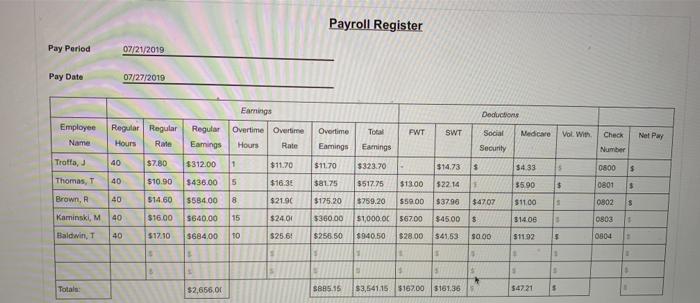

Payroll Register Pay Period 07/21/2019 Pay Date 07/27/2019 Earnings Deduction Employee Name Regular Regular Hours Rate To Regular Esmings SWT FWT Overtime Overtime Hours Rate Medicare Vol. With Check Overtime Eamings Net Pay Social Security Earnings Number Troffa, 40 $7,80 $312.00 1 $11.70 $323.70 $14.73 $ $433 0800 $ $11.70 38175 Thomas, T 40 $10.00 $436.00 $16.30 $517.75 $13.00 $22.14 55.90 $ 0801 $ Brown, 40 514.60 $58400 8 $21.90 $175.20 $759.20 $5900 $3796 $4707 $11.00 0802 $ 40 $16.00 5640,00 15 $2400 $360.00 $1,0000 567.00 $4500 $ 0803 Kaminski, Baldwin, $14.00 $1192 40 $12.10 $684.00 8 $25.6: $256.50 $940.50 $28.00 541,53 $0.00 5 0804 1 3 5 Total: $2,656,00 SBH55 $3,54115 $167.00 $161.36 $ 54721 Sb 4-6 Populate a Payroll Register Complete the remaining columns of the payroll register for the five employees whose information was provided in PSb 24. PS 2-12, and PSD 3-8. All employees work in a state that does not require the withholding of disability insurance, and none of the employees files a tax return under married filing separately status. Additional information for each employee is provided below 1. Jimmy Trotta carns $780/hour, and worked 4 hours during the most recent week. He makes a 401(k) retirement plan contribution of 9.0% of gross pay each period. Jimmy Troffa is married, and claims 3 withholding allowances for both the federal and state Jimmy Troffa voluntary deducts life insurance of $10 and a charitable contextion of $15 each pay period His year-to-date taxable earning for Social Security tax, prior to the current pay period, are $71,300, and he is paid with check *0800 2. Tyler Thomas earns $10.90/hour and worked 45 hours during the most recent week. Her participates in a cafeteria plan, to which he pays 575 each perod. Tyler Thomas in single, claims 3 federal withholist allowancesand 2 state withholding allowances. Tyler Thomas voluntarily deducts a charitable contribution of $35 each pay period. His year-to-date taxable oaming for Social Security tax, prior to the cure pay period, are $132.150, and he is paid with check HOB01 3. Ryan Brown eams $14.60 hour, and worked 48 hours during the most recent week. He does not make any voluntary deductions each period. Ryan Brown is single, and claim 2 withholding allowances for both federal and state. His year to-date taxable earning for Social Security tax, prior to the current pay period, are $22.400, and he is paid with check 0802 4. Michael Kaminski cams $16.00 hour, and worked 55 hours during the most recent week. He makes a 403) retirement plan contribution of 10% of gross pay each period. Michael Kaminklas single, and claims 3 withholding allowance for both federal and state Michael Kaminski voluntarily deduct life insurance of $30 each pay period. His year-to-date taxable aming for Social Securty, prior to the current pay period, are $79,560, and he is paid with check 0803 5. Tina Baldwin earns $17.10 hour, and worked 50 hours during the most recent wook. She contributes $110 to a flexible spending account each period. Tina Balchin is married claimed federal withholding llowances, and 3 state withholding allowances. Tina Baldwin voluntarily deducts life insurance of $5 and a charitable contribution of $3 each pay period Her year-o-date taxable caring for Social Security tax, prior to the current pay period. $133,700, and she is paid with check 004 Notes: Forlimplicity calculations throughout this exercise, both intermediate and final, should be founded to two decimal places