Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PB12-4 (Algo) Preparing and Interpreting a Statement of Cash Flows (Indirect Method) [LO 12-2, LO 12-3, LO 12-4, LO 12-5] Dive In Company was started

PB12-4 (Algo) Preparing and Interpreting a Statement of Cash Flows (Indirect Method) [LO 12-2, LO 12-3, LO 12-4, LO 12-5]

Dive In Company was started several years ago by two diving instructors. The companys comparative balance sheets and income statement, as well as additional information, are presented below.

| Current Year | Previous Year | |

|---|---|---|

| Balance Sheet at December 31 | ||

| Cash | $ 4,040 | $ 4,870 |

| Accounts Receivable | 1,600 | 800 |

| Prepaid Rent | 160 | 80 |

| Total Assets | $ 5,800 | $ 5,750 |

| Salaries and Wages Payable | $ 650 | $ 1,700 |

| Common Stock | 1,800 | 1,300 |

| Retained Earnings | 3,350 | 2,750 |

| Total Liabilities and Stockholders Equity | $ 5,800 | $ 5,750 |

| Income Statement | ||

| Service Revenue | $ 40,550 | |

| Salaries and Wages Expense | 36,000 | |

| Rent and Office Expenses | 3,950 | |

| Net Income | $ 600 |

Additional Data:

- Rent is paid in advance each month, and Office Expenses are paid in cash as incurred.

- An owner contributed capital by paying $500 cash in exchange for the companys stock.

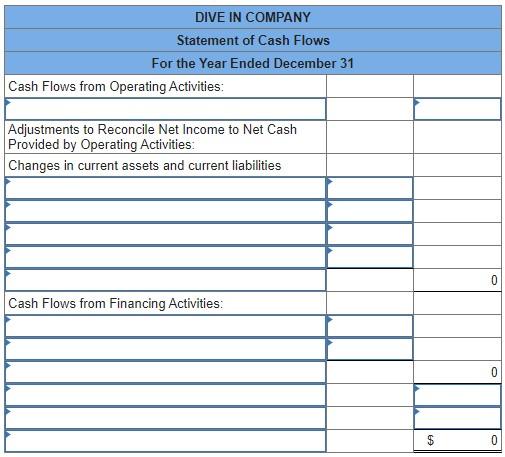

Required: 1. Prepare the statement of cash flows for the current year ended December 31 using the indirect method. (Amounts to be deducted should be indicated by a minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started