Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PB2-1 (Static) Recording Manufacturing and Nonmanufacturing Costs, Preparing Cost of Goods Manufactured Report and Income Statement [LO 2-3, 2-4, 2-5, 2-6] Coda Industries uses a

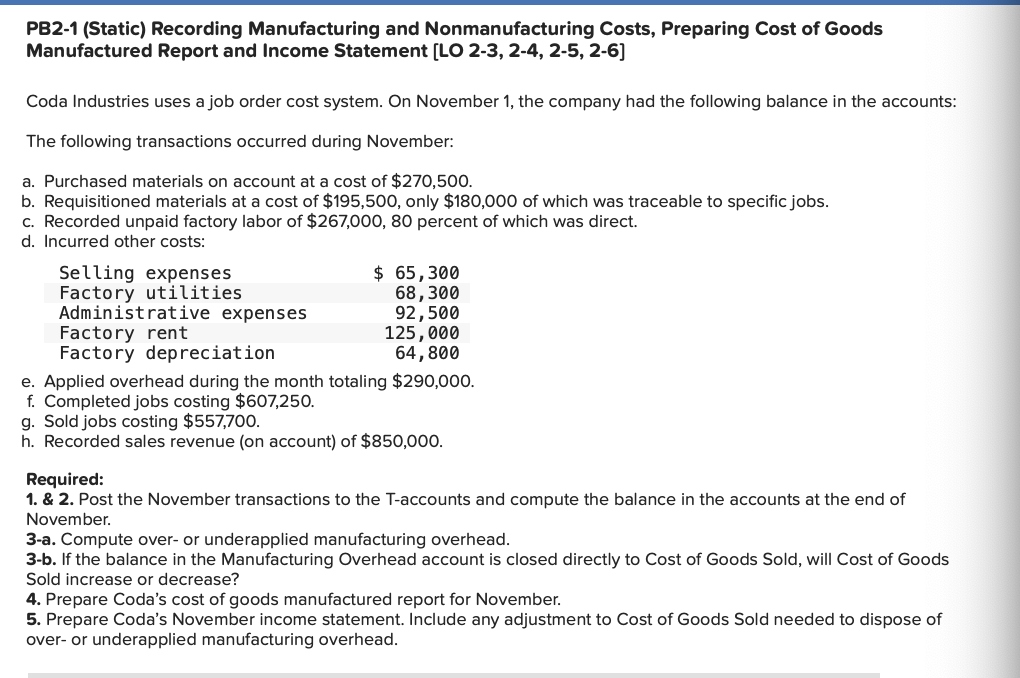

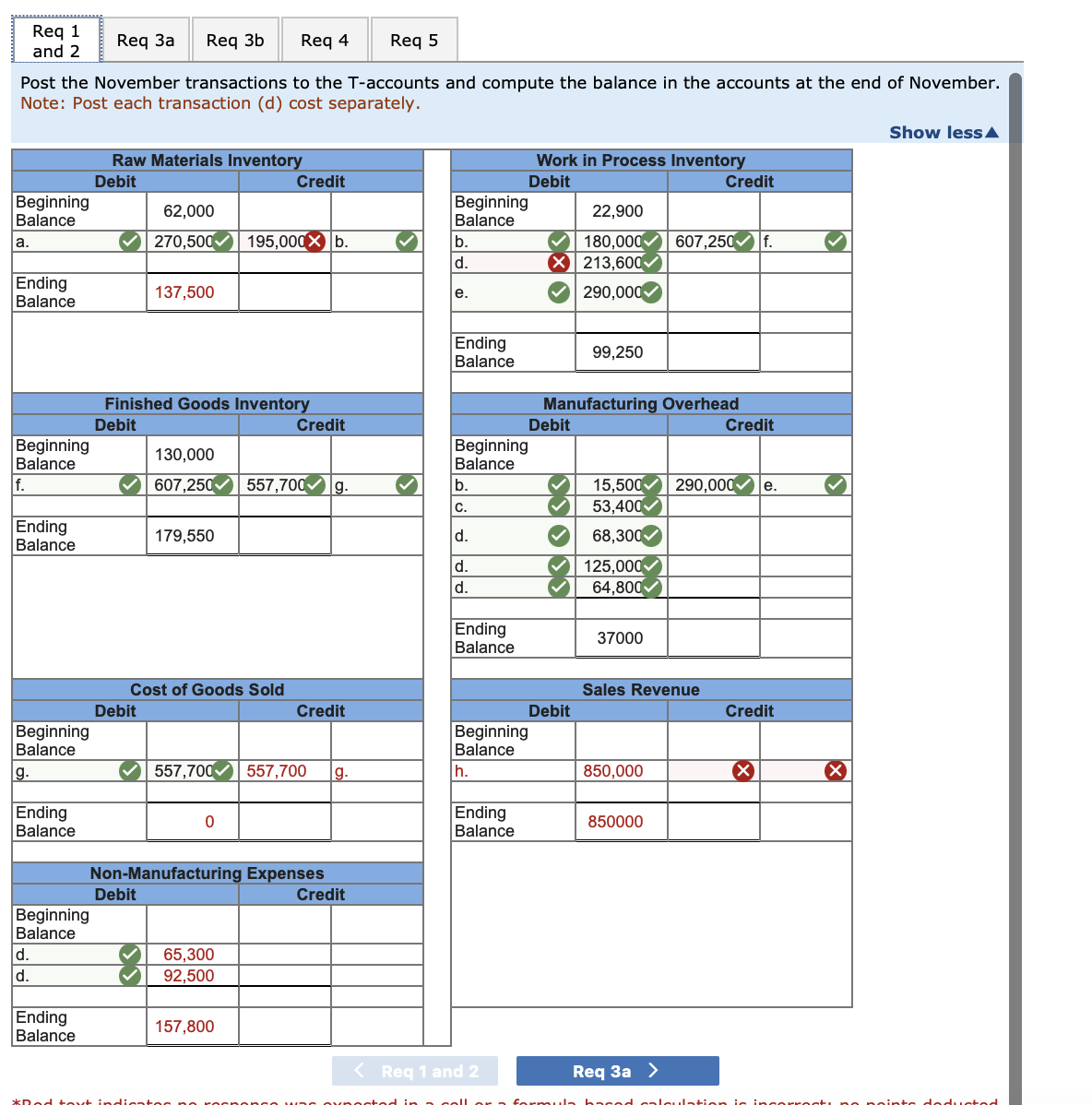

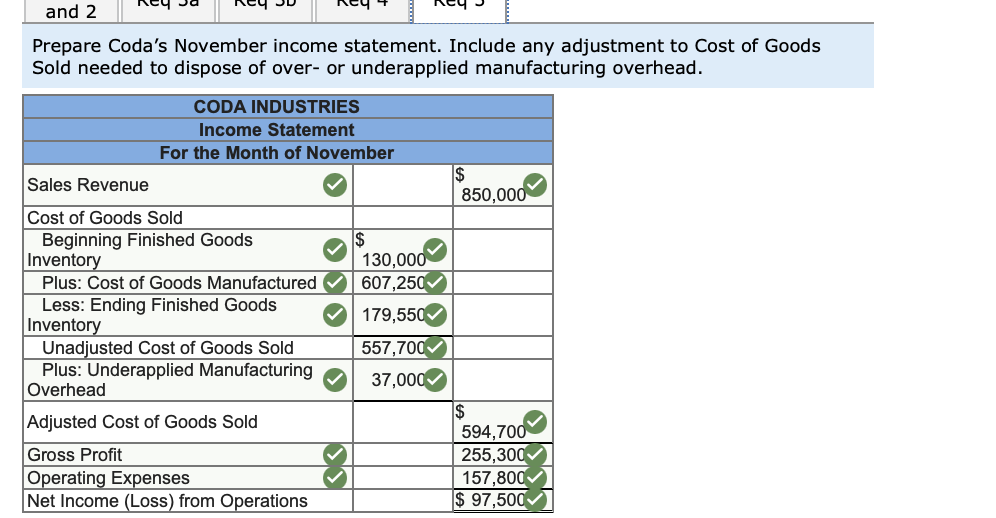

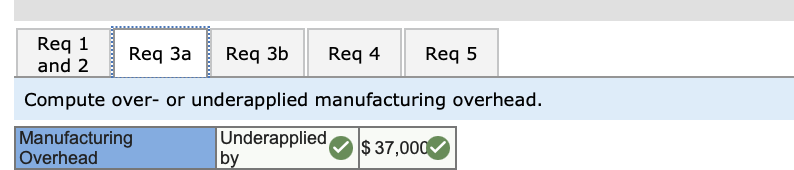

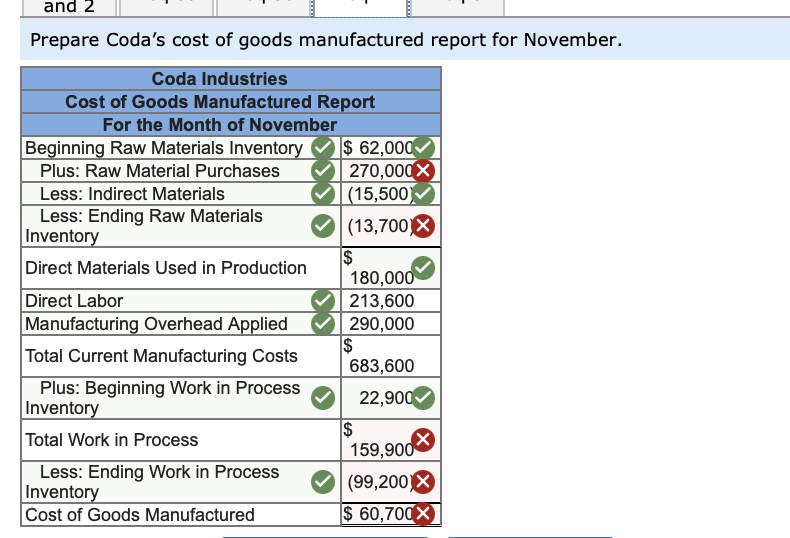

PB2-1 (Static) Recording Manufacturing and Nonmanufacturing Costs, Preparing Cost of Goods Manufactured Report and Income Statement [LO 2-3, 2-4, 2-5, 2-6] Coda Industries uses a job order cost system. On November 1, the company had the following balance in the accounts: The following transactions occurred during November: a. Purchased materials on account at a cost of $270,500. b. Requisitioned materials at a cost of $195,500, only $180,000 of which was traceable to specific jobs. c. Recorded unpaid factory labor of $267,000,80 percent of which was direct. d. Incurred other costs: e. Applied overhead during the month totaling $290,000. f. Completed jobs costing $607,250. g. Sold jobs costing $557,700. h. Recorded sales revenue (on account) of $850,000. Required: 1. \& 2. Post the November transactions to the T-accounts and compute the balance in the accounts at the end of November. 