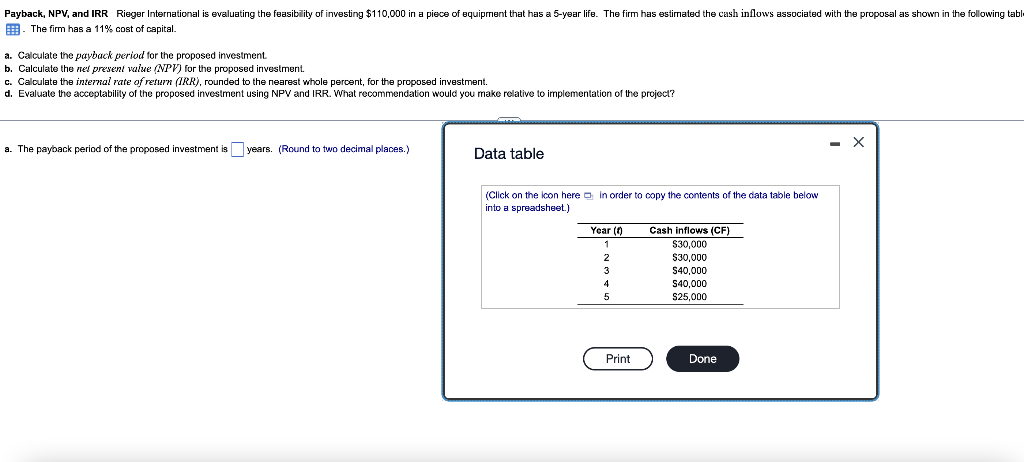

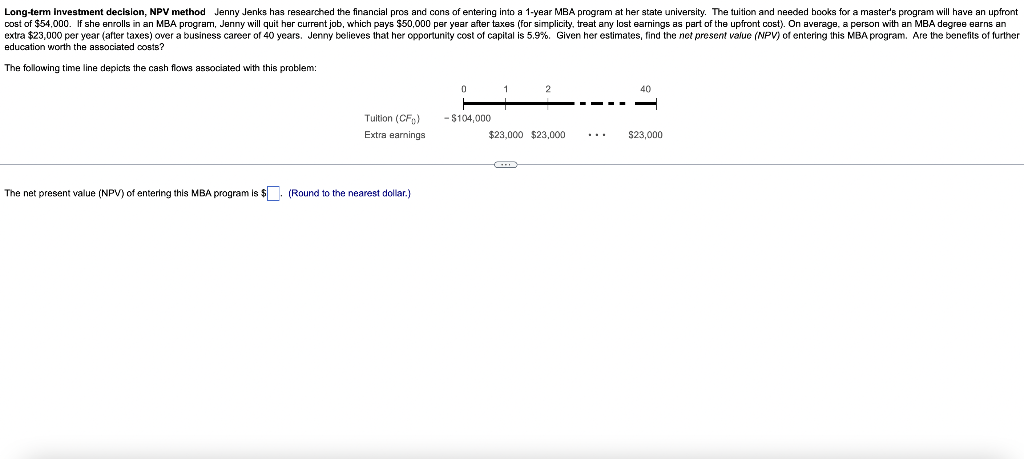

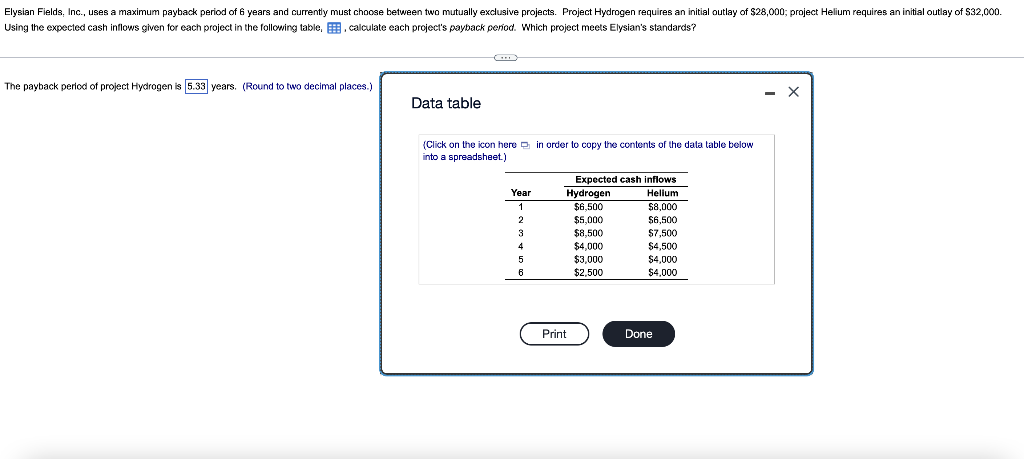

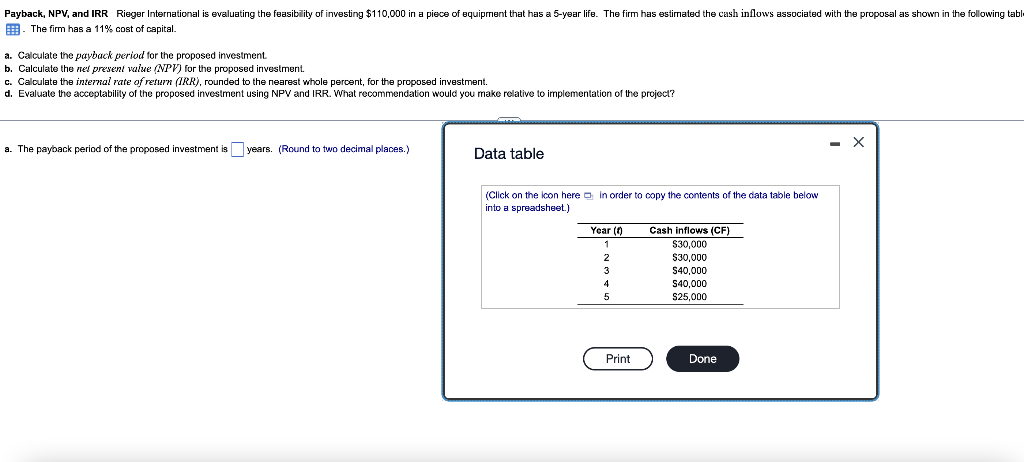

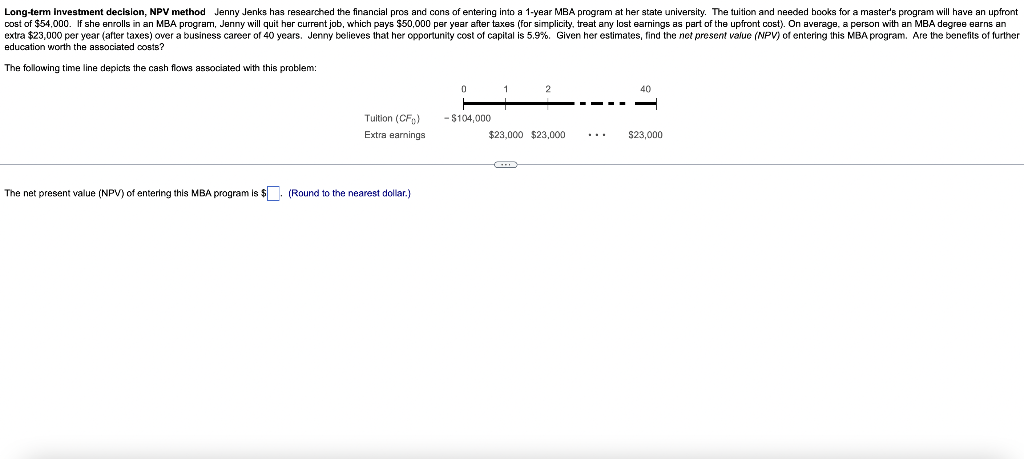

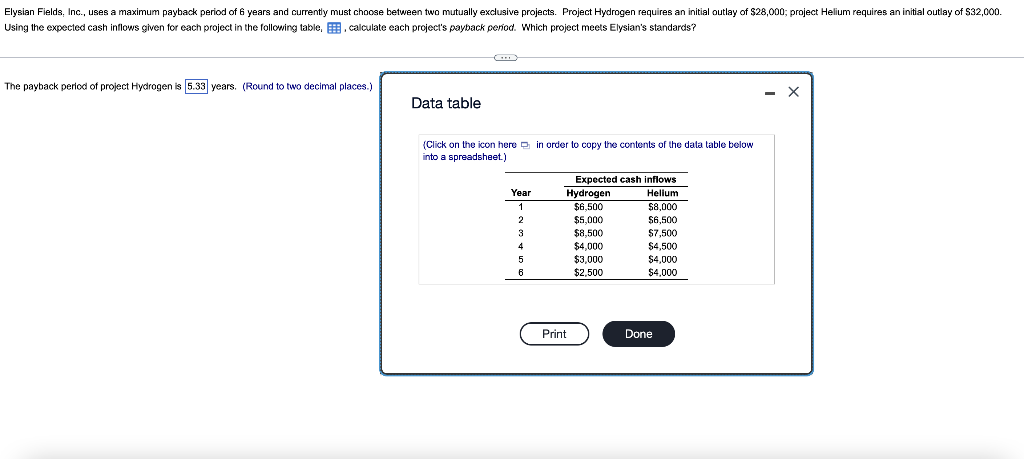

Payback, NPV, and IRR Rieger International is evaluating the feasibility of investing $110,000 in a piece of equipment that has a 5-year life. The firm has estimated the cash inflows associated with the proposal as shown in the following tabl. The firm has a 11% cost of capital. a. Calculate the payback period for the proposed investment b. Calculate the nel present value (NPV) for the proposed investment. c. Calculate the internal rate of return (IRR), rounded to the nearest whole percent, for the proposed investment. d. Evaluate the acceptability of the proposed investment using NPV and IRR. What recommendation would you make relative implementation of the project? X a. The payback period of the proposed investment is years. (Round to two decimal places.) Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Year (0) 1 2 3 Cash inflows (CF) $30,000 $30,000 S40,000 S40,000 S25,000 4 5 Print Done Long-term Investment decision, NPV method Jenny Jenks has researched the financial pros and cons of entering into a 1-year MBA program at her state university. The tuition and needed books for a master's program will have an upfront cost of $54,000. If she enrolls in an MBA program, Jenny will quit her current job, which pays $50,000 per year after taxes (for simplicity, treat any lost earnings as part of the upfront cost). On average, a person with an MBA degree earns an extra $23,000 per year (after taxes) over a business career of 40 years. Jenny believes that her opportunity cost of capital is 5.9%. Given her estimates, find the net present value (NPV) of entering this MBA program. Are the benefits of further education worth the associated costs? The following timeline depicts the cash flows associated with this problem: 0 Tuition (CF) Extra earnings - $104,000 $23,000 $23,000 S23,000 The net present value (NPV) of entering this MBA program is $. (Round to the nearest dollar.) Axis Corp. is studying two mutually exclusive projects. Project Kelvin involves an overhaul of the existing system, it will cost $43,500 and generate cash inflows of $24,500 per year for the next 3 years. Project Thompson replaces the existing system; it will cost S235,000 and generate cash inflows of S55,000 per year for 6 years. Using a(n) 9.15% cost of capital, calculate each project's NPV and make a recommendation based on your findings. The NPV of project Kelvin is $. (Round to the nearest cent.) Elysian Fields, Inc., uses a maximum payback period of 6 years and currently must choose between two mutually exclusive projects. Project Hydrogen requires an initial outlay of $28,000; project Helium requires an initial outlay of $32,000. Using the expected cash inflows given for each project in the following table, B. calculate each project's payback period. Which project meets Elysian's standards? The payback period of project Hydrogen is 5.33 years. (Round to two decimal places.) Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Year Hydrogen 1 2 Expected cash inflows Helium $6,500 $8,000 $5,000 $6,500 $8,500 $7,500 $4.000 $4,500 $3.000 $4.000 $2,500 $4,000 3 4 5 6 Print Done