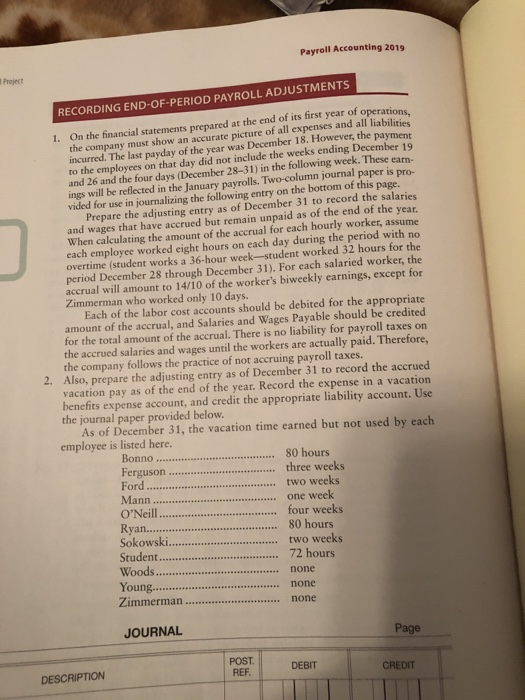

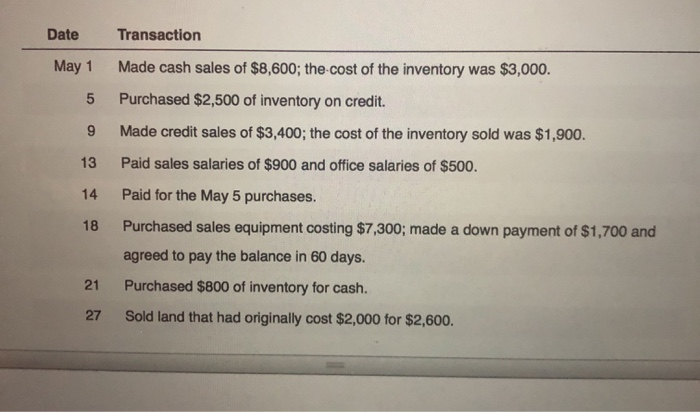

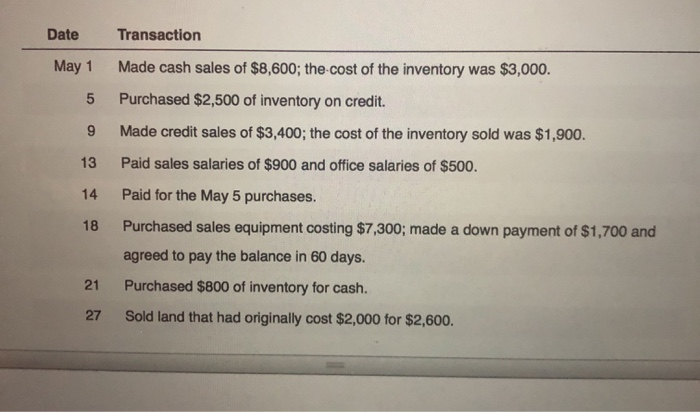

Payroll Accounting 2019 Project RECORDING END OF PERIOD PAYROLL ADJUSTMENTS 1. On the financial statements prepared at the end of its first year of operations the company must show an accurate picture of all expenses and all liabilities incurred. The last payday of the year was December 18. However, the payment to the employees on that day did not include the weeks ending December 19 and 26 and the four days (December 28-31) in the following week. These eam- ings will be reflected in the January payrolls. Two-column journal paper is pro- vided for use in journalizing the following entry on the bottom of this page. Prepare the adjusting entry as of December 31 to record the salaries and wages that have accrued but remain unpaid as of the end of the year. When calculating the amount of the accrual for each hourly worker, assume each employee worked eight hours on each day during the period with no overtime student works a 36 hour week-student worked 32 hours for the period December 28 through December 31). For each salaried worker, the accrual will amount to 14/10 of the worker's biweekly earnings, except for Zimmerman who worked only 10 days. Each of the labor cost accounts should be debited for the appropriate amount of the accrual, and Salaries and Wages Payable should be credited for the total amount of the accrual. There is no liability for payroll taxes on the accrued salaries and wages until the workers are actually paid. Therefore, the company follows the practice of not accruing payroll taxes. Also, prepare the adjusting entry as of December 31 to record the accrued vacation pay as of the end of the year. Record the expense in a vacation benefits expense account, and credit the appropriate liability account. Use the journal paper provided below. As of December 31, the vacation time earned but not used by each employee is listed here. 80 hours three weeks two weeks one week four weeks 80 hours two weeks 72 hours none none none Bonno ... Ferguson ........ Ford ................ Mann ....... O'Neill...... Ryan....... Sokowski...... Student...... Woods ......... Young.............. Zimmerman... JOURNAL Page POST REF. DEBIT CREDIT DESCRIPTION Date May 1 5 9 13 14 Transaction Made cash sales of $8,600; the cost of the inventory was $3,000. Purchased $2,500 of inventory on credit Made credit sales of $3,400; the cost of the inventory sold was $1,900. Paid sales salaries of $900 and office salaries of $500. Paid for the May 5 purchases. Purchased sales equipment costing $7,300; made a down payment of $1,700 and agreed to pay the balance in 60 days. Purchased $800 of inventory for cash. Sold land that had originally cost $2,000 for $2,600. 