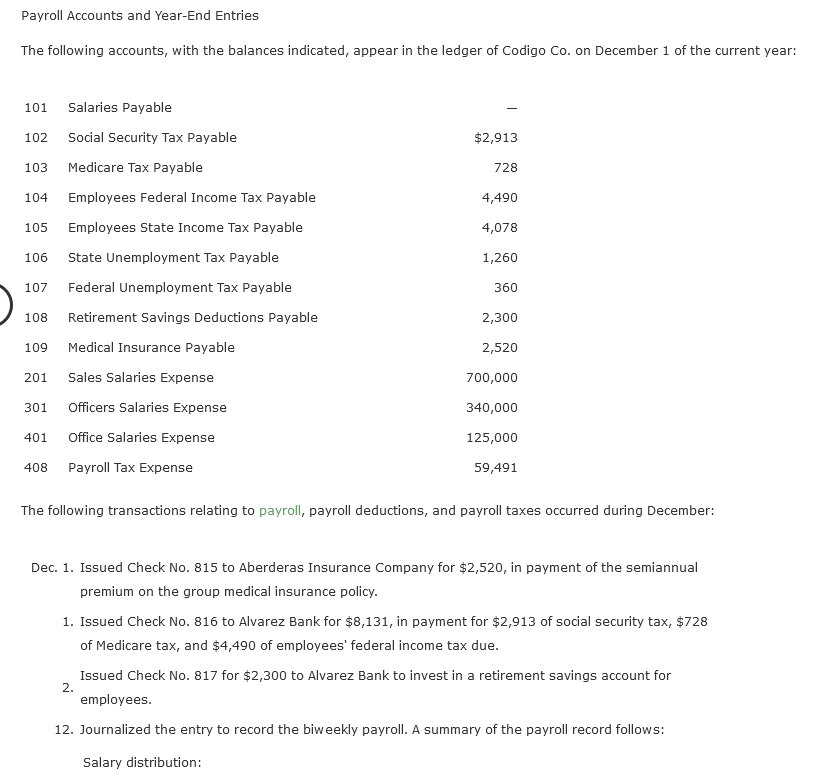

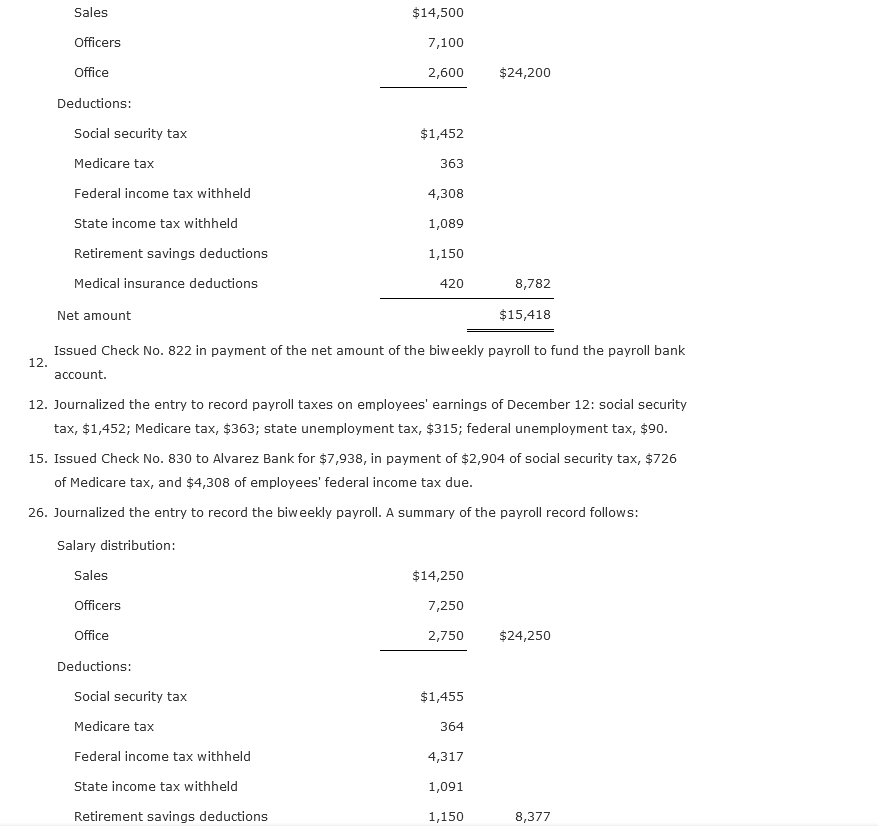

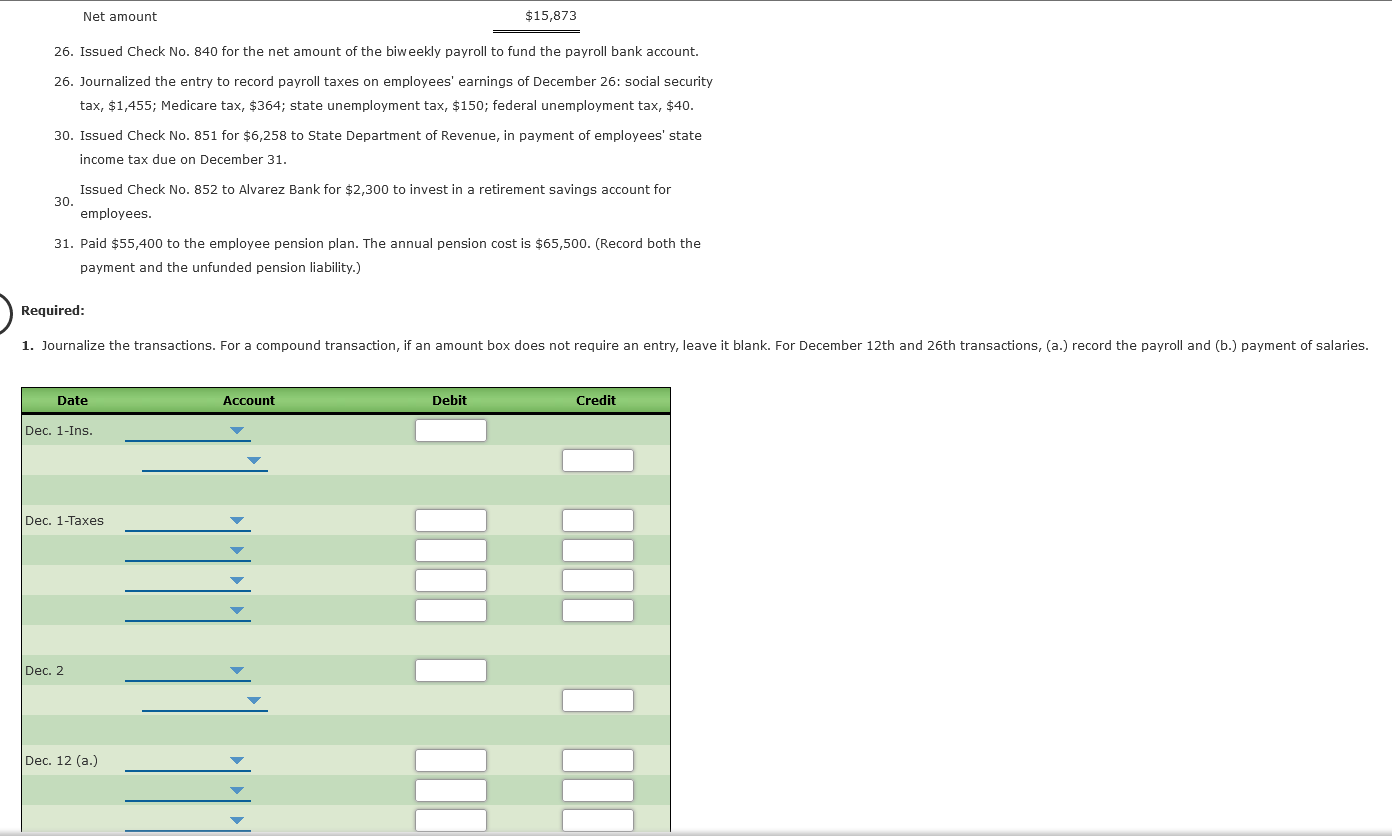

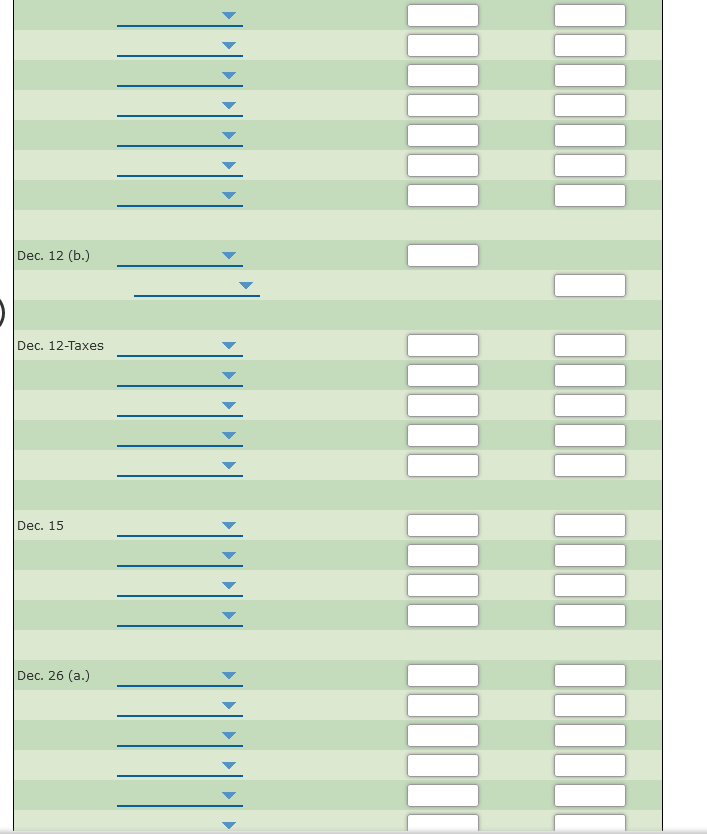

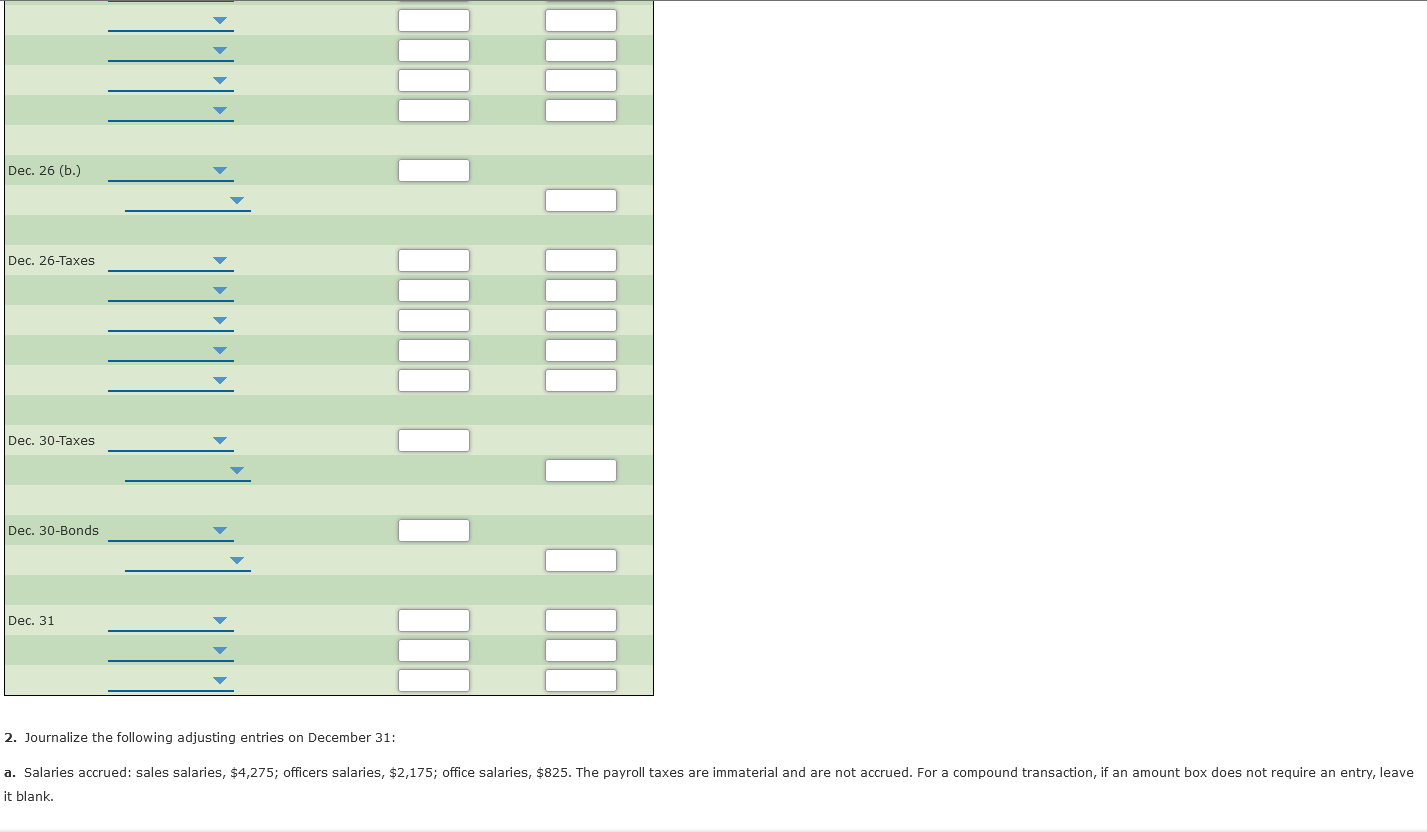

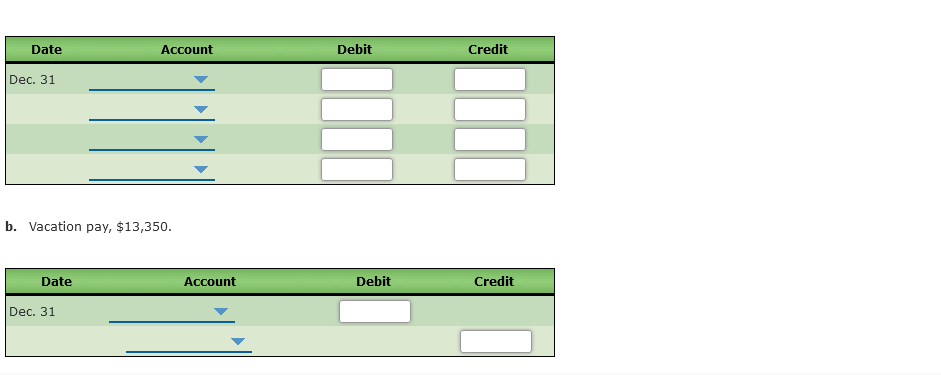

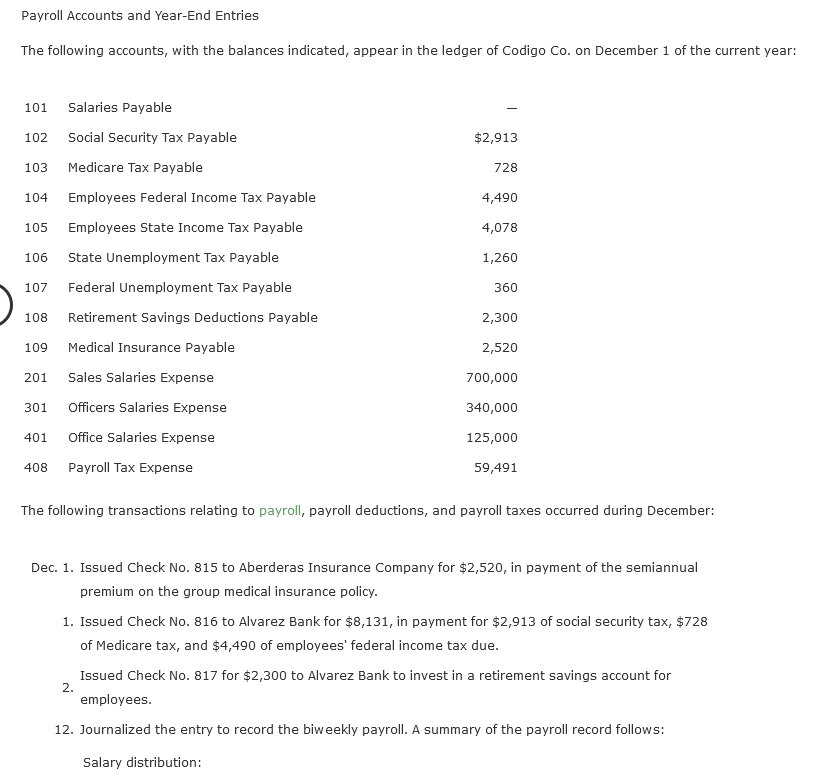

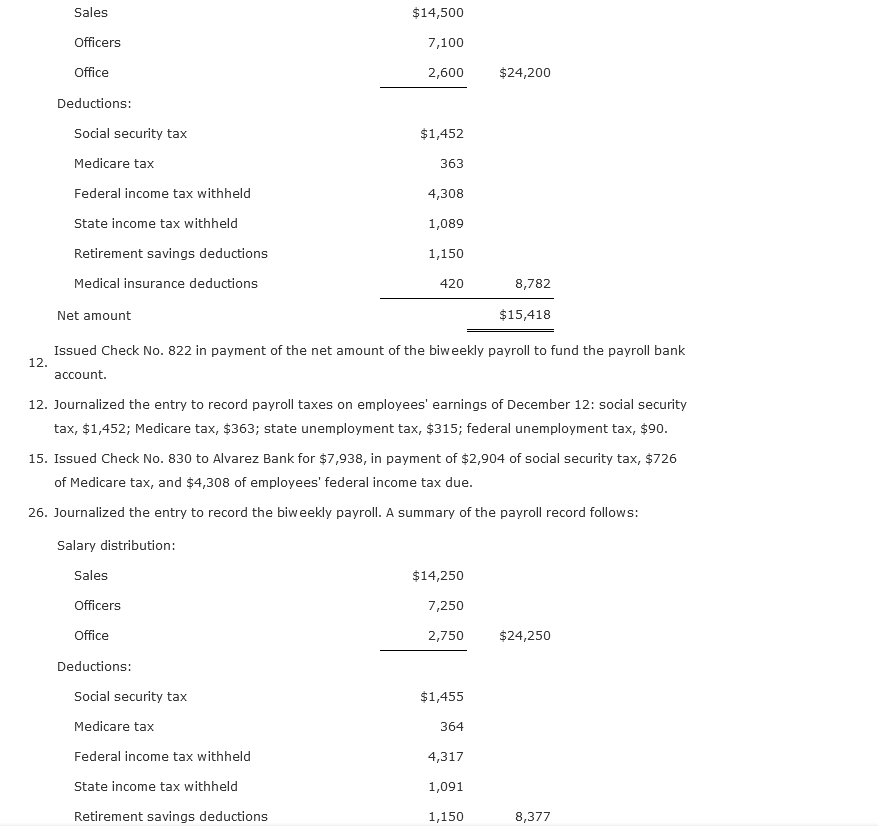

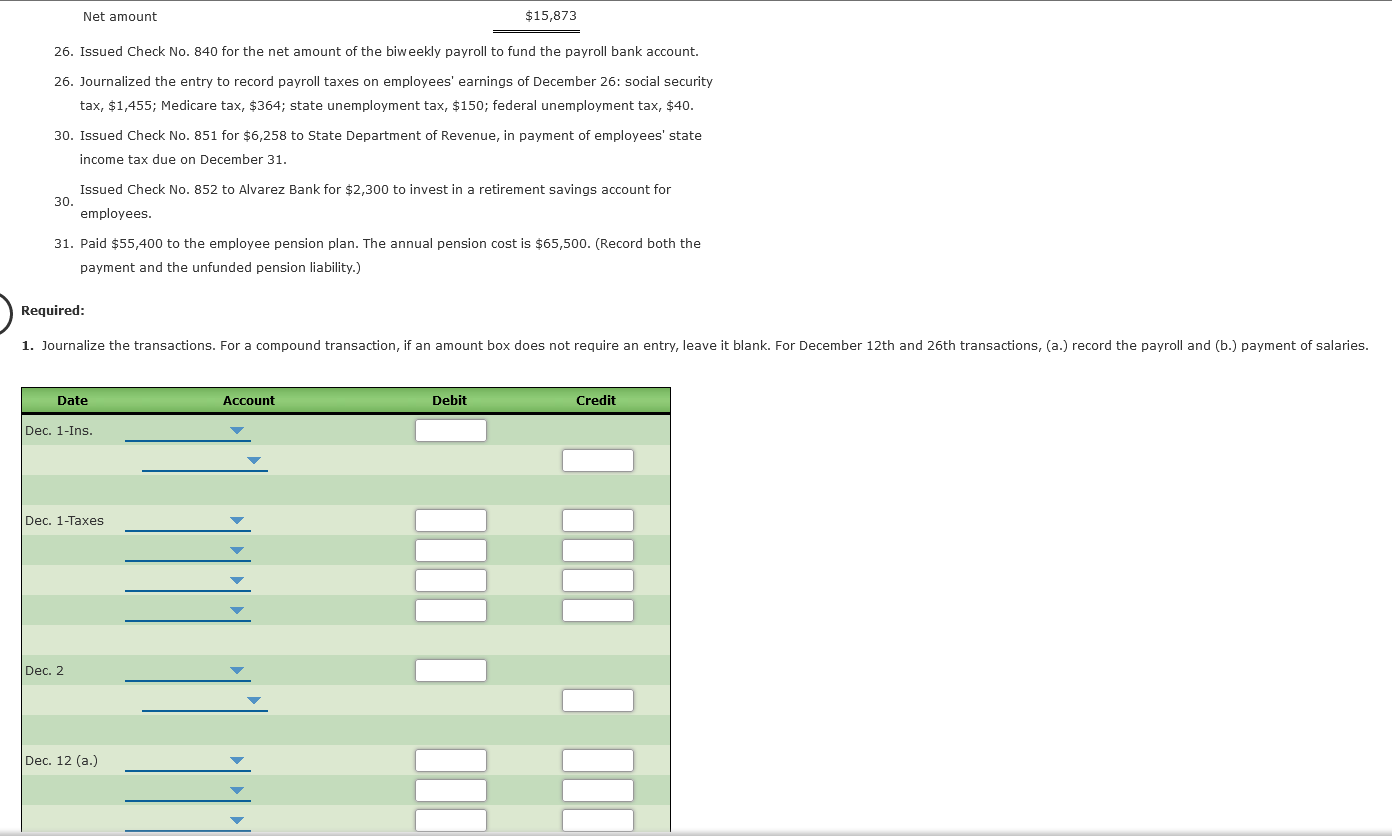

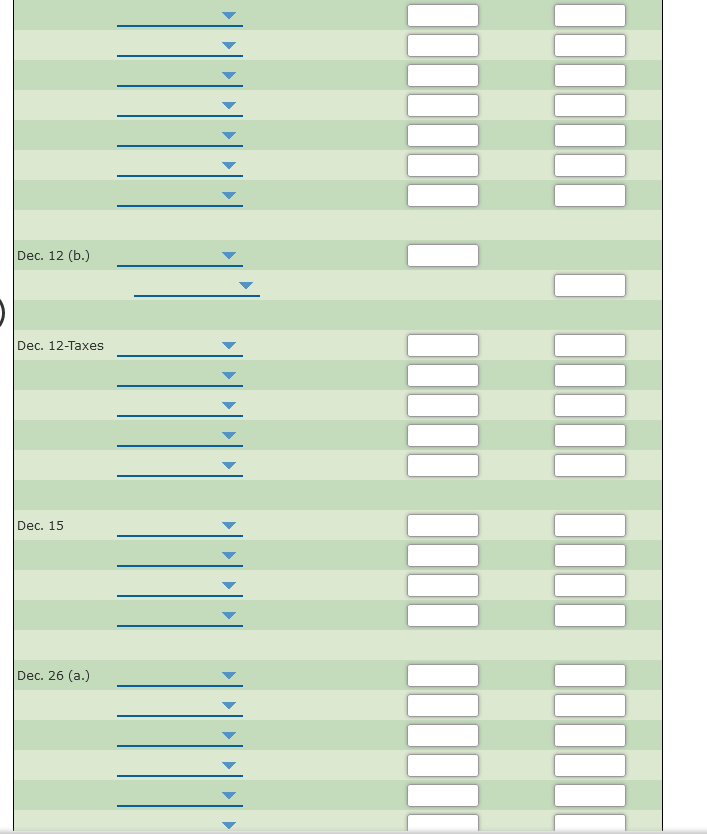

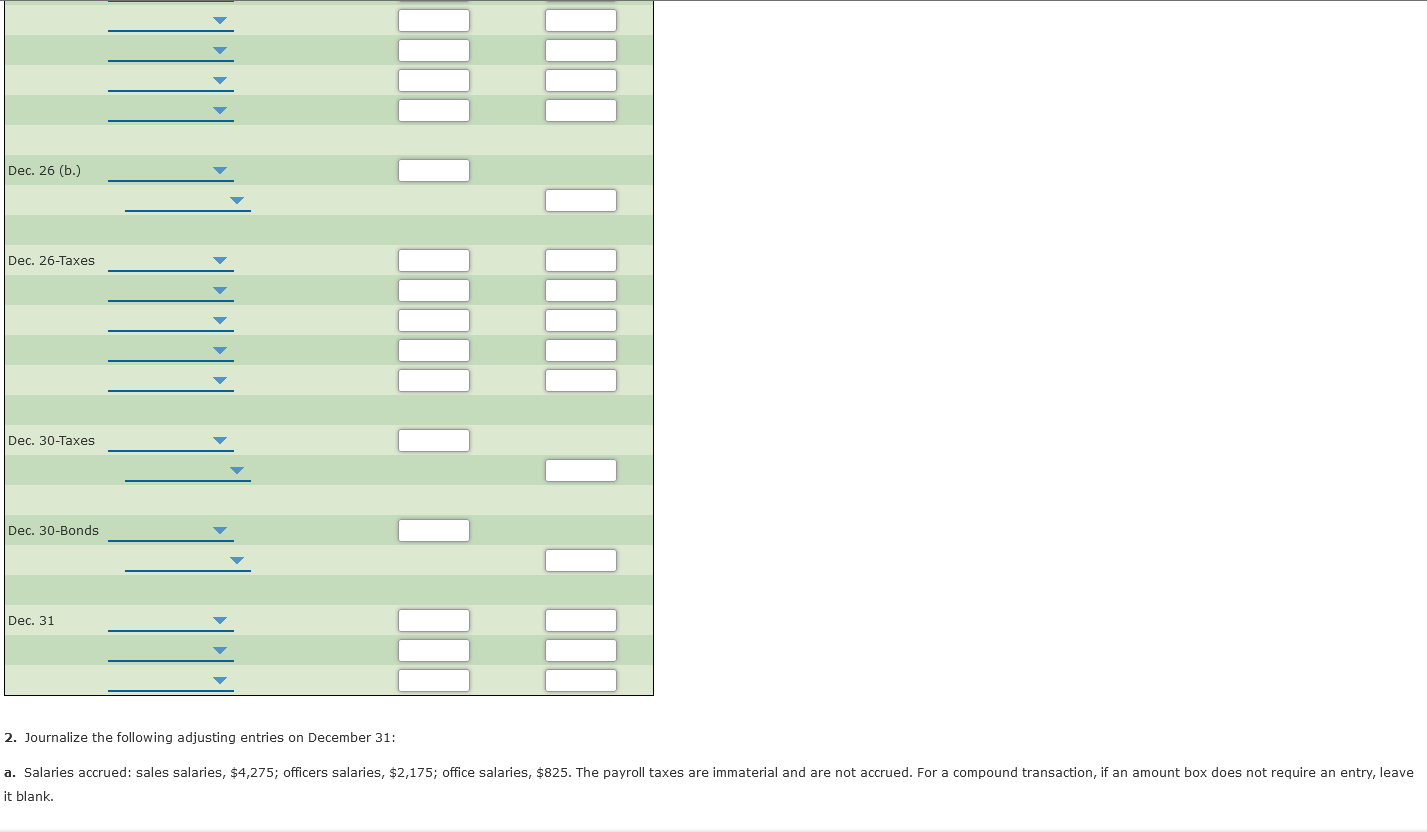

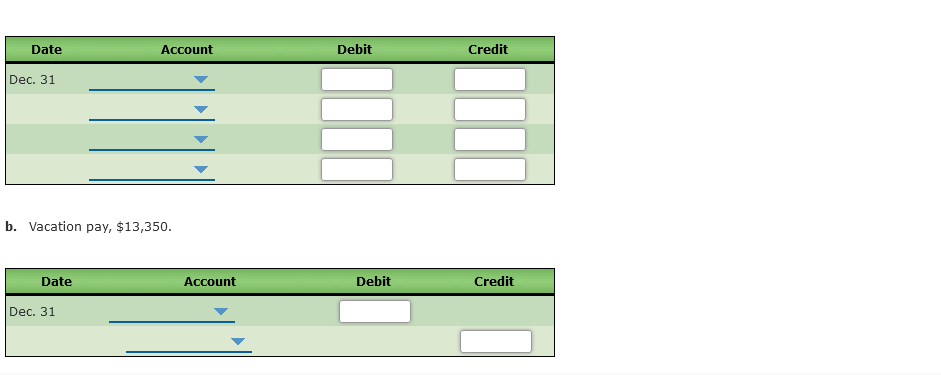

