Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PAYG Instalments 6 . What are the options available to taxpayers in determining the amount of PAYG instalments? 7 . When are quarterly PAYG instalments

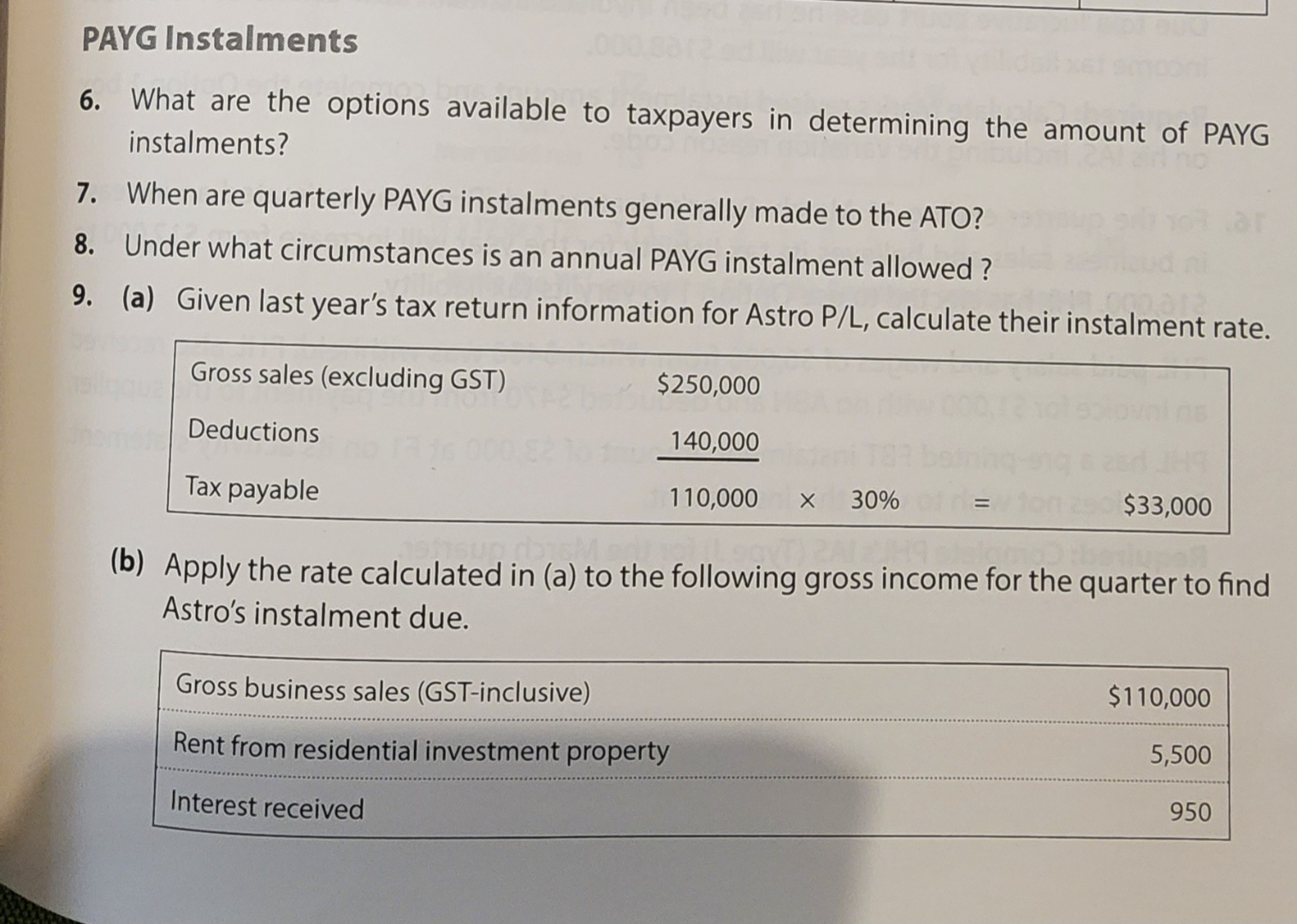

PAYG Instalments

What are the options available to taxpayers in determining the amount of PAYG instalments?

When are quarterly PAYG instalments generally made to the ATO?

Under what circumstances is an annual PAYG instalment allowed

a Given last year's tax return information for Astro calculate their instalment rate.

tableGross sales excluding GST$DeductionsTax payable,$

b Apply the rate calculated in a to the following gross income for the quarter to find Astro's instalment due.

tableGross business sales GSTinclusive$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started