18 21 27 Payroll Accounting 2019 Project RECORDING END OF PERIOD PAYROLL ADJUSTMENTS 1. On the financial statements prepared at the end of its first year of operations the company must show an accurate picture of all expenses and all liabilities incurred. The last payday of the year was December 18. However, the payment to the employees on that day did not include the weeks ending December 19 and 26 and the four days (December 28-31) in the following week. These eam- ings will be reflected in the January payrolls. Two-column journal paper is pro- vided for use in journalizing the following entry on the bottom of this page. Prepare the adjusting entry as of December 31 to record the salaries and wages that have accrued but remain unpaid as of the end of the year. When calculating the amount of the accrual for each hourly worker, assume each employee worked eight hours on each day during the period with no overtime student works a 36 hour week-student worked 32 hours for the period December 28 through December 31). For each salaried worker, the accrual will amount to 14/10 of the worker's biweekly earnings, except for Zimmerman who worked only 10 days. Each of the labor cost accounts should be debited for the appropriate amount of the accrual, and Salaries and Wages Payable should be credited for the total amount of the accrual. There is no liability for payroll taxes on the accrued salaries and wages until the workers are actually paid. Therefore, the company follows the practice of not accruing payroll taxes. Also, prepare the adjusting entry as of December 31 to record the accrued vacation pay as of the end of the year. Record the expense in a vacation benefits expense account, and credit the appropriate liability account. Use the journal paper provided below. As of December 31, the vacation time earned but not used by each employee is listed here. 80 hours three weeks two weeks one week four weeks 80 hours two weeks 72 hours none none none Bonno ... Ferguson ........ Ford ................ Mann ....... O'Neill...... Ryan....... Sokowski...... Student...... Woods ......... Young.............. Zimmerman... JOURNAL Page POST REF. DEBIT CREDIT DESCRIPTION Date May 1 5 9 13 14 Transaction Made cash sales of $8,600; the cost of the inventory was $3,000. Purchased $2,500 of inventory on credit Made credit sales of $3,400; the cost of the inventory sold was $1,900. Paid sales salaries of $900 and office salaries of $500. Paid for the May 5 purchases. Purchased sales equipment costing $7,300; made a down payment of $1,700 and agreed to pay the balance in 60 days. Purchased $800 of inventory for cash. Sold land that had originally cost $2,000 for $2,600. 18 21 27