Payroll Accounts and Year-End Entries The following accounts, with the balances indicated, appear in the ledger of Codigo Co. on December 1 of the current year: 101 102 Salaries Payable Social Security Tax Payable Medicare Tax Payable $2,913 103 728 104 Employees Federal Income Tax Payable 4,490 105 4,078 106 1,260 Employees State Income Tax Payable State Unemployment Tax Payable Federal Unemployment Tax Payable Retirement Savings Deductions Payable 107 360 108 2,300 109 Medical Insurance Payable 2,520 201 700,000 Sales Salaries Expense Officers Salaries Expense 301 340,000 401 Office Salaries Expense 125,000 408 Payroll Tax Expense 59,491 The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December: Dec. 1. Issued Check No. 815 to Aberderas Insurance Company for $2,520, in payment of the semiannual premium on the group medical insurance policy. 1. Issued Check No. 816 to Alvarez Bank for $8,131, in payment for $2,913 of social security tax, $728 of Medicare tax, and $4,490 of employees' federal income tax due. Issued Check No. 817 for $2,300 to Alvarez Bank to invest in a retirement savings account for employees. 12. Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: 2. Salary distribution: Sales $14,500 Officers 7,100 Office 2,600 $24,200 $1,452 Deductions: Social security tax Medicare tax Federal income tax withheld 363 4,308 1,089 State income tax withheld Retirement savings deductions Medical insurance deductions 1,150 420 8,782 Net amount $15,418 12. Issued Check No. 822 in payment of the net amount of the biweekly payroll to fund the payroll bank account. 