusive projects Project Hydrogen requires an inte outlay of $25,000; project Helium requires an initial outlay of $35,000. Using the expected cash inflows given for each project in the following table, calculate each project's payback period. Which project meets Elysian's standards? The payback period of project Hydrogen is years. Data Table (Click on the icon located on the top-right corner of the datatable below in order to copy its contents into a spreadshoot.) Expected cash inflows Year Hydrogen Helium $6,000 $7.000 $6,000 $7,000 $8.000 $8,000 $4,000 $5,000 $3,500 $2,000 $4.000 $5,000 Enter your answer in the answer box and then click