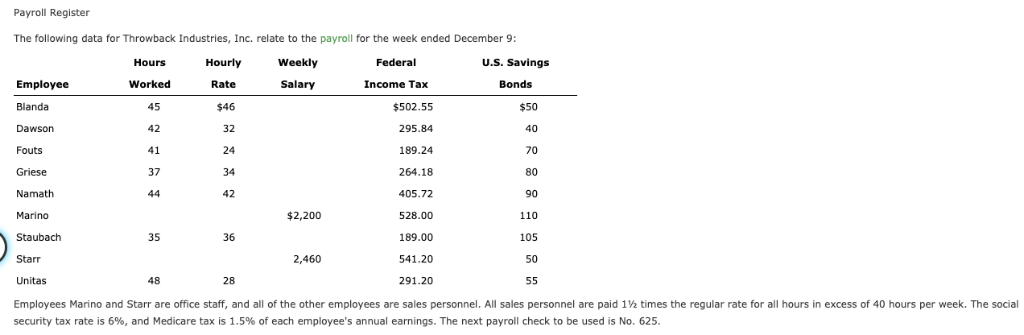

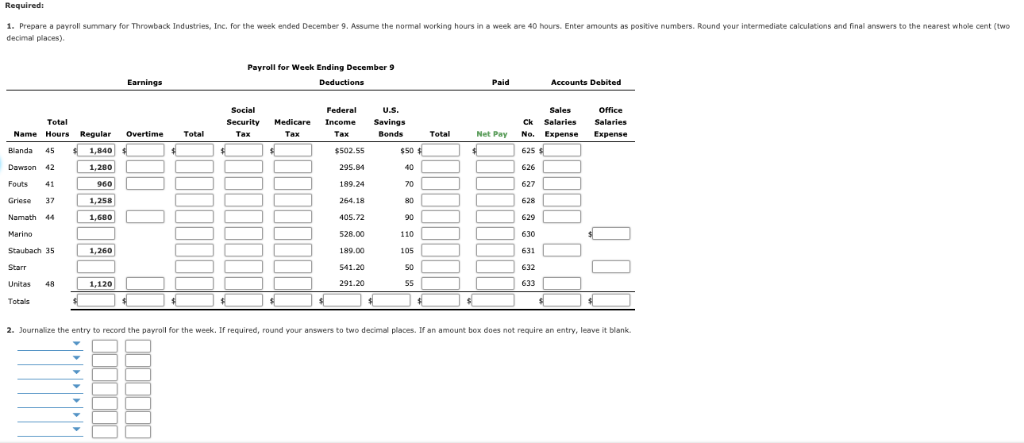

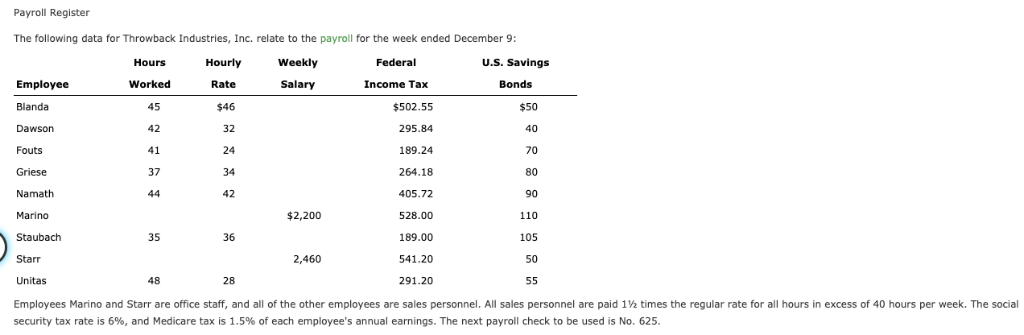

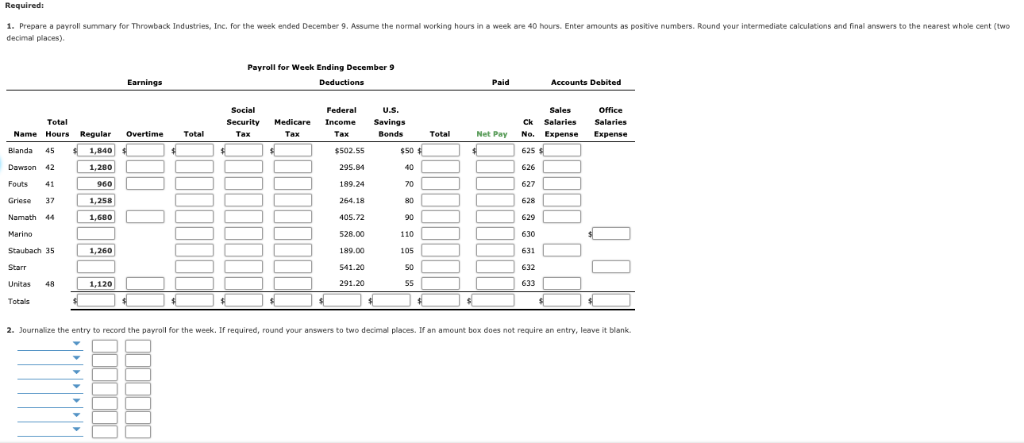

Payroll Register The following data for Throwback Industries, Inc. relate to the payroll for the week ended December 9: Hours Worked 45 42 41 37 Hourly Weekly Federal U.S. Savings Employee Blanda Dawson Fouts Rate Salary Income Tax $502.55 295.84 189.24 264.18 405.72 528.00 189.00 541.20 291.20 $50 40 70 80 90 110 105 50 32 24 34 42 Namath $2,200 Staubach Starr Unitas Employees Marino and Starr are office staff, and all of the other employees are sales personnel. All sales personnel are paid 1 times the regular rate for all hours in excess of 40 hours per week. The social security tax rate is 6%, and Medicare tax is 1.5% of each employee's annual earnings. The next payroll check to be used is No. 625. 35 2,460 48 28 1. Prepare a payroll summary for Throwback Industries, Inc. for the week ended December 9. Assume the normal working hours in a week are 40 hours. Enter amounts as positive numbers. Round your intermediate calculations and final answers to the nearest whole cent (two decimal places). Payroll for Week Ending December 9 Paid Accounts Debited U.S Office Ck Salries Salaries Sales Security Medicare Income Savings Bonds Name Hours Regular Overtime Total Blanda 45 Dawson 42 Fouts 41 Tax Net Pay No. Expense Expense 1,840 502.55 295.84 189.24 264.18 405.72 526.00 189.00 541.20 $50 625 1,280 Griese 37 1,258 628 Namath 44 1,680 328.00 103 Merino 110 Staubach 35 1,260 105 Unitas 48 1,120 633 Totals 2. Journalize the entry to record the payroll for the week. If required, round your answers