12. Journalized the entry to record payroll taxes on employees' earnings of December 12: social security tax, $1,452; Medicare tax, $363; state unemployment tax, $315; federal unemployment tax, $90. 15. Issued Check No. 830 to Alvarez Bank for $7,938, in payment of $2,904 of social security tax, $726 of Medicare tax, and $4,308 of employees' federal income tax due. 26. Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: Salary distribution: Sales $14,250 Officers 7,250 Office 2,750 $24,250 Deductions: Social security tax $1,455 364 Medicare tax Federal income tax withheld State income tax withheld 4,317 1,091 Retirement savings deductions 1,150 8,377 Net amount $15,873 26. Issued Check No. 840 for the net amount of the biweekly payroll to fund the payroll bank account. 26. Journalized the entry to record payroll taxes on employees' earnings of December 26: social security tax, $1,455; Medicare tax, $364; state unemployment tax, $150; federal unemployment tax, $40. 30. Issued Check No. 851 for $6,258 to State Department of Revenue, in payment of employees' state income tax due on December 31. Issued Check No. 852 to Alvarez Bank for $2,300 to invest in a retirement savings account for 30. employees. 31. Paid $55,400 to the employee pension plan. The annual pension cost is $65,500. (Record both the payment and the unfunded pension liability.) Required: 1. Journalize the transactions. For a compound transaction, if an amount box does not require an entry, leave it blank. For December 12th and 26th transactions, (a.) record the payroll and (b.) payment of salaries. Date Account Debit Credit Dec. 1-Ins. Dec. 1-Taxes Dec. 2 III III Dec. 12 (a.) Dec. 12 (b.) Dec. 12-Taxes Dec. 15 10 Dec. 26 (a.) > Dec. 26 (b.) Dec. 26-Taxes HIILI Dec. 30-Taxes Dec. 30-Bonds Dec. 31 2. Journalize the following adjusting entries on December 31: a. Salaries accrued: sales salaries, $4,275; officers salaries, $2,175; office salaries, $825. The payroll taxes are immaterial and are not accrued. For a compound transaction, if an amount box does not require an entry, leave it blank. Date Account Debit Credit Dec. 31 b. Vacation pay, $13,350. Date Account Debit Credit Dec. 31