Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Payout ratio. Debt used. You have been approached by the CEO of the Italian company Coverciano Generali S.p.A. She wants to discuss the dividend policy

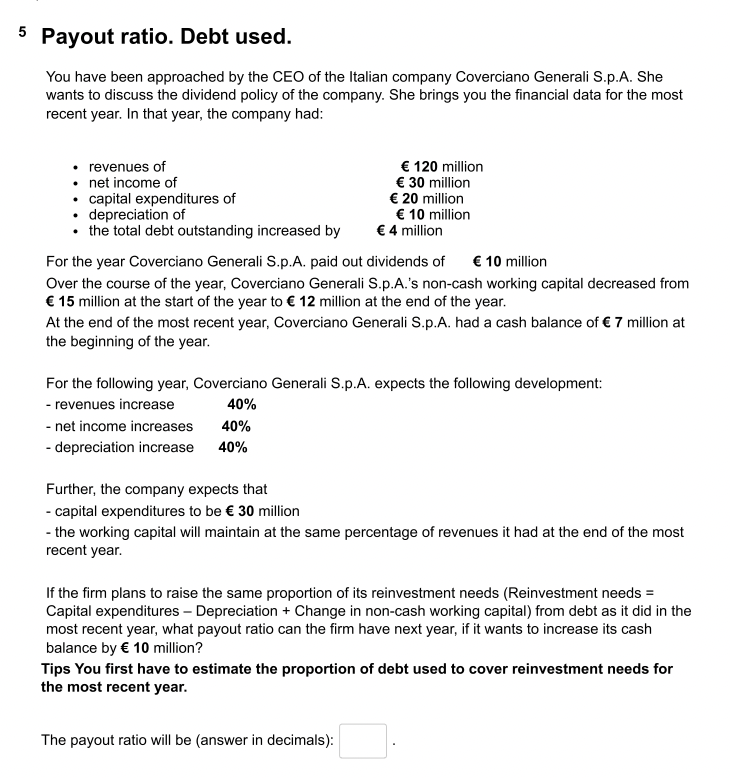

Payout ratio. Debt used. You have been approached by the CEO of the Italian company Coverciano Generali S.p.A. She wants to discuss the dividend policy of the company. She brings you the financial data for the most recent year. In that year, the company had: For the year Coverciano Generali S.p.A. paid out dividends of 10 million Over the course of the year, Coverciano Generali S.p.A.'s non-cash working capital decreased from 15 million at the start of the year to 12 million at the end of the year. At the end of the most recent year, Coverciano Generali S.p.A. had a cash balance of 7 million at the beginning of the year. For the following year, Coverciano Generali S.p.A. expects the following development: Further, the company expects that - capital expenditures to be 30 million - the working capital will maintain at the same percentage of revenues it had at the end of the most recent year. If the firm plans to raise the same proportion of its reinvestment needs (Reinvestment needs = Capital expenditures - Depreciation + Change in non-cash working capital) from debt as it did in the most recent year, what payout ratio can the firm have next year, if it wants to increase its cash balance by 10 million? Tips You first have to estimate the proportion of debt used to cover reinvestment needs for the most recent year. The payout ratio will be (answer in decimals)

Payout ratio. Debt used. You have been approached by the CEO of the Italian company Coverciano Generali S.p.A. She wants to discuss the dividend policy of the company. She brings you the financial data for the most recent year. In that year, the company had: For the year Coverciano Generali S.p.A. paid out dividends of 10 million Over the course of the year, Coverciano Generali S.p.A.'s non-cash working capital decreased from 15 million at the start of the year to 12 million at the end of the year. At the end of the most recent year, Coverciano Generali S.p.A. had a cash balance of 7 million at the beginning of the year. For the following year, Coverciano Generali S.p.A. expects the following development: Further, the company expects that - capital expenditures to be 30 million - the working capital will maintain at the same percentage of revenues it had at the end of the most recent year. If the firm plans to raise the same proportion of its reinvestment needs (Reinvestment needs = Capital expenditures - Depreciation + Change in non-cash working capital) from debt as it did in the most recent year, what payout ratio can the firm have next year, if it wants to increase its cash balance by 10 million? Tips You first have to estimate the proportion of debt used to cover reinvestment needs for the most recent year. The payout ratio will be (answer in decimals) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started