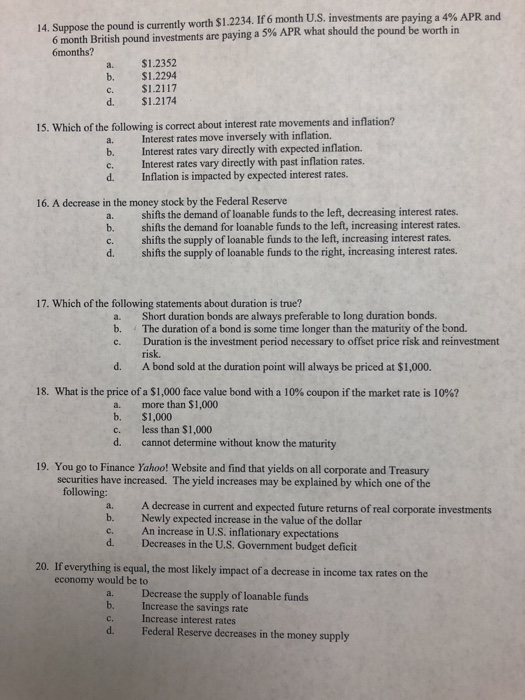

paying a 4% APR and 14. Suppose the pound is currently worth $1.2234. If 6 month U.S. investments are 6 month British pound investments are paying a 5% APR what should the pound be worth in 6months? a. $1.2352 b. $1.2294 c. $1.2117 d. $1.2174 15. Which of the following is correct about interest rate movements and inflation? a. Interest rates move inversely with inflation. b. Interest rates vary directly with expected inflation. c. Interest rates vary directly with past inflation rates. d. Inflation is impacted by expected interest rates. 16. A decrease in the money stock by the Federal Reserve a. shifts the demand of loanable funds to the left, decreasing interest rates b. shifts the demand for loanable funds to the left, increasing interest rates. c. shifits the supply of loanable funds to the left, increasing interest rates. d. shifts the supply of loanable funds to the right, increasing interest rates. 17. Which of the following statements about duration is true? a. Short duration bonds are always preferable to long duration bonds. b. The duration of a bond is some time longer than the maturity of the bond. c. Duration is the investment period necessary to offset price risk and reinvestment risk. A bond sold at the duration point will always be priced at $1,000. d. 18, what is the price of a $1,000 face value bond with a 10% coupon if the market rate is 10%? a. more than $1,000 b. $1,000 c. less than $1,000 d. cannot determine without know the maturity 19. You go to Finance Yahoo! Website and find that yields on all corporate and Treasury securities have increased. The yield increases may be explained by which one of the following: a. A decrease in current and expected future returns of real corporate investments b. Newly expected increase in the value of the dollar c. An increase in U.S. inflationary expectations d. Decreases in the U.S. Government budget deficit 20. If everything is equal, the most likely impact of a decrease in income tax rates on the economy would be to a. Decrease the supply of loanable funds b. Increase the savings rate c. Increase interest rates d. Federal Reserve decreases in the money supply