Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Payroll Employees earn $50,000 for the period Jan. 1 to 7. 2019 and are paid their net wages on Jan. 7 FICA taxes are withheld

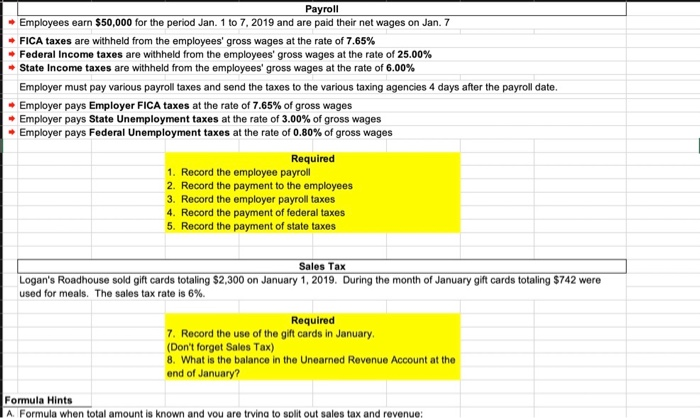

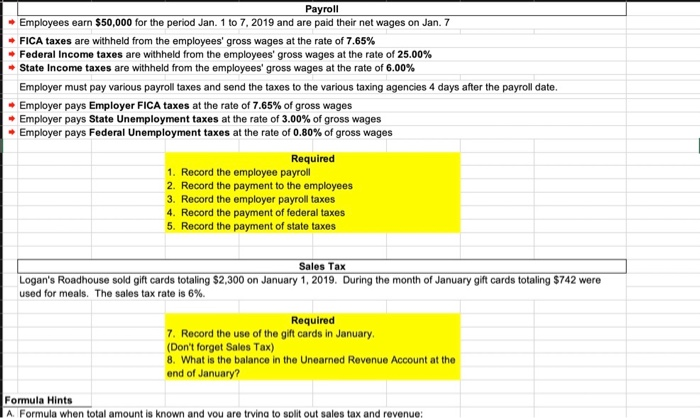

Payroll Employees earn $50,000 for the period Jan. 1 to 7. 2019 and are paid their net wages on Jan. 7 FICA taxes are withheld from the employees' gross wages at the rate of 7.65% Federal Income taxes are withheld from the employees' gross wages at the rate of 25.00% - State Income taxes are withheld from the employees' gross wages at the rate of 6.00% Employer must pay various payroll taxes and send the taxes to the various taxing agencies 4 days after the payroll date. Employer pays Employer FICA taxes at the rate of 7.65% of gross wages Employer pays State Unemployment taxes at the rate of 3.00% of gross wages Employer pays Federal Unemployment taxes at the rate of 0.80% of gross wages Required 1. Record the employee payroll 2. Record the payment to the employees 3. Record the employer payroll taxes 4. Record the payment of federal taxes 5. Record the payment of state taxes Sales Tax Logan's Roadhouse sold gift cards totaling $2,300 on January 1, 2019. During the month of January gift cards totaling $742 were used for meals. The sales tax rate is 6%. Required 7. Record the use of the gift cards in January (Don't forget Sales Tax) 8. What is the balance in the Unearned Revenue Account at the end of January? Formula Hints A Formula when total amount is known and you are trving to split out sales tax and revenue

Payroll Employees earn $50,000 for the period Jan. 1 to 7. 2019 and are paid their net wages on Jan. 7 FICA taxes are withheld from the employees' gross wages at the rate of 7.65% Federal Income taxes are withheld from the employees' gross wages at the rate of 25.00% - State Income taxes are withheld from the employees' gross wages at the rate of 6.00% Employer must pay various payroll taxes and send the taxes to the various taxing agencies 4 days after the payroll date. Employer pays Employer FICA taxes at the rate of 7.65% of gross wages Employer pays State Unemployment taxes at the rate of 3.00% of gross wages Employer pays Federal Unemployment taxes at the rate of 0.80% of gross wages Required 1. Record the employee payroll 2. Record the payment to the employees 3. Record the employer payroll taxes 4. Record the payment of federal taxes 5. Record the payment of state taxes Sales Tax Logan's Roadhouse sold gift cards totaling $2,300 on January 1, 2019. During the month of January gift cards totaling $742 were used for meals. The sales tax rate is 6%. Required 7. Record the use of the gift cards in January (Don't forget Sales Tax) 8. What is the balance in the Unearned Revenue Account at the end of January? Formula Hints A Formula when total amount is known and you are trving to split out sales tax and revenue

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started