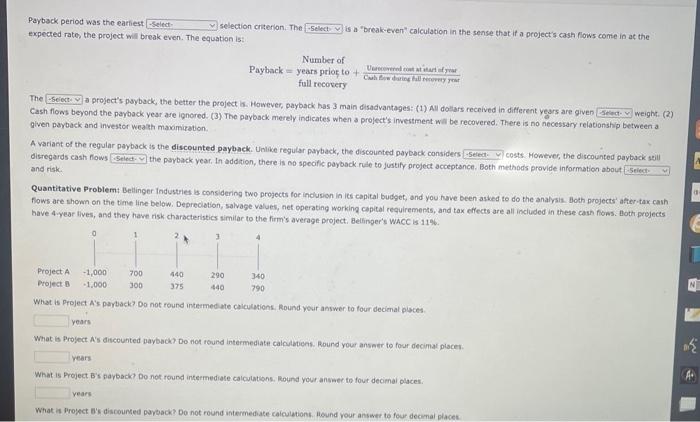

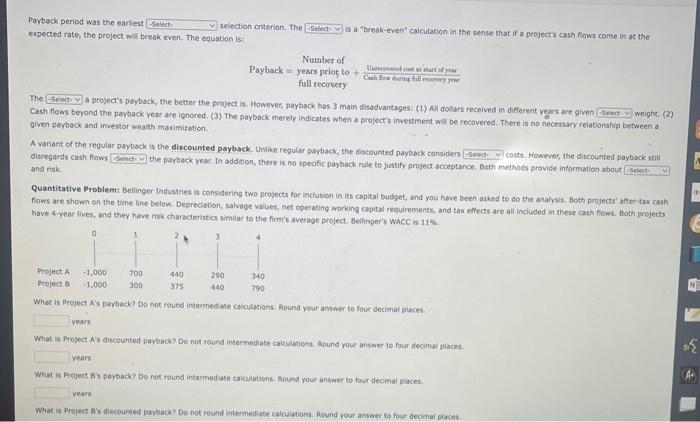

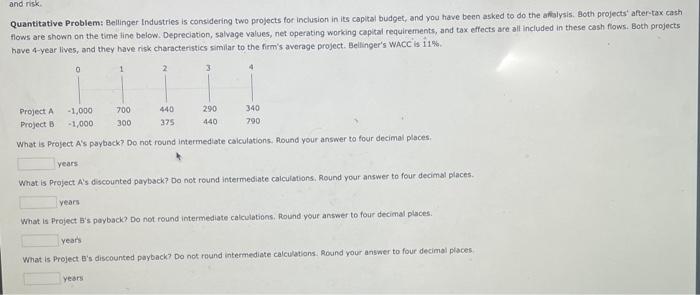

Payback period was the earliest selection criterion. The expected rate, the project will break even. The equation is: fullrecovery The a project's payback, the better the project is. Howeven, payback has 3 main disadvantages: (1) All doliars received in different years are given Gash flows beyond the payback year are ignored. (3) The payback merely indicates when a project's investment wall be rect investor wea sth mavintratuon. recovered. There is no necessary relationship between a A variant of the regular payback is the discounted payback. Unlike regular payback, the discounted payback considers disregards Quantitative Problem: Belinger Industries is considering two progects for indusion in its capital budget, ond you huve been asked to do the analysis. Both projects' after-tax cash fows are thown on the time line below. Depreciotion, salvage values, net operating working capital requirements, and tax effects are all included in these cash fioms. Aloth projects bave 4-year llves, and they have risk characteristics similar to the firm's average project. Bellinger's wacc is 1146. What is Project A's parback? Do not round intermed ate calculations, Round your answer to four decimal places. years What is Project A's ditcounted payback Do not round intermediate calculatiens. Round your ansetr to four decimat places. What is Project B's payback? Do nof round intermediate calculations. Round your answer to four decimai places. vears. What is Project E's discoursed porback? Do not round intermediate calculetions. Hound your answer to four deconal elaces. Payback period was the earliest selection criterion. The expected rate, the project will break even. The equation is: fullrecovery The a project's payback, the better the project is. Howeven, payback has 3 main disadvantages: (1) All doliars received in different years are given Gash flows beyond the payback year are ignored. (3) The payback merely indicates when a project's investment wall be rect investor wea sth mavintratuon. recovered. There is no necessary relationship between a A variant of the regular payback is the discounted payback. Unlike regular payback, the discounted payback considers disregards Quantitative Problem: Belinger Industries is considering two progects for indusion in its capital budget, ond you huve been asked to do the analysis. Both projects' after-tax cash fows are thown on the time line below. Depreciotion, salvage values, net operating working capital requirements, and tax effects are all included in these cash fioms. Aloth projects bave 4-year llves, and they have risk characteristics similar to the firm's average project. Bellinger's wacc is 1146. What is Project A's parback? Do not round intermed ate calculations, Round your answer to four decimal places. years What is Project A's ditcounted payback Do not round intermediate calculatiens. Round your ansetr to four decimat places. What is Project B's payback? Do nof round intermediate calculations. Round your answer to four decimai places. vears. What is Project E's discoursed porback? Do not round intermediate calculetions. Hound your answer to four deconal elaces. Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the afilysis. Both projects' after-tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working copital requirements, and tax effects are all included in these cash flows. Both projects have 4-year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WAcC is 11%. What is Project A's payback? Do not round intermediate calculations, Round your answer to four decimal places. years: What is Praject A's discounted payback? Do not round intermediate calculations, Round your answer to four decimal places. What is Project a's payback? Do not round intermediate calculations. Round your answer to four decimal places. years What is Project E's discounted payback? Do nok round intermediate