Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PB Company has only one job in process on January 1, 2022, Job No. 97 for 75 units, carried at a cost of P78,400. During

PB Company has only one job in process on January 1, 2022, Job No. 97 for 75 units, carried at a cost of P78,400. During the 6 months period January to June 2022 JC accepted two more jobs, Job No. 98 for 200 units and Job No. 99 for 100 units. Actual data for the period is as follows:

Direct Materials used, P2,800,000 distributed as: Job No. 97, 20%; Job No. 98, 45%; Job No. 99, 35%.

Direct Labor cost, P2,175,000 distributed as: Job No. 97, 25%; Job No. 98, 50%; Job No. 99, 25%.

Various overhead incurred, P2,878,000

Purchases of Raw Materials, P3,200,000

The company's annual budgeted overhead is P5,460,000 while the annual budgeted direct labor costs is P4,200,000. Overhead is applied to production on the bases of direct labor costs. Jobs 97 and 98 were completed and sold while Job 99 is still in process at the end of June. Any variance is considered immaterial.

The adjusted cost of goods sold for the period ended is?

Direct Materials used, P2,800,000 distributed as: Job No. 97, 20%; Job No. 98, 45%; Job No. 99, 35%.

Direct Labor cost, P2,175,000 distributed as: Job No. 97, 25%; Job No. 98, 50%; Job No. 99, 25%.

Various overhead incurred, P2,878,000

Purchases of Raw Materials, P3,200,000

The company's annual budgeted overhead is P5,460,000 while the annual budgeted direct labor costs is P4,200,000. Overhead is applied to production on the bases of direct labor costs. Jobs 97 and 98 were completed and sold while Job 99 is still in process at the end of June. Any variance is considered immaterial.

The adjusted cost of goods sold for the period ended is?

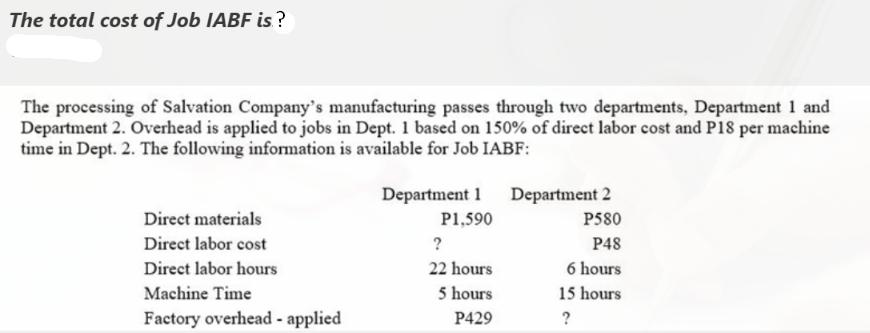

The total cost of Job IABF is? The processing of Salvation Company's manufacturing passes through two departments, Department 1 and Department 2. Overhead is applied to jobs in Dept. 1 based on 150% of direct labor cost and P18 per machine time in Dept. 2. The following information is available for Job IABF: Direct materials Direct labor cost Direct labor hours Machine Time Factory overhead - applied Department 1 P1,590 ? 22 hours 5 hours P429 Department 2 P580 P48 6 hours 15 hours ?

Step by Step Solution

★★★★★

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Adjusted Cost of Goods Sold We can start by calculating the total cost incurred by the comp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started