to two decimal places. If an amount box does not require an entry, leave it blank Payroll Register The following data for Throwback Industries, Inc. relate to the payroll for the week ended December 9: Hours Worked 45 42 41 37 Hourly Weekly Federal U.S. Savings Employee Blanda Dawson Fouts Rate Salary Income Tax $502.55 295.84 189.24 264.18 405.72 528.00 189.00 541.20 291.20 $50 40 70 80 90 110 105 50 32 24 34 42 Namath $2,200 Staubach Starr Unitas Employees Marino and Starr are office staff, and all of the other employees are sales personnel. All sales personnel are paid 1 times the regular rate for all hours in excess of 40 hours per week. The social security tax rate is 6%, and Medicare tax is 1.5% of each employee's annual earnings. The next payroll check to be used is No. 625. 35 2,460 48 28 1. Prepare a payroll summary for Throwback Industries, Inc. for the week ended December 9. Assume the normal working hours in a week are 40 hours. Enter amounts as positive numbers. Round your intermediate calculations and final answers to the nearest whole cent (two decimal places). Payroll for Week Ending December 9 Paid Accounts Debited U.S Office Ck Salries Salaries Sales Security Medicare Income Savings Bonds Name Hours Regular Overtime Total Blanda 45 Dawson 42 Fouts 41 Tax Net Pay No. Expense Expense 1,840 502.55 295.84 189.24 264.18 405.72 526.00 189.00 541.20 $50 625 1,280 Griese 37 1,258 628 Namath 44 1,680 328.00 103 Merino 110 Staubach 35 1,260 105 Unitas 48 1,120 633 Totals 2. Journalize the entry to record the payroll for the week. If required, round your answers to two decimal places. If an amount box does not require an entry, leave it blank