Answered step by step

Verified Expert Solution

Question

1 Approved Answer

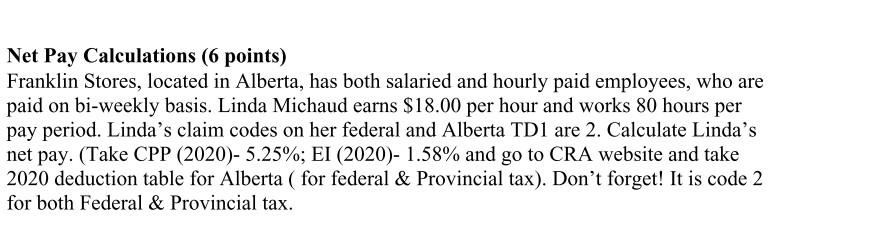

payroll compliance: topic I need detailed explanation of calculations plz help me Net Pay Calculations (6 points) Franklin Stores, located in Alberta, has both salaried

payroll compliance: topic

I need detailed explanation of calculations plz help me

Net Pay Calculations (6 points) Franklin Stores, located in Alberta, has both salaried and hourly paid employees, who are paid on bi-weekly basis. Linda Michaud earns $18.00 per hour and works 80 hours per pay period. Linda's claim codes on her federal and Alberta TD1 are 2. Calculate Linda's net pay. (Take CPP (2020)- 5.25%; EI (2020)- 1.58% and go to CRA website and take 2020 deduction table for Alberta ( for federal & Provincial tax). Don't forget! It is code 2 for both Federal & Provincial taxStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started