Answered step by step

Verified Expert Solution

Question

1 Approved Answer

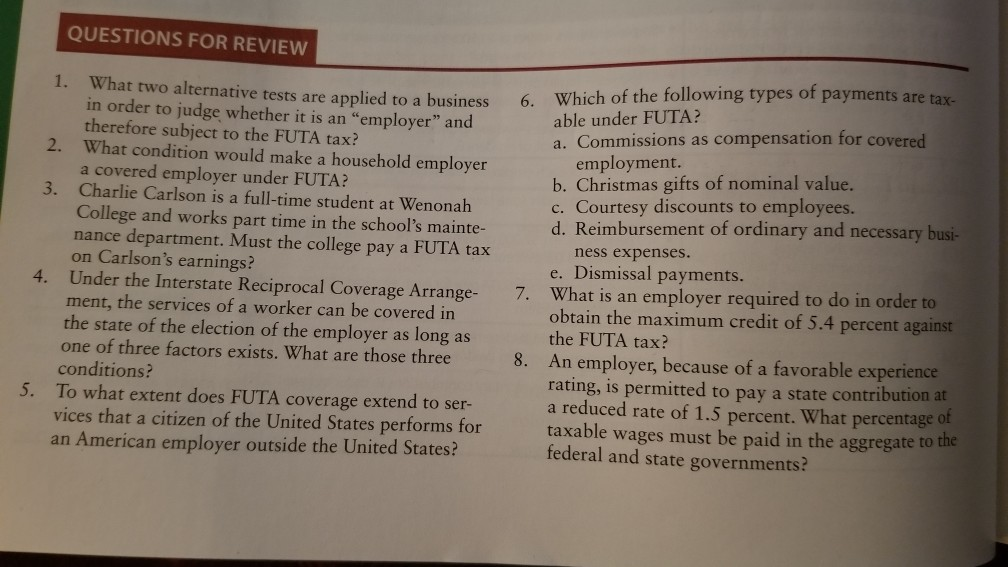

Payroll Chapter 5 QUESTIONS FOR REVIEW 1. What t ewo alternative tests are applied to a business 6. Which of the following types of payments

Payroll Chapter 5

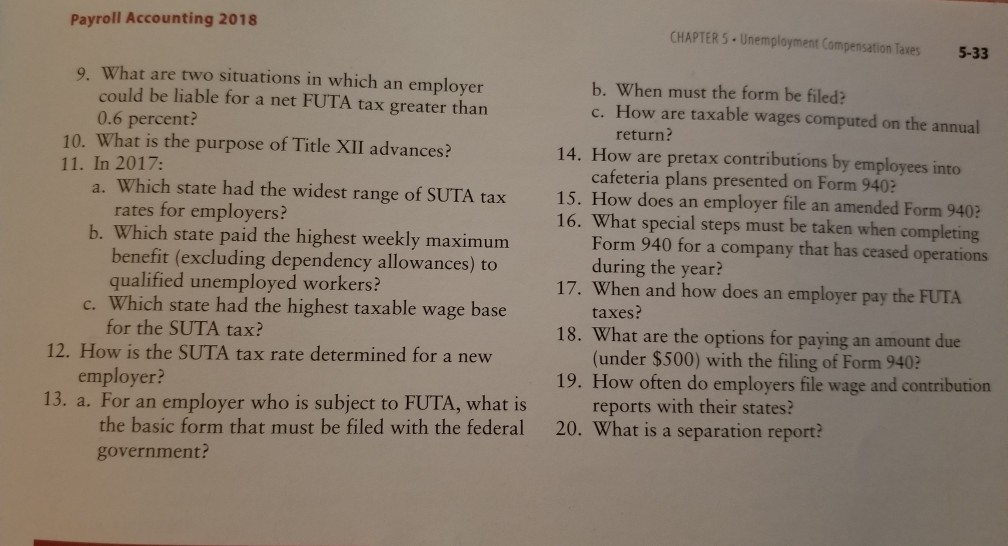

QUESTIONS FOR REVIEW 1. What t ewo alternative tests are applied to a business 6. Which of the following types of payments are tax- able under FUTA? a. Commissions as compensation for covered in order to judge whether it is an "employer" and therefore subject to the FUTA tax? 2. What condition would make a household employer employment. b. Christmas gifts of nominal value. a covered employer under FUTA? Charlie Carlson is a full-time student at Wenonah College and works part time in the school's mainte- nance department. Must the college pay a FUTA tax on Carlson's earnings? Under the Interstate Reciprocal Coverage Arrange- ment, the services of a worker can be covered in the state of the election of the employer as long as one of three factors exists. What are those three conditions? Courtesy discounts to employees. d. Reimbursement of ordinary and necessary busi- 3. ness expenses. e. Dismissal payments What is an employer required to do in order to obtain the maximum credit of 5.4 percent against the FUTA tax? An employer, because of a favorable experience rating, is permitted to pay a state contribution at a reduced rate of 1.5 percent. What percentage of taxable wages must be paid in the aggregate to the federal and state governments? 4. 7. 8. 5. To what extent does FUTA coverage extend to ser vices that a citizen of the United States performs for an American employer outside the United States? Payroll Accounting 2018 CHAPTER5 Unemployment Compensation Taxes5-33 9. What are two situations in which an employer could be liable for a net FUTA tax greater than 0.6 percent? b. When must the form be filed? c. How are taxable wages computed on the annual return? cafeteria plans presented on Form 940 Form 940 for a company that has ceased operations 10. What is the purpose of Title XII advances? 11. In 2017: 14. How are pretax contributions by employees into a. Which state had the widest range of SUTA tax 15. How does an employer file an amended Form 940? 16. What special steps must be taken when completing 17. When and how does an employer pay the FUTA 18. What are the options for paying an amount due 19. How often do employers file wage and contribution 20. What is a separation report? rates for employers? b. Which state paid the highest weekly maximum benefit (excluding dependency allowances) to qualified unemployed workers? during the year? taxes? (under $500) with the filing of Form 940 reports with their states? c. Which state had the highest taxable wage base for the SUTA tax? 12. How is the SUTA tax rate determined for a new employer? 13. a. For an employer who is subject to FUTA, what is the basic form that must be filed with the federal governmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started