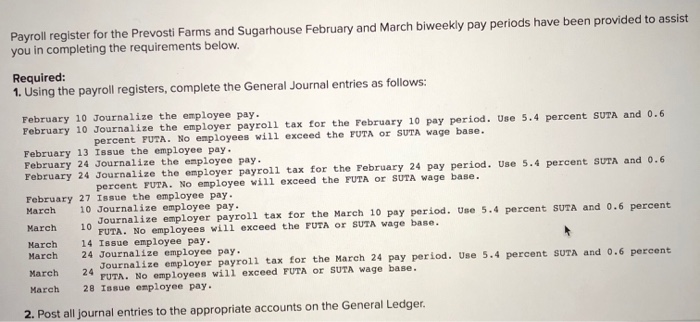

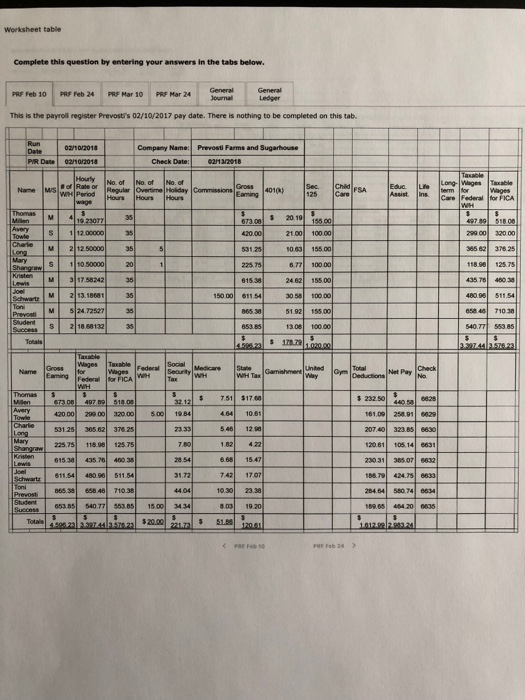

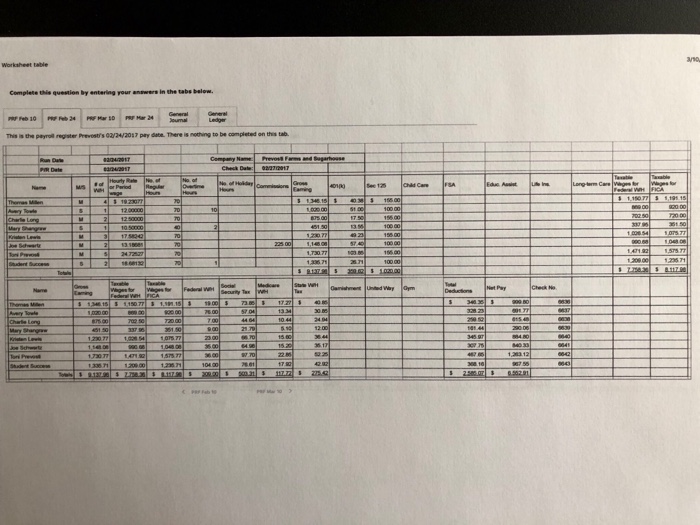

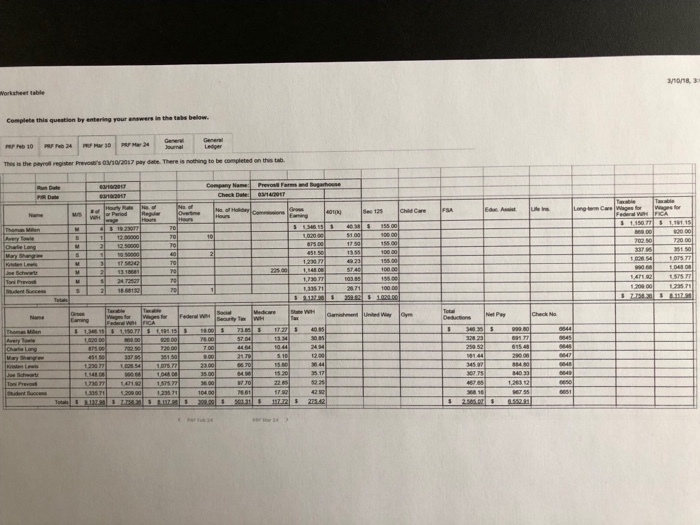

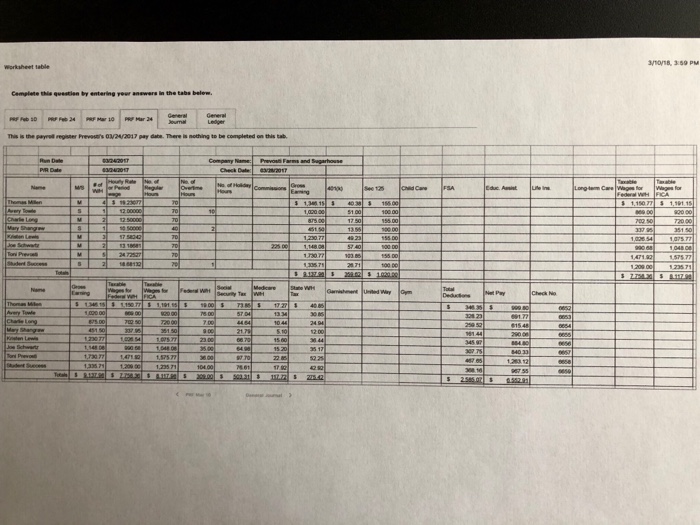

Payroll you in completing the requirements below Required: 1. Using the payroll registers, complete the General Journal entries as follows: register for the Prevosti Farms and Sugarhouse February and March biweekly pay periods have been provided to assist February 10 Journalize the employee pay. 0 Bourn zo ahe enployey paycoll easc tor the rvebruary z0 pay poriod. Use 5.4 percent SUTA and o.6 percent PUTA. No employees wil1 exceed the FUTA or SUTA wage base. February 13 Issue the employee pay. February 24 Journalize the employee pay February 24 Journalize the mployer payroll tax for the February 24 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employee will exceed the FUTA or SUTA wage base. February 27 Issue the employee pay March 10 Journalize employee pay varchlze employer payroll tax for the March 10 pay period. Use 5.4 percent SUTA and 0.6 percent March 14 Issue employee pay. FUTA. No employees will exceed the FUTA or SUTA wage base. March 24 Journalize employee pay March 24 March 28 Issue employee pay Journalize employer payroll tax for the March 24 pay period. Use 5.4 percent sun and percent PUTA. No employees will exceed FUTA or SUTA wage base. 2. Post all journal entries to the appropriate accounts on the General Ledger. Payroll you in completing the requirements below Required: 1. Using the payroll registers, complete the General Journal entries as follows: register for the Prevosti Farms and Sugarhouse February and March biweekly pay periods have been provided to assist February 10 Journalize the employee pay. 0 Bourn zo ahe enployey paycoll easc tor the rvebruary z0 pay poriod. Use 5.4 percent SUTA and o.6 percent PUTA. No employees wil1 exceed the FUTA or SUTA wage base. February 13 Issue the employee pay. February 24 Journalize the employee pay February 24 Journalize the mployer payroll tax for the February 24 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employee will exceed the FUTA or SUTA wage base. February 27 Issue the employee pay March 10 Journalize employee pay varchlze employer payroll tax for the March 10 pay period. Use 5.4 percent SUTA and 0.6 percent March 14 Issue employee pay. FUTA. No employees will exceed the FUTA or SUTA wage base. March 24 Journalize employee pay March 24 March 28 Issue employee pay Journalize employer payroll tax for the March 24 pay period. Use 5.4 percent sun and percent PUTA. No employees will exceed FUTA or SUTA wage base. 2. Post all journal entries to the appropriate accounts on the General Ledger