at each calculation Payroll Register Pay Period 07/21/2019 Pay Date 07/27/2019 Earnings Deduction Employee Name Regular Regular Hours Rate To Regular Esmings SWT FWT Overtime Overtime Hours Rate Medicare Vol. With Check Overtime Eamings Net Pay Social Security Earnings Number Troffa, 40 $7,80 $312.00 1 $11.70 $323.70 $14.73 $ $433 0800 $ $11.70 38175 Thomas, T 40 $10.00 $436.00 $16.30 $517.75 $13.00 $22.14 55.90 $ 0801 $ Brown, 40 514.60 $58400 8 $21.90 $175.20 $759.20 $5900 $3796 $4707 $11.00 0802 $ 40 $16.00 5640,00 15 $2400 $360.00 $1,0000 567.00 $4500 $ 0803 Kaminski, Baldwin, $14.00 $1192 40 $12.10 $684.00 8 $25.6: $256.50 $940.50 $28.00 541,53 $0.00 5 0804 1 3 5 Total: $2,656,00 SBH55 $3,54115 $167.00 $161.36 $ 54721 Sb 4-6 Populate a Payroll Register Complete the remaining columns of the payroll register for the five employees whose information was provided in PSb 24. PS 2-12, and PSD 3-8. All employees work in a state that does not require the withholding of disability insurance, and none of the employees files a tax return under married filing separately status. Additional information for each employee is provided below 1. Jimmy Trotta carns $780/hour, and worked 4 hours during the most recent week. He makes a 401(k) retirement plan contribution of 9.0% of gross pay each period. Jimmy Troffa is married, and claims 3 withholding allowances for both the federal and state Jimmy Troffa voluntary deducts life insurance of $10 and a charitable contextion of $15 each pay period His year-to-date taxable earning for Social Security tax, prior to the current pay period, are $71,300, and he is paid with check *0800 2. Tyler Thomas earns $10.90/hour and worked 45 hours during the most recent week. Her participates in a cafeteria plan, to which he pays 575 each perod. Tyler Thomas in single, claims 3 federal withholist allowancesand 2 state withholding allowances. Tyler Thomas voluntarily deducts a charitable contribution of $35 each pay period. His year-to-date taxable oaming for Social Security tax, prior to the cure pay period, are $132.150, and he is paid with check HOB01 3. Ryan Brown eams $14.60 hour, and worked 48 hours during the most recent week. He does not make any voluntary deductions each period. Ryan Brown is single, and claim 2 withholding allowances for both federal and state. His year to-date taxable earning for Social Security tax, prior to the current pay period, are $22.400, and he is paid with check 0802 4. Michael Kaminski cams $16.00 hour, and worked 55 hours during the most recent week. He makes a 403) retirement plan contribution of 10% of gross pay each period. Michael Kaminklas single, and claims 3 withholding allowance for both federal and state Michael Kaminski voluntarily deduct life insurance of $30 each pay period. His year-to-date taxable aming for Social Securty, prior to the current pay period, are $79,560, and he is paid with check 0803 5. Tina Baldwin earns $17.10 hour, and worked 50 hours during the most recent wook. She contributes $110 to a flexible spending account each period. Tina Balchin is married claimed federal withholding llowances, and 3 state withholding allowances. Tina Baldwin voluntarily deducts life insurance of $5 and a charitable contribution of $3 each pay period Her year-o-date taxable caring for Social Security tax, prior to the current pay period. $133,700, and she is paid with check 004 Notes: Forlimplicity calculations throughout this exercise, both intermediate and final, should be founded to two decimal places at each calculation