Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PAYG withholding is $670 Employer superannuation guarantee is 10% The payroll tax rate is 4.85%, Assume Caspian does not meet the tax-free threshold for 1

PAYG withholding is $670

Employer superannuation guarantee is 10%

The payroll tax rate is 4.85%,

Assume Caspian does not meet the tax-free threshold for 1 July 2022 to 30 June 2023 is $700,000, with a monthly threshold of $58,333. and its employees work in non-regional Victoria.

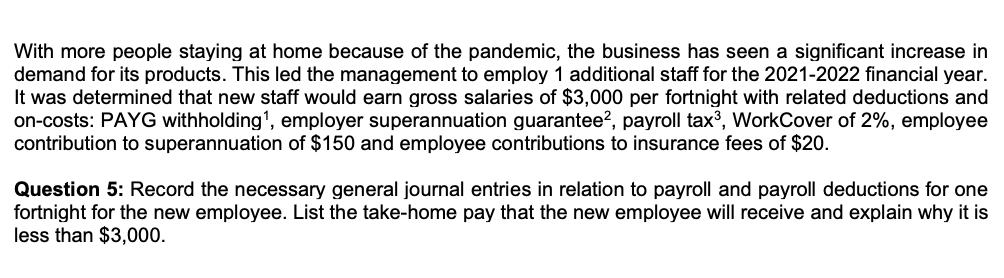

With more people staying at home because of the pandemic, the business has seen a significant increase in demand for its products. This led the management to employ 1 additional staff for the 2021-2022 financial year. It was determined that new staff would earn gross salaries of $3,000 per fortnight with related deductions and on-costs: PAYG withholding 1, employer superannuation guarantee 2, payroll tax 3, WorkCover of 2%, employee contribution to superannuation of $150 and employee contributions to insurance fees of $20. Question 5: Record the necessary general journal entries in relation to payroll and payroll deductions for one fortnight for the new employee. List the take-home pay that the new employee will receive and explain why it is less than $3,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started