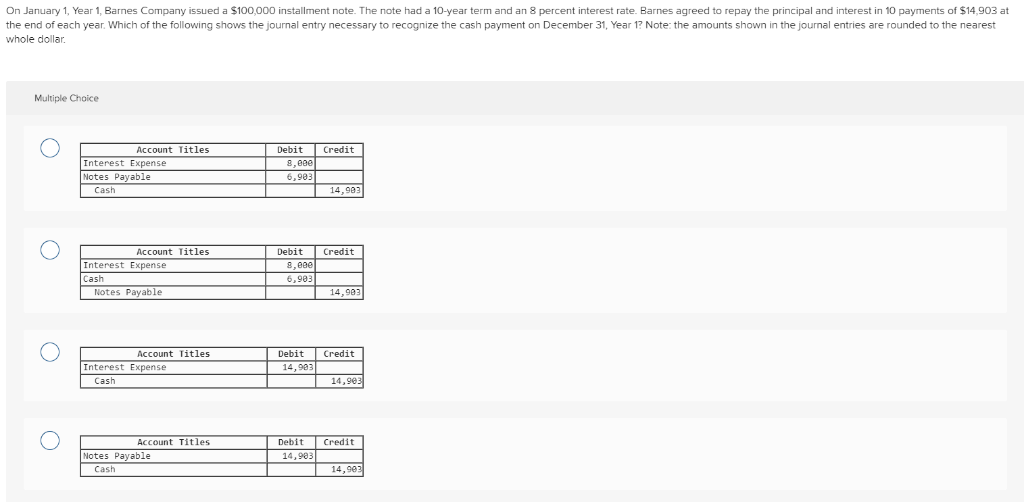

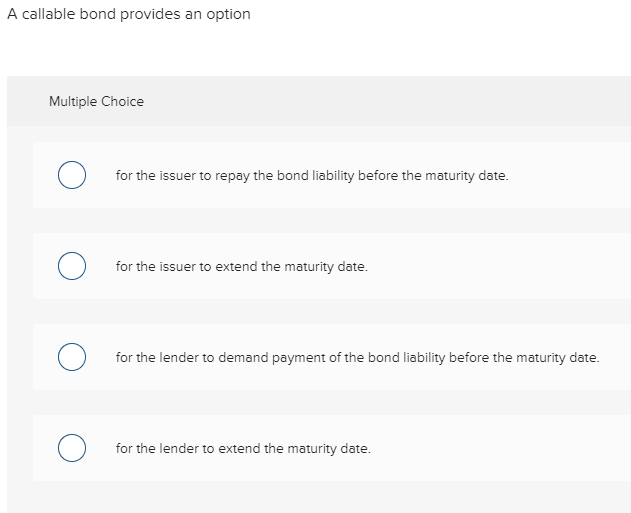

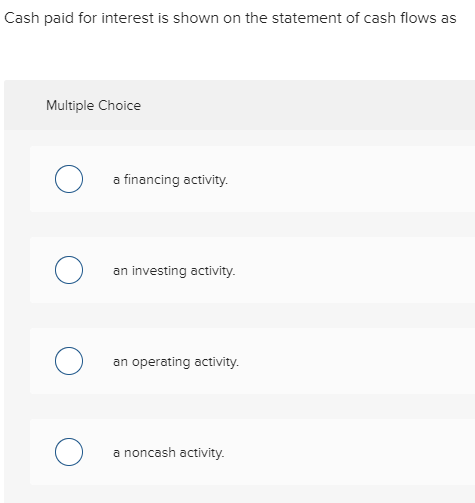

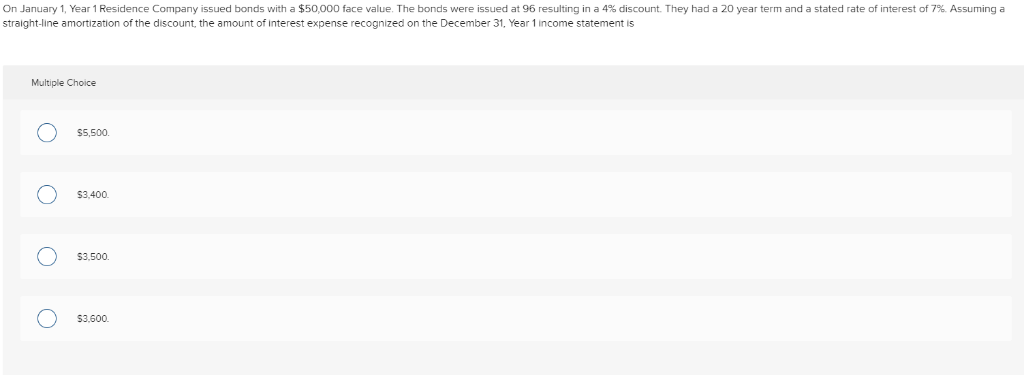

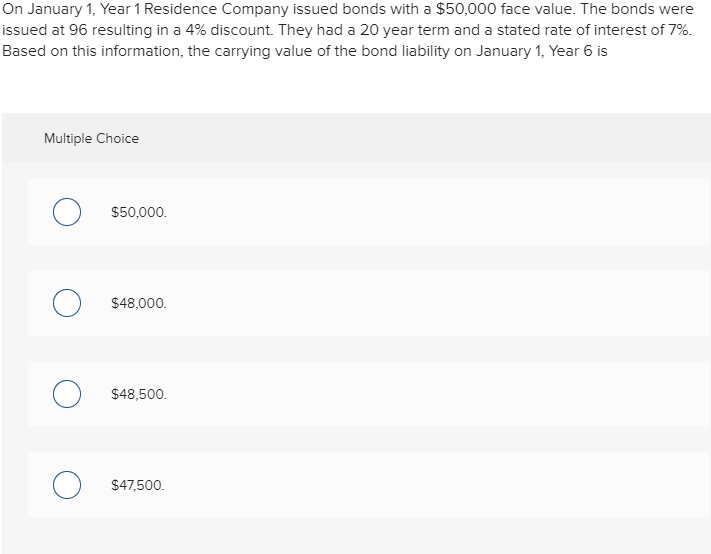

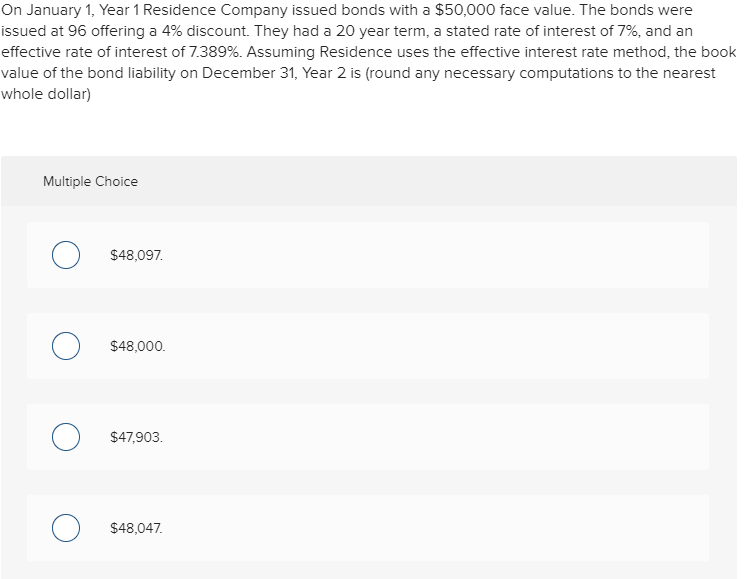

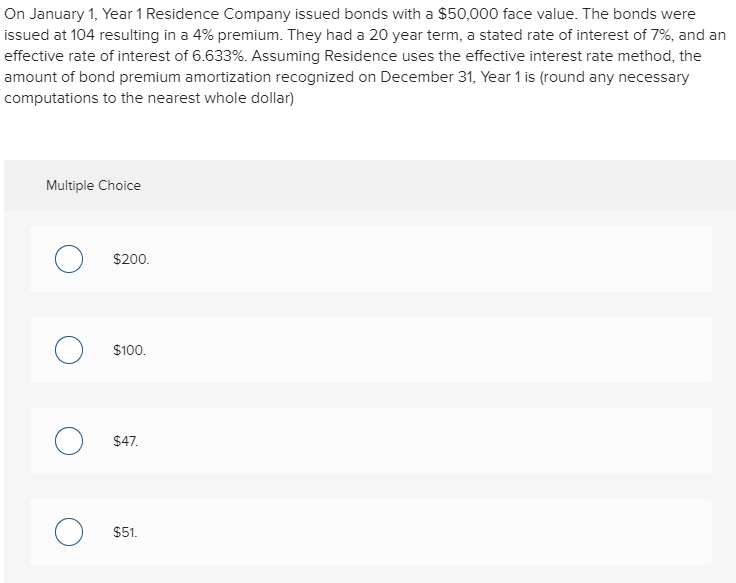

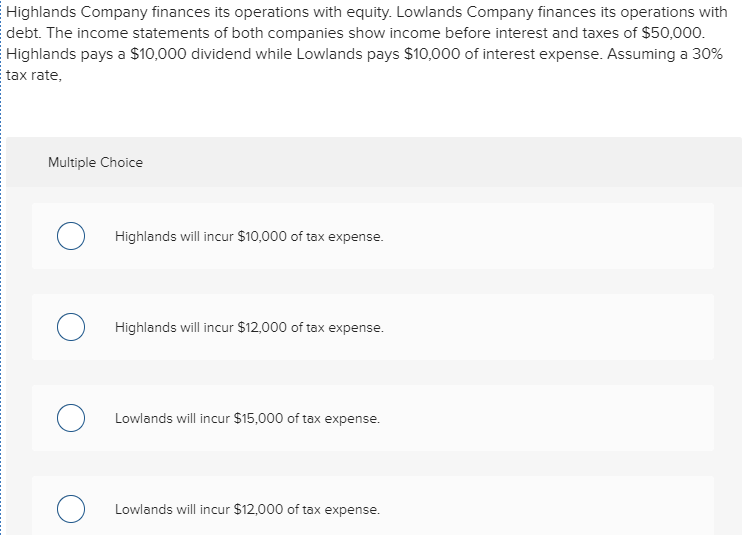

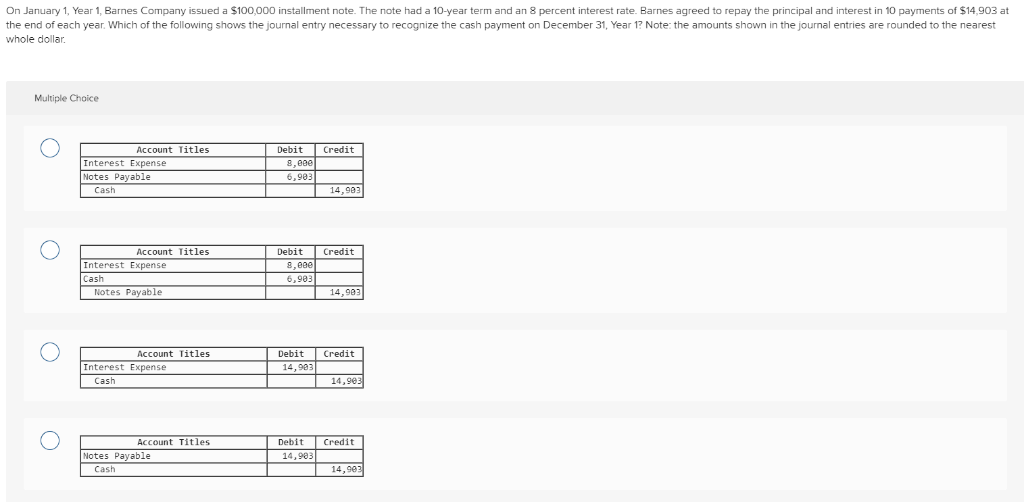

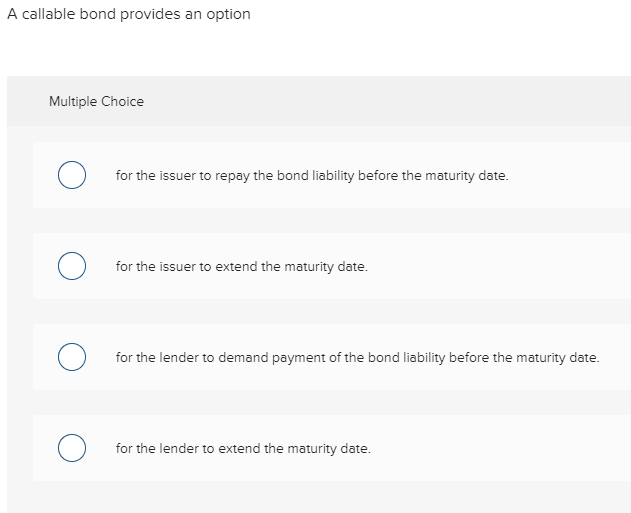

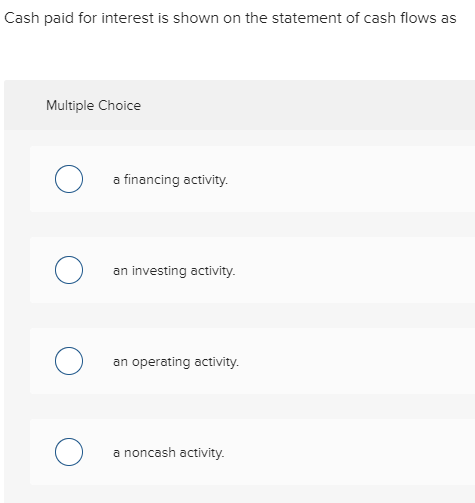

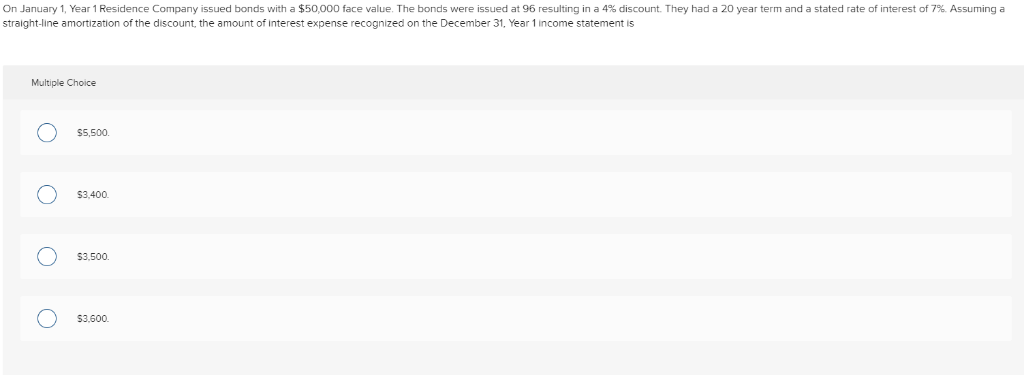

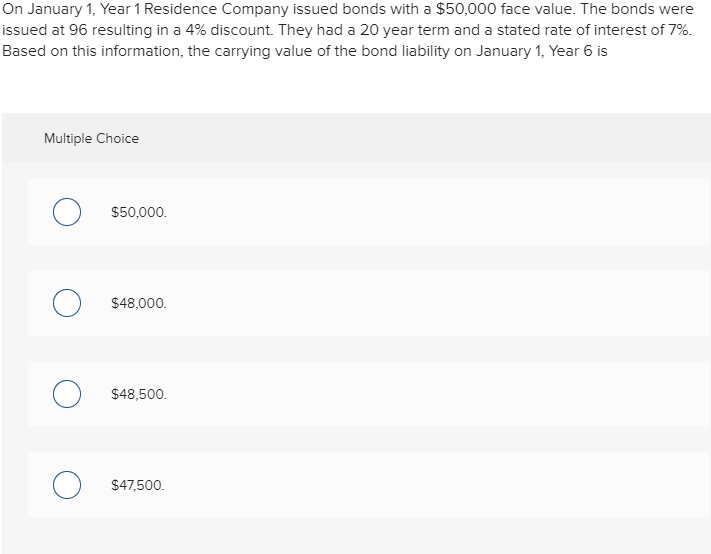

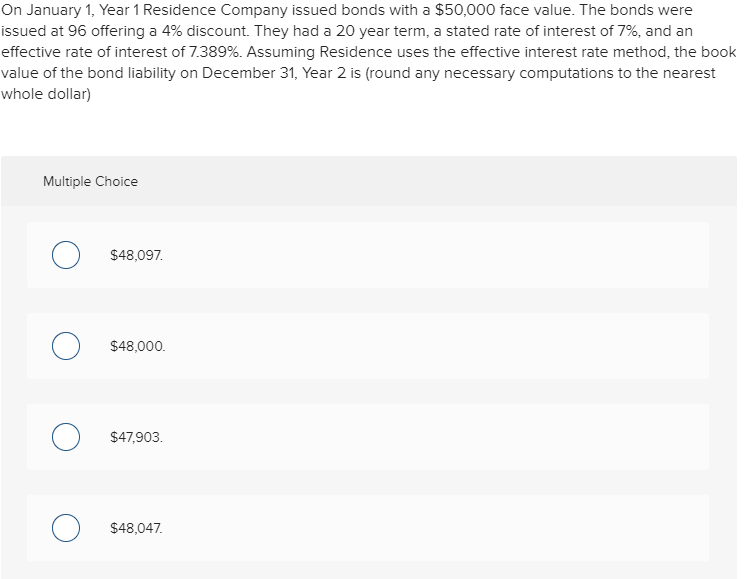

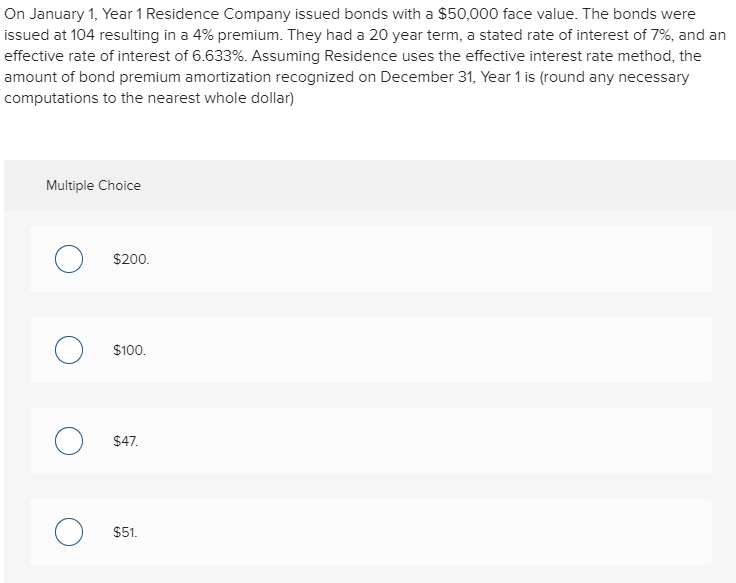

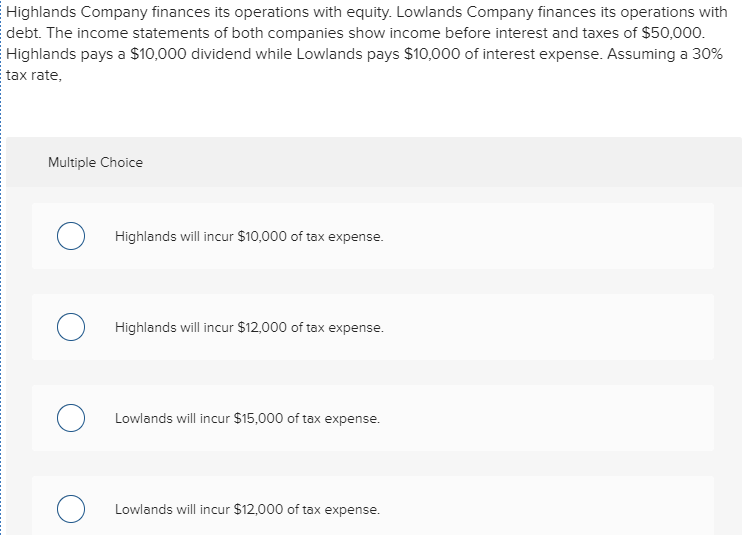

payments of $14,903 at Note: the amounts shown in the journal entries are rounded to the nearest On January 1, Year 1, Barnes Company issued a $100,000 installment note. The note had a 10-year term and an 8 percent interest rate. Barnes agreed to repay the principal and interest in the end of each year. Which of the following shows the journal entry necessary to recognize the cash payment on December 31, Year whole dollar Multiple Choice Account