3-a. Compute over- or underapplied manufacturing overhead. 3-b. If the balance in the Manufacturing Overhead account is closed directly to Cost of Goods Sold, will Cost of Goods Sold increase or decrease? 4. Prepare Coda's cost of goods manufactured report for November. 5. Prepare Coda's November income statement. Include any adjustment to Cost of Goods Sold needed to dispose of over- or underapplied manufacturing overhead. Post the November transactions to the T-accounts and compute the balance in the accounts at the end of November. Nota. Dnet oarh trancartion (d) onct conaratolk Prepare Coda's November income statement. Include any adjustment to Cost of Goods Sold needed to dispose of over- or underapplied manufacturing overhead. Compute over- or underapplied manufacturing overhead. Prepare Coda's cost of goods manufactured report for November

PB2-1 (Static) Recording Manufacturing and Nonmanufacturing Costs, Preparing Cost of Goods Manufactured Report and Income Statement [LO 2-3, 2-4, 2-5, 2-6] Coda Industries uses a job order cost system. On November 1, the company had the following balance in the accounts: The following transactions occurred during November: a. Purchased materials on account at a cost of $270,500. b. Requisitioned materials at a cost of $195,500, only $180,000 of which was traceable to specific jobs. c. Recorded unpaid factory labor of $267,000,80 percent of which was direct. d. Incurred other costs: e. Applied overhead during the month totaling $290,000. f. Completed jobs costing $607,250. g. Sold jobs costing $557,700. h. Recorded sales revenue (on account) of $850,000. Required: 1. \& 2. Post the November transactions to the T-accounts and compute the balance in the accounts at the end of November. 3-a. Compute over- or underapplied manufacturing overhead. 3-b. If the balance in the Manufacturing Overhead account is closed directly to Cost of Goods Sold, will Cost of Goods Sold increase or decrease? 4. Prepare Coda's cost of goods manufactured report for November. 5. Prepare Coda's November income statement. Include any adjustment to Cost of Goods Sold needed to dispose of over- or underapplied manufacturing overhead. Post the November transactions to the T-accounts and compute the balance in the accounts at the end of November. Nota. Dnet oarh trancartion (d) onct conaratolk Prepare Coda's November income statement. Include any adjustment to Cost of Goods Sold needed to dispose of over- or underapplied manufacturing overhead. Compute over- or underapplied manufacturing overhead. Prepare Coda's cost of goods manufactured report for November Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started