Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Payroll 24. An employee works in Alberta and earns $37,500 per year. They also enjoy a cash allowance of $250 per month and non-cash taxable

Payroll

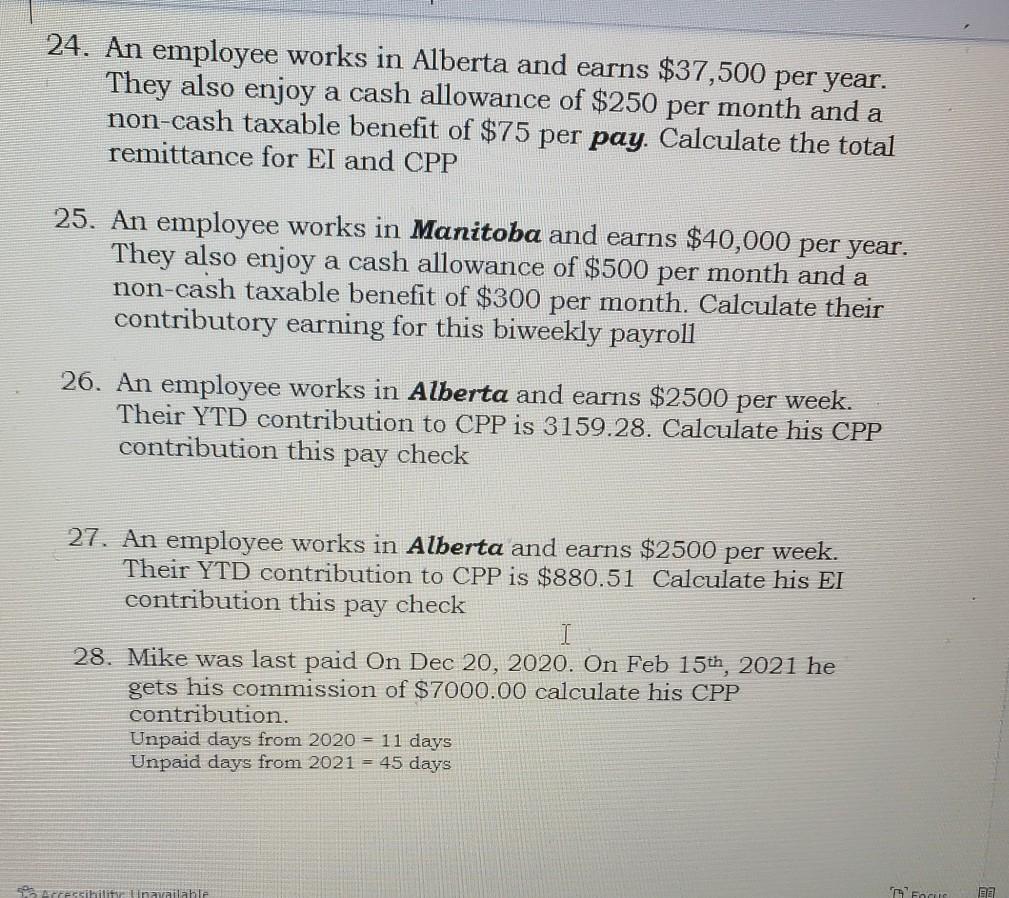

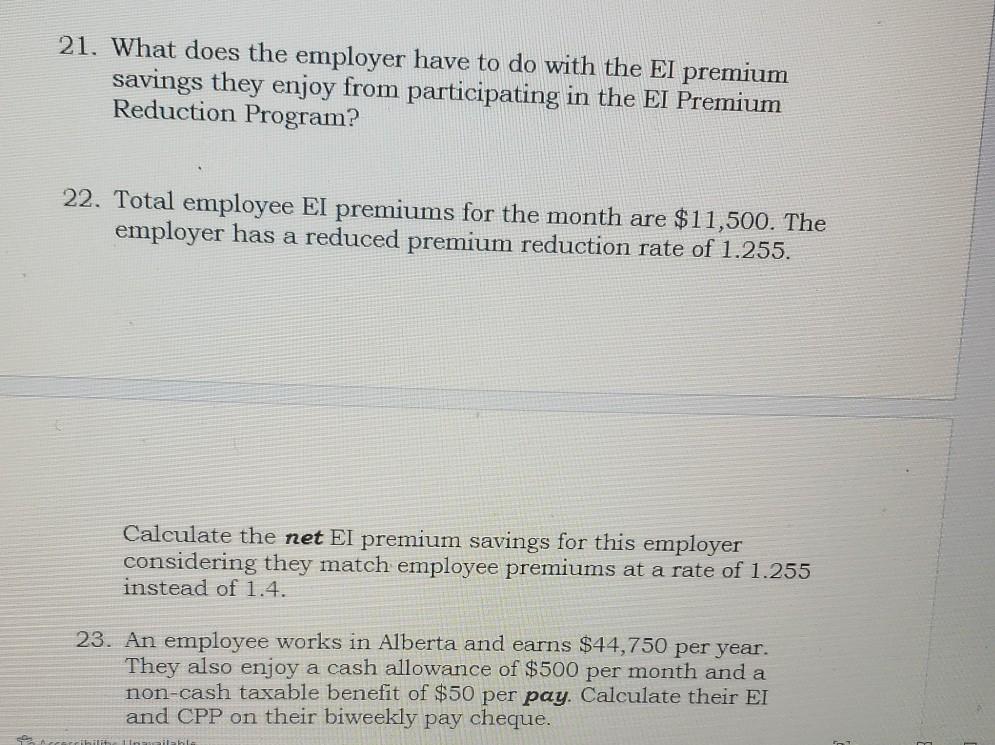

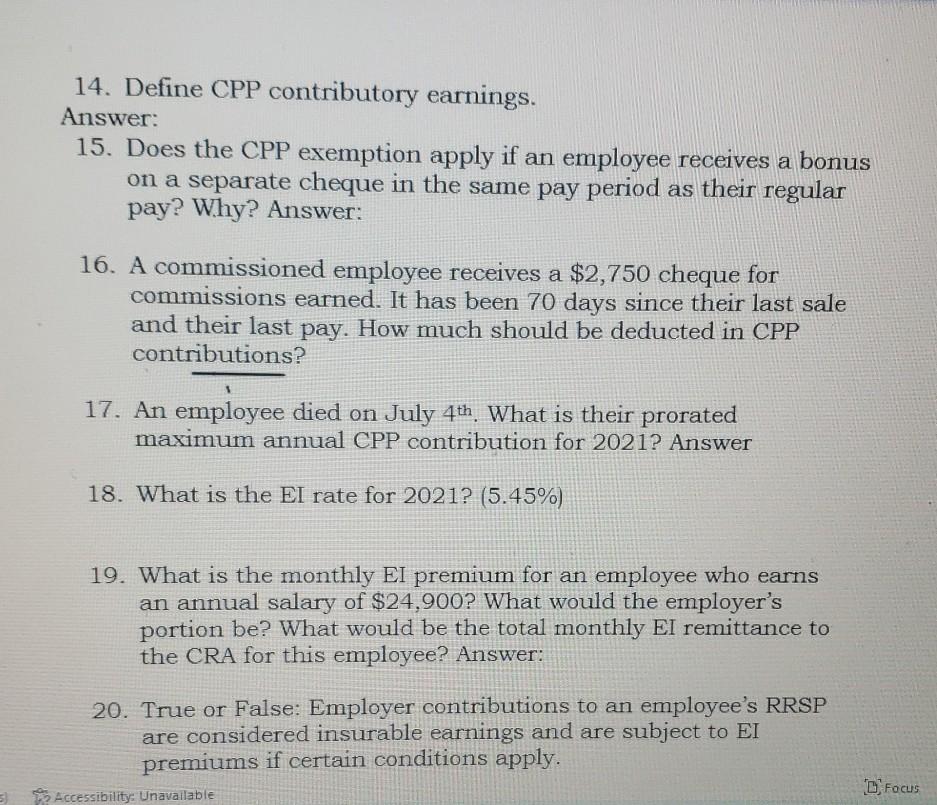

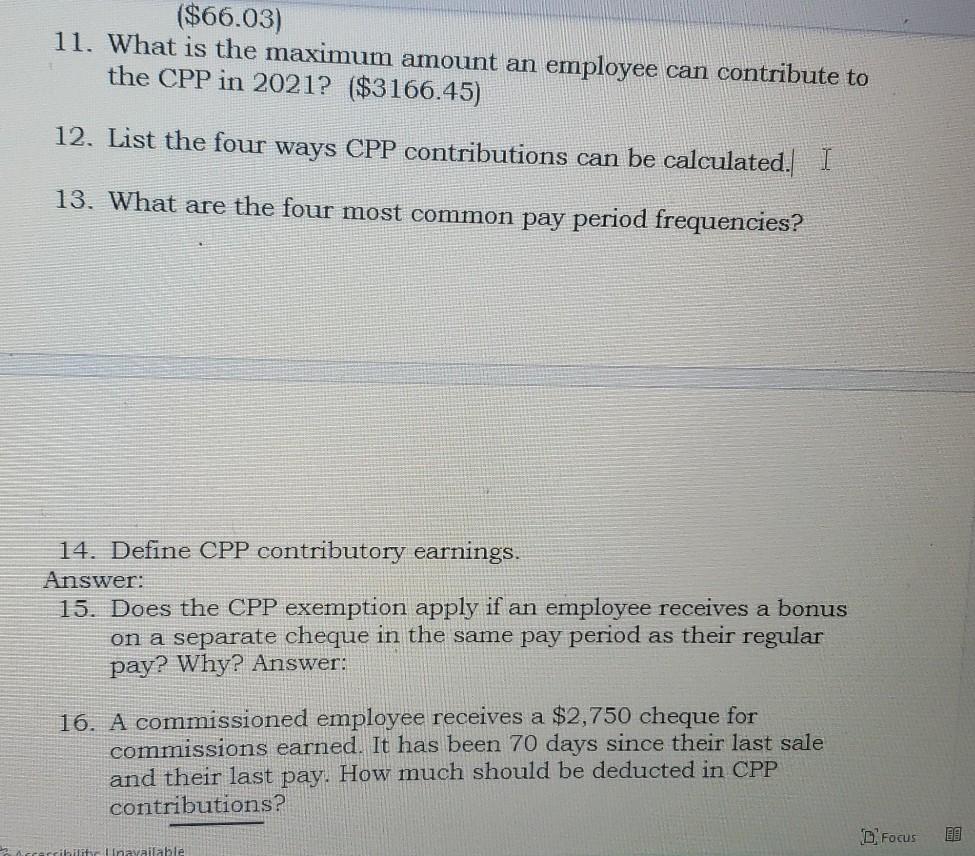

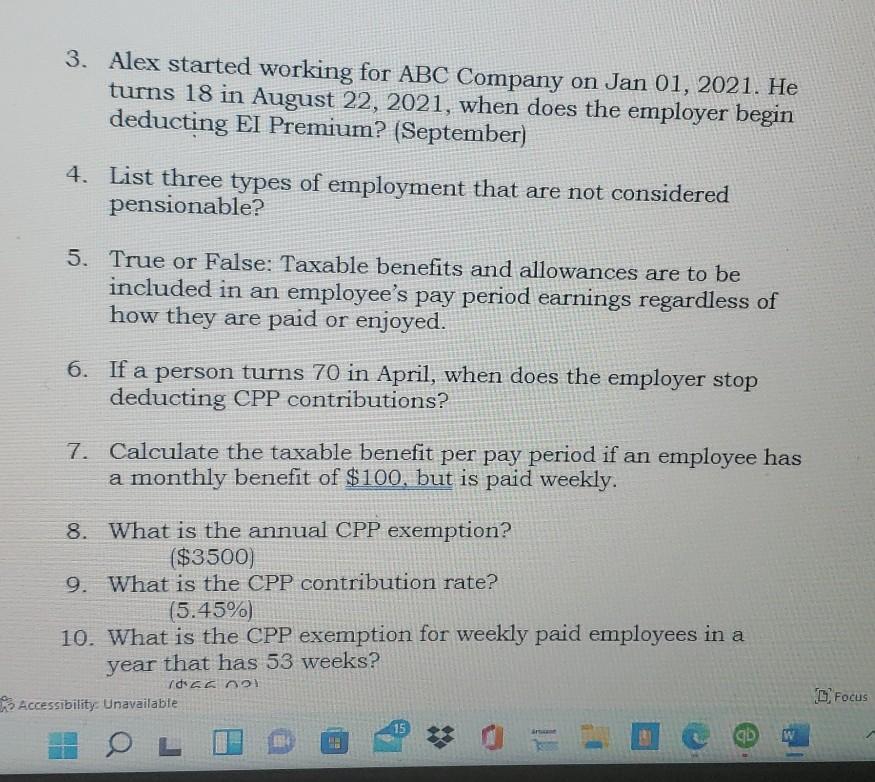

24. An employee works in Alberta and earns $37,500 per year. They also enjoy a cash allowance of $250 per month and non-cash taxable benefit of $75 per pay. Calculate the total remittance for El and CPP 25. An employee works in Manitoba and earns $40,000 per year. They also enjoy a cash allowance of $500 per month and a non-cash taxable benefit of $300 per month. Calculate their contributory earning for this biweekly payroll 26. An employee works in Alberta and earns $2500 per week. Their YTD contribution to CPP is 3159.28. Calculate his CPP contribution this pay check 27. An employee works in Alberta and earns $2500 per week. Their YTD contribution to CPP is $880.51 