Titles Debit Credit Interest Expense ,e0e yable ,983 Cash 14.903 Account Titles Debit Credit Interest Expense .ee Cash ,903 Notes Payable 14.903 Credit Account Titles DEVA - Interest Cash 14,903 Debit Account Titles Credit Notes Payable Cash 14,903 14,907 A callable bond provides an option Multiple Choice for the issuer to repay the bond liability before the maturity date. for the issuer to extend the maturity date. for the lender to demand payment of the bond liability before the maturity date. for the lender to extend the maturity date. Cash paid for interest is shown on the statement of cash flows as Multiple Choice a financing activity an investing activity an operating activity a noncash activity. On January 1, Year 1 Residence Company issued bonds with a $50,000 face value. The bonds were issued at 96 resulting in a 4% discount. They had a 20 year term and a stated rate of interest of 7% Assuming a straight-line amortization of the discount, the amount of interest expense recognized on the December 31, Year 1 income statement is Multiple Choice S5,500. S3.400 S3.500. $3.600. On January 1, Year 1 Residence Company issued bonds with a $50,000 face value. The bonds were issued at 96 resulting in a 4% discount. They had a 20 year term and a stated rate of interest of 7%. Based on this information, the carrying value of the bond liability on January 1, Year 6 is Multiple Choice $50,000. $48,000. $48,500. $47,500. On January 1, Year 1 Residence Company issued bonds with a $50,000 face value. The bonds were issued at 104 resulting in a 4% premium. They had a 20 year term and a stated rate of interest of 7%.The company amortizes the premium on a straight-line basis. Which of the following shows how the recognition of interest expense will affect Residence's financial statements on December 31, Year 1? Multiple Choice On January 1, Year 1 Residence Company issued bonds with a $50,000 face value. The bonds were issued at 96 offering a 4% discount. They had a 20 year term, a stated rate of interest of 7%, and an effective rate of interest of 7.389%. Assuming Residence uses the effective interest rate method, the book value of the bond liability on December 31, Year 2 is (round any necessary computations to the nearest