calculations. Round your answer to four decimal pisces yests Payback period was the earliest selection criterion. The expected rate, the project will break even. The equation is: fullrecovery The a project's payback, the better the project is. Howeven, payback has 3 main disadvantages: (1) All doliars received in different years are given Gash flows beyond the payback year are ignored. (3) The payback merely indicates when a project's investment wall be rect investor wea sth mavintratuon. recovered. There is no necessary relationship between a A variant of the regular payback is the discounted payback. Unlike regular payback, the discounted payback considers disregards Quantitative Problem: Belinger Industries is considering two progects for indusion in its capital budget, ond you huve been asked to do the analysis. Both projects' after-tax cash fows are thown on the time line below. Depreciotion, salvage values, net operating working capital requirements, and tax effects are all included in these cash fioms. Aloth projects bave 4-year llves, and they have risk characteristics similar to the firm's average project. Bellinger's wacc is 1146. What is Project A's parback? Do not round intermed ate calculations, Round your answer to four decimal places. years What is Project A's ditcounted payback Do not round intermediate calculatiens. Round your ansetr to four decimat places. What is Project B's payback? Do nof round intermediate calculations. Round your answer to four decimai places. vears. What is Project E's discoursed porback? Do not round intermediate calculetions. Hound your answer to four deconal elaces. Payback period was the earliest selection criterion. The expected rate, the project will break even. The equation is: fullrecovery The a project's payback, the better the project is. Howeven, payback has 3 main disadvantages: (1) All doliars received in different years are given Gash flows beyond the payback year are ignored. (3) The payback merely indicates when a project's investment wall be rect investor wea sth mavintratuon. recovered. There is no necessary relationship between a A variant of the regular payback is the discounted payback. Unlike regular payback, the discounted payback considers disregards Quantitative Problem: Belinger Industries is considering two progects for indusion in its capital budget, ond you huve been asked to do the analysis. Both projects' after-tax cash fows are thown on the time line below. Depreciotion, salvage values, net operating working capital requirements, and tax effects are all included in these cash fioms. Aloth projects bave 4-year llves, and they have risk characteristics similar to the firm's average project. Bellinger's wacc is 1146. What is Project A's parback? Do not round intermed ate calculations, Round your answer to four decimal places. years What is Project A's ditcounted payback Do not round intermediate calculatiens. Round your ansetr to four decimat places. What is Project B's payback? Do nof round intermediate calculations. Round your answer to four decimai places. vears. What is Project E's discoursed porback? Do not round intermediate calculetions. Hound your answer to four deconal elaces. Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the afilysis. Both projects' after-tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working copital requirements, and tax effects are all included in these cash flows. Both projects have 4-year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WAcC is 11%. What is Project A's payback? Do not round intermediate calculations, Round your answer to four decimal places. years: What is Praject A's discounted payback? Do not round intermediate calculations, Round your answer to four decimal places. What is Project a's payback? Do not round intermediate calculations. Round your answer to four decimal places. years What is Project E's discounted payback? Do nok round intermediate calculations. Round your answer to four decimal pisces yests