Calculate his EI contribution this pay check 28. Mike was last paid On Dec 20, 2020. On Feb 15th, 2021 he gets his commission of $7000.00 calculate his CPP contribution. Unpaid days from 2020 = 11 days Unpaid days from 2021 = 45 days Pressibility Unavailable Focus 32 21. What does the employer have to do with the EI premium savings they enjoy from participating in the EI Premium Reduction Program? 22. Total employee EI premiums for the month are $11,500. The employer has a reduced premium reduction rate of 1.255. Calculate the net El premium savings for this employer considering they match employee premiums at a rate of 1.255 instead of 1.4. 23. An employee works in Alberta and earns $44,750 per year. They also enjoy a cash allowance of $500 per month and a non-cash taxable benefit of $50 per pay. Calculate their EI and CPP on their biweekly pay cheque. Silate 14. Define CPP contributory earnings. Answer: 15. Does the CPP exemption apply if an employee receives a bonus on a separate cheque in the same pay period as their regular pay? Why? Answer: 16. A commissioned employee receives a $2,750 cheque for commissions earned. It has been 70 days since their last sale and their last pay. How much should be deducted in CPP contributions? 17. An employee died on July 4th. What is their prorated maximum annual CPP contribution for 2021? Answer 18. What is the EI rate for 2021? (5.45%) 19. What is the monthly El premium for an employee who earns an annual salary of $24,900? What would the employer's portion be? What would be the total monthly El remittance to the CRA for this employee? Answer: 20. True or False: Employer contributions to an employee's RRSP are considered insurable earnings and are subject to EI premiums if certain conditions apply. Accessibility: Unavailable Focus ($66.03) 11. What is the maximum amount an employee can contribute to the CPP in 2021? ($3166.45) 12. List the four ways CPP contributions can be calculated. I 13. What are the four most common pay period frequencies? 14. Define CPP contributory earnings. Answer: 15. Does the CPP exemption apply if an employee receives a bonus on a separate cheque in the same pay period as their regular pay? Why? Answer: 16. A commissioned employee receives a $2,750 cheque for commissions earned. It has been 70 days since their last sale and their last pay. How much should be deducted in CPP contributions? D Focus Unavailable 3. Alex started working for ABC Company on Jan 01, 2021. He turns 18 in August 22, 2021, when does the employer begin deducting El Premium? (September) 4. List three types of employment that are not considered pensionable? 5. True or False: Taxable benefits and allowances are to be included in an employee's pay period earnings regardless of how they are paid or enjoyed. 6. If a person turns 70 in April, when does the employer stop deducting CPP contributions? 7. Calculate the taxable benefit per pay period if an employee has a monthly benefit of $100, but is paid weekly. 8. What is the annual CPP exemption? ($3500) 9. What is the CPP contribution rate? (5.45%) 10. What is the CPP exemption for weekly paid employees in a year that has 53 weeks? rdica not Accessibility Unavailable OL Focus 15

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started