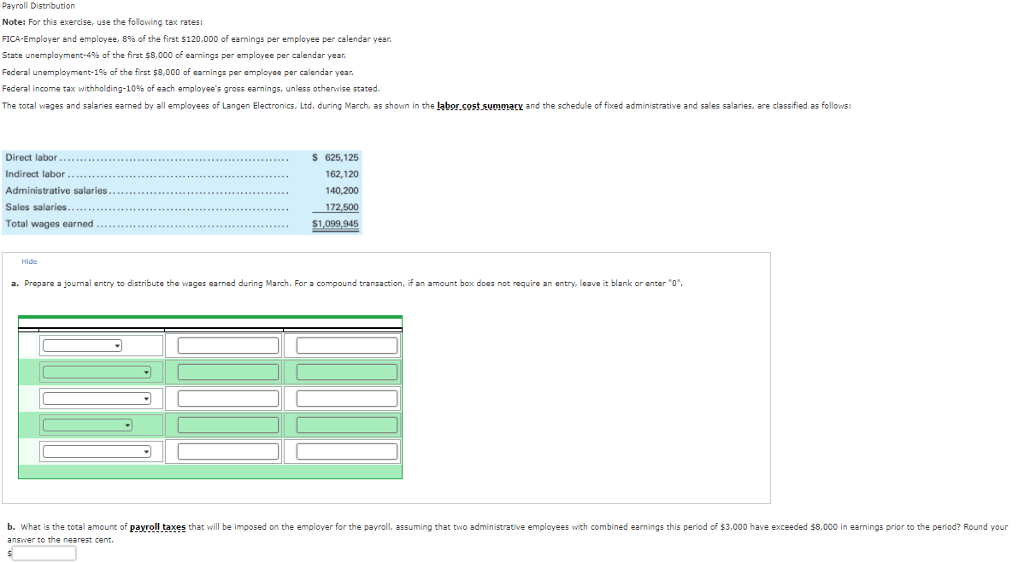

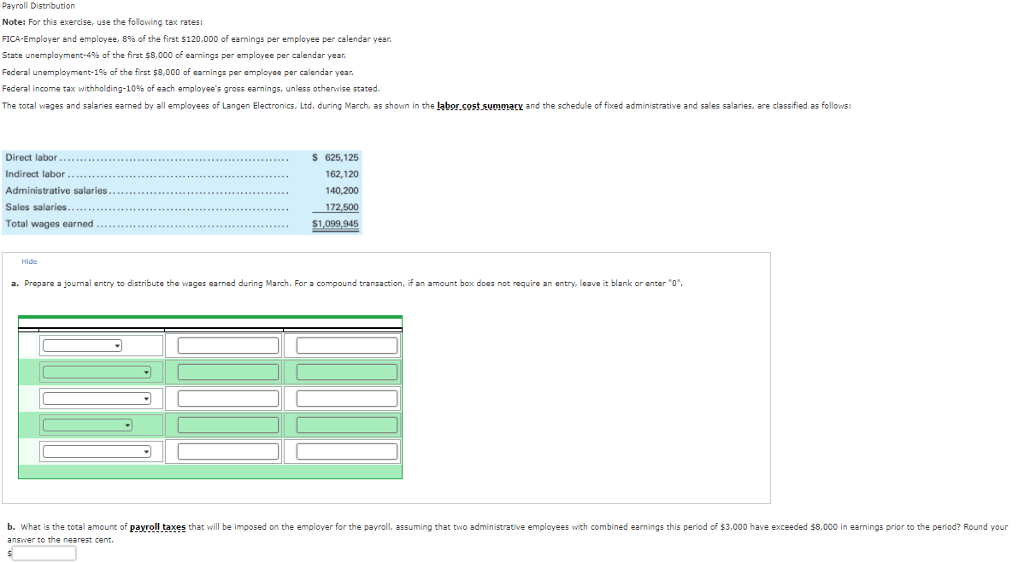

Payroll Distribution Note: For this exercise, use the following tax rates: FICA-Employer and employee, 8% of the first $120,000 of earnings per employee per calendar year. State unemployment-4% of the first $8,000 of earnings per employee per calendar year. Federal unemployment-1% of the first $8,000 of earnings per employee per calendar year Federal income tax withholding-10% of each employee's gross earnings, unless otherwise stated. The total wages and salaries eaned by all employees of Langen Electronics, Ltd. during March, as shown in the labor.cost.summar and the schedule of fixed administrative and sales salaries, are classified as follows: Direct labor..s 625,125 Indirect labor Administrative salaries.. Sales salaries 162,120 140,200 172 a. Prepare a journal entry to distribute the wages earned during March. For a compound transaction, if an amount bex does not require an entry, leave it blank or enter b. What is the total amount of payroll taxes that will be imposed on the employer for the payroll, assuming that two administrative employees with combined earnings this period of $3,000 have exceeded $8,000 in eanings prior to the period? Round your answer to the nearest cent. Payroll Distribution Note: For this exercise, use the following tax rates: FICA-Employer and employee, 8% of the first $120,000 of earnings per employee per calendar year. State unemployment-4% of the first $8,000 of earnings per employee per calendar year. Federal unemployment-1% of the first $8,000 of earnings per employee per calendar year Federal income tax withholding-10% of each employee's gross earnings, unless otherwise stated. The total wages and salaries eaned by all employees of Langen Electronics, Ltd. during March, as shown in the labor.cost.summar and the schedule of fixed administrative and sales salaries, are classified as follows: Direct labor..s 625,125 Indirect labor Administrative salaries.. Sales salaries 162,120 140,200 172 a. Prepare a journal entry to distribute the wages earned during March. For a compound transaction, if an amount bex does not require an entry, leave it blank or enter b. What is the total amount of payroll taxes that will be imposed on the employer for the payroll, assuming that two administrative employees with combined earnings this period of $3,000 have exceeded $8,000 in eanings prior to the period? Round your answer to the nearest cent