Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Payroll Chapter 5 QUESTIONS FOR DISCUSSION Can employers make voluntary contributions to Can the owner of a small business receive unem ployment compensation? Explain What

Payroll Chapter 5

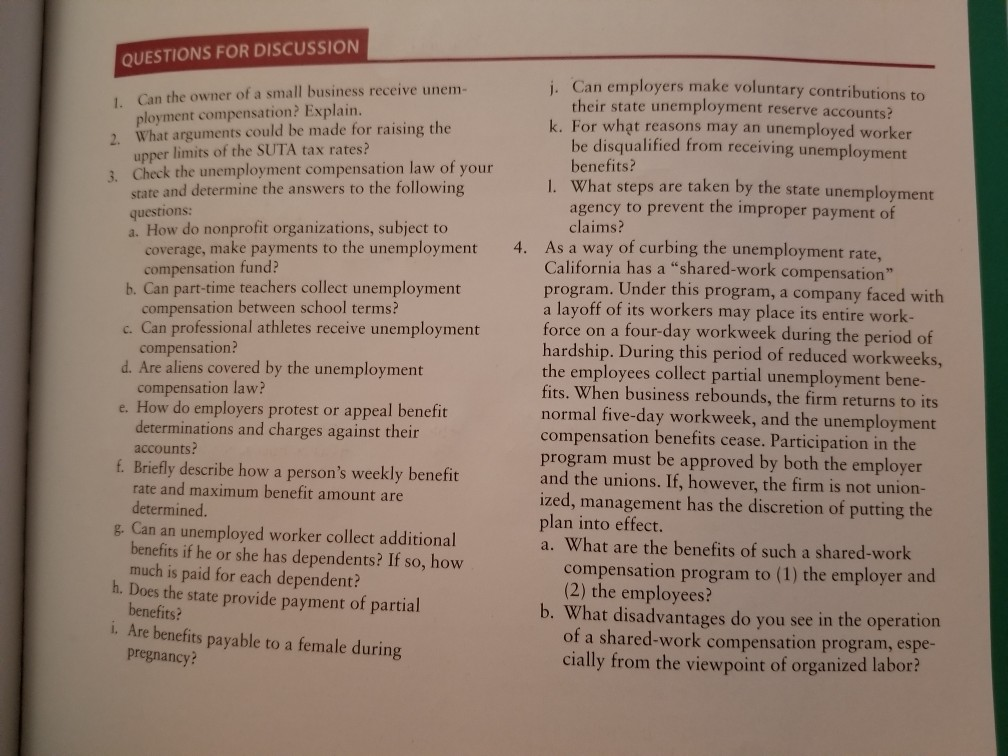

QUESTIONS FOR DISCUSSION Can employers make voluntary contributions to Can the owner of a small business receive unem ployment compensation? Explain What arguments could be made for raising the upper limits of the SUTA tax rates? Check the unemployment compensation law of your state and determine the answers to the following questions: a. How do nonprofit organizations, subject to their state unemployment reserve accounts? k. For what reasons may an unemployed worker 1. 2. be disqualified from receiving unemployment benefits? 1. What steps are taken by the state unemployment agency to prevent the improper payment of claims? As a way of curbing the unemployment rate, California has a "shared-work compensation" program. Under this program, a company faced with a layoff of its workers may place its entire work- force on a four-day workweek during the period of hardship. During this period of reduced workweeks, the employees collect partial unemployment bene- fits. When business rebounds, the firm returns to its normal five-day workweek, and the unemployment compensation benefits cease. Participation in the program must be approved by both the employer and the unions. If, however, the firm is not union- ized, management has the discretion of putting the plan into effect. a. What are the benefits of such a shared-work verage, make payments to the unemployment 4. compensation fund? Can part-time teachers collect unemployment compensation between school terms? c. Can professional athletes receive unemployment compensation? Are aliens covered by the unemployment compensation law? e. How do employers protest or appeal benefit f. Briefly describe how a person's weekly benefit B. Can an unemployed worker collect additional h. Does the state provide payment of partial determinations and charges against their accounts: rate and maximum benefit amount are benefits if he or she has dependents? If so, how much is paid for each dependent? compensation program to (1) the employer and (2) the employees? b. What disadvantages do you see in the operation i. Are benefits payable to a female during of a shared-work compensation program, espe cially from the viewpoint of organized labor? pregnancyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started