whole dollar) Multiple Choice $48,097. $48,000. $47,903. $48,047 On January 1, Year 1 Residence Company issued bonds with a $50,000 face value. The bonds were issued at 104 resulting in a 4% premium. They had a 20 year term, a stated rate of interest of 7%, and an effective rate of interest of 6.633%. Assuming Residence uses the effective interest rate method, the amount of bond premium amortization recognized on December 31, Year 1 is (round any necessary computations to the nearest whole dollar) Multiple Choice $200 $100 $47 $51 Highlands Company finances its operations with equity. Lowlands Company finances its operations with debt. The income statements of both companies show income before interest and taxes of $50,000. Highlands pays a $10,000 dividend while Lowlands pays $10,000 of interest expense. Assuming a 30% tax rate, Multiple Choice Highlands will incur $10,000 of tax expense. Highlands will incur $12,000 of tax expense. Lowlands will incur $15,000 of tax expense. Lowlands will incur $12,000 of tax expense. Cash paid for interest is shown on the statement of cash flows as Multiple Choice a financing activity an investing activity an operating activity a noncash activity. On January 1, Year 1 Residence Company issued bonds with a $50,000 face value. The bonds were issued at 96 resulting in a 4% discount. They had a 20 year term and a stated rate of interest of 7% Assuming a straight-line amortization of the discount, the amount of interest expense recognized on the December 31, Year 1 income statement is Multiple Choice S5,500. S3.400 S3.500. $3.600. On January 1, Year 1 Residence Company issued bonds with a $50,000 face value. The bonds were issued at 104 resulting in a 4% premium. They had a 20 year term, a stated rate of interest of 7%, and an effective rate of interest of 6.633%. Assuming Residence uses the effective interest rate method, the amount of bond premium amortization recognized on December 31, Year 1 is (round any necessary computations to the nearest whole dollar) Multiple Choice $200 $100 $47 $51 On January 1, Year 1 Residence Company issued bonds with a $50,000 face value. The bonds were issued at 96 resulting in a 4% discount. They had a 20 year term and a stated rate of interest of 7%. Based on this information, the carrying value of the bond liability on January 1, Year 6 is Multiple Choice $50,000. $48,000. $48,500. $47,500. Highlands Company finances its operations with equity. Lowlands Company finances its operations with debt. The income statements of both companies show income before interest and taxes of $50,000. Highlands pays a $10,000 dividend while Lowlands pays $10,000 of interest expense. Assuming a 30% tax rate, Multiple Choice Highlands will incur $10,000 of tax expense. Highlands will incur $12,000 of tax expense. Lowlands will incur $15,000 of tax expense. Lowlands will incur $12,000 of tax expense. On January 1, Year 1 Residence Company issued bonds with a $50,000 face value. The bonds were issued at 96 offering a 4% discount. They had a 20 year term, a stated rate of interest of 7%, and an effective rate of interest of 7.389%. Assuming Residence uses the effective interest rate method, the book value of the bond liability on December 31, Year 2 is (round any necessary computations to the nearest whole dollar) Multiple Choice $48,097. $48,000